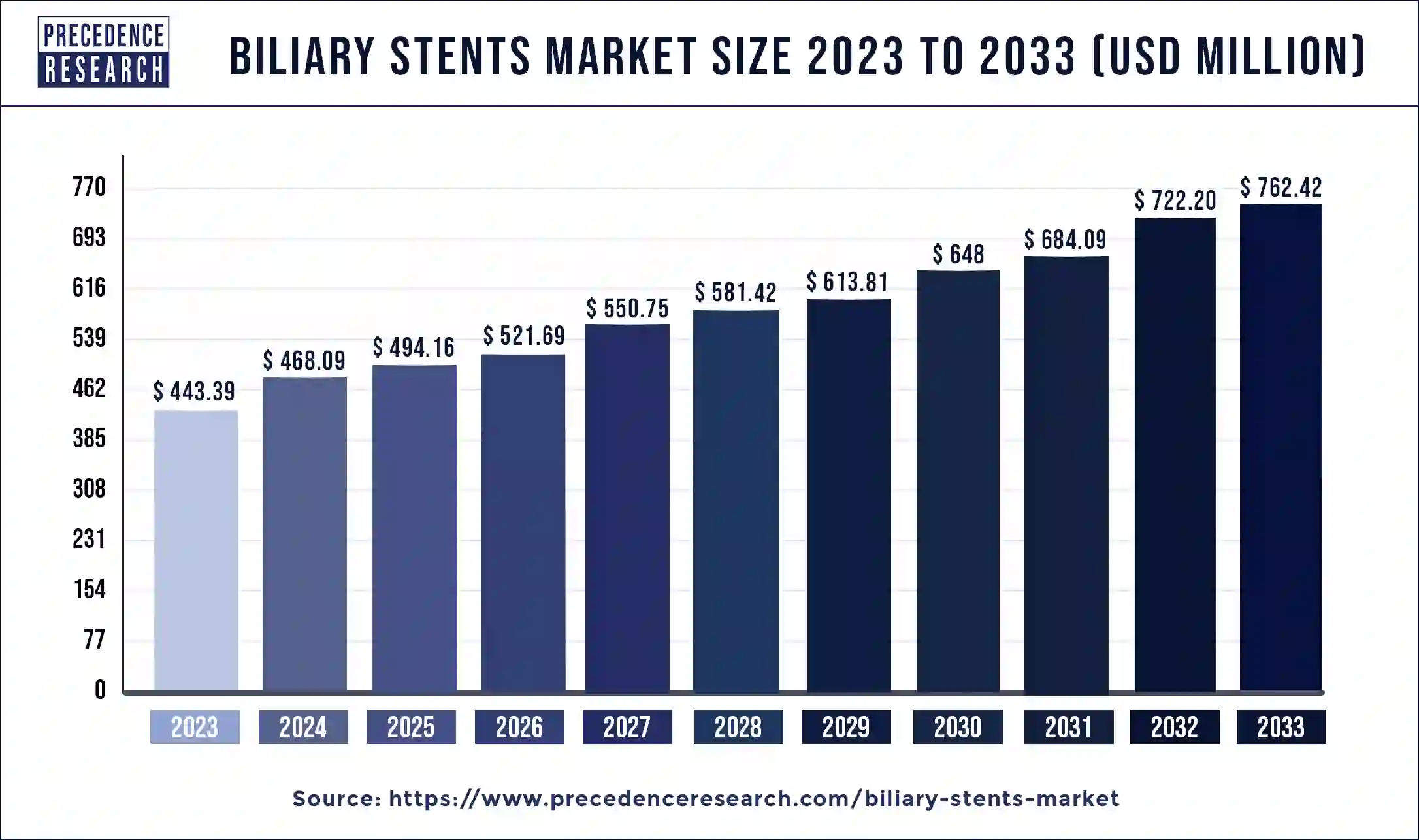

The global biliary stents market size reached USD 443.39 million in 2023 and is projected to grow around USD 762.42 million by 2033, poised to grow at a CAGR of 5.57% from 2024 to 2033.

Key Points

- North America captured the most significant share of the biliary stents market.

- By product type, the metal segment has held the largest market share in 2023.

- By application, the gallstone segment has held the largest segment of the biliary stents market.

- By end use, the hospital segment held the dominating position in the market in 2023.

The biliary stents market refers to the segment of the medical device industry focused on the production and distribution of stents designed specifically for the biliary tract. Biliary stents are tubular devices made from various materials such as metal, plastic, or a combination of both. These stents are used primarily to maintain the patency of the bile ducts, which may become obstructed due to conditions like gallstones, tumors, or strictures. The market encompasses a wide range of products, including self-expandable metal stents (SEMS), plastic stents, and drug-eluting stents, among others. As the prevalence of biliary disorders continues to rise globally, fueled by factors such as aging populations and lifestyle changes, the demand for biliary stents is expected to increase significantly in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3931

Growth Factors

Several factors are driving the growth of the biliary stents market. Firstly, the rising incidence of biliary disorders, including gallstones, bile duct cancers, and benign biliary strictures, is a key factor contributing to market growth. Additionally, technological advancements in stent design and materials have led to the development of more efficient and durable biliary stents, driving adoption rates among healthcare providers and patients. Moreover, the increasing preference for minimally invasive procedures, such as endoscopic retrograde cholangiopancreatography (ERCP), which often involves the placement of biliary stents, is further fueling market growth. Furthermore, the growing geriatric population, who are more prone to biliary complications, is expected to drive demand for biliary stents in the aging demographic.

Region Insights

The biliary stents market exhibits a global presence, with significant demand across various regions. North America and Europe are among the leading regions in terms of market share, driven by well-established healthcare infrastructure, high prevalence of biliary disorders, and increasing adoption of advanced medical technologies. In Asia-Pacific, rapid urbanization, improving healthcare facilities, and a growing patient pool with biliary diseases are contributing to market growth. Additionally, emerging economies in Latin America and the Middle East & Africa are witnessing increasing demand for biliary stents due to improving access to healthcare and rising awareness about minimally invasive treatment options.

Biliary Stents Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.57% |

| Global Market Size in 2023 | USD 443.39 Million |

| Global Market Size by 2033 | USD 762.42 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biliary Stents Market Dynamics

Drivers

Several drivers are propelling the growth of the biliary stents market. One significant driver is the increasing prevalence of biliary diseases worldwide, driven by factors such as sedentary lifestyles, obesity, and dietary habits. Moreover, advancements in endoscopic techniques and imaging technologies have facilitated the precise placement of biliary stents, improving patient outcomes and reducing complications. Additionally, the expanding application of biliary stents in palliative care for patients with inoperable malignancies is driving market growth. Furthermore, strategic collaborations and partnerships among key market players to enhance product portfolios and expand market reach are contributing to market growth.

Restraints

Despite the positive growth trajectory, the biliary stents market faces certain challenges and restraints. One major restraint is the risk of complications associated with biliary stent placement, including stent migration, occlusion, and infection. These complications can lead to additional medical interventions and increase healthcare costs, posing a challenge to market growth. Moreover, limited reimbursement policies for biliary stent procedures in some regions may hinder market expansion. Furthermore, concerns regarding the long-term durability and efficacy of biliary stents, particularly plastic stents, remain a restraint for market growth.

Opportunities

Despite the challenges, the biliary stents market presents several opportunities for growth and innovation. Technological advancements in stent design, such as the development of fully covered and biodegradable stents, hold promise for improving clinical outcomes and reducing complications. Moreover, expanding indications for biliary stent placement, including the treatment of post-operative complications and benign biliary diseases, present new avenues for market expansion. Additionally, increasing healthcare expenditure in developing economies, coupled with growing awareness about minimally invasive treatment options, is expected to create lucrative opportunities for market players in these regions. Furthermore, initiatives aimed at raising awareness about biliary disorders and promoting early diagnosis and treatment are likely to drive market growth in the long term.

Read Also: Softgel Capsules Market Size to Rake USD 17.19 Billion by 2033

Recent Developments

- In January 2024, Olympus concluded the acquisition of Taewoong Medical Co. Ltd., a leading Korean gastrointestinal stent company.

- In October 2022, Cordis, a global frontrunner in the innovation and production of interventional cardiovascular and endovascular technologies, revealed its acquisition of MedAlliance, a Switzerland-based firm renowned for pioneering drug-eluting balloons.

- In June 2022, Boston Scientific announced its agreement to acquire a majority stake in M.I.Tech Co. Ltd. from Synergy Innovation Co. Ltd.

Biliary Stents Market Companies

- Boston Scientific

- Cook Group

- ENDO-FLEX GmbH

- Olympus Corporation

- B Braun Melsungen

- CONMED Corporation

- M.I Tech

- Becton, Dickinson & Company

- Medtronic plc

- Cardinal Health

- Merit Medical System

Segments Covered in the Report

By Type

- Metal

- Polymer

- Plastic

By Application

- Biliopancreatic Leakages

- Pancreatic Cancer

- Benign Biliary Structures

- Gallstones

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/