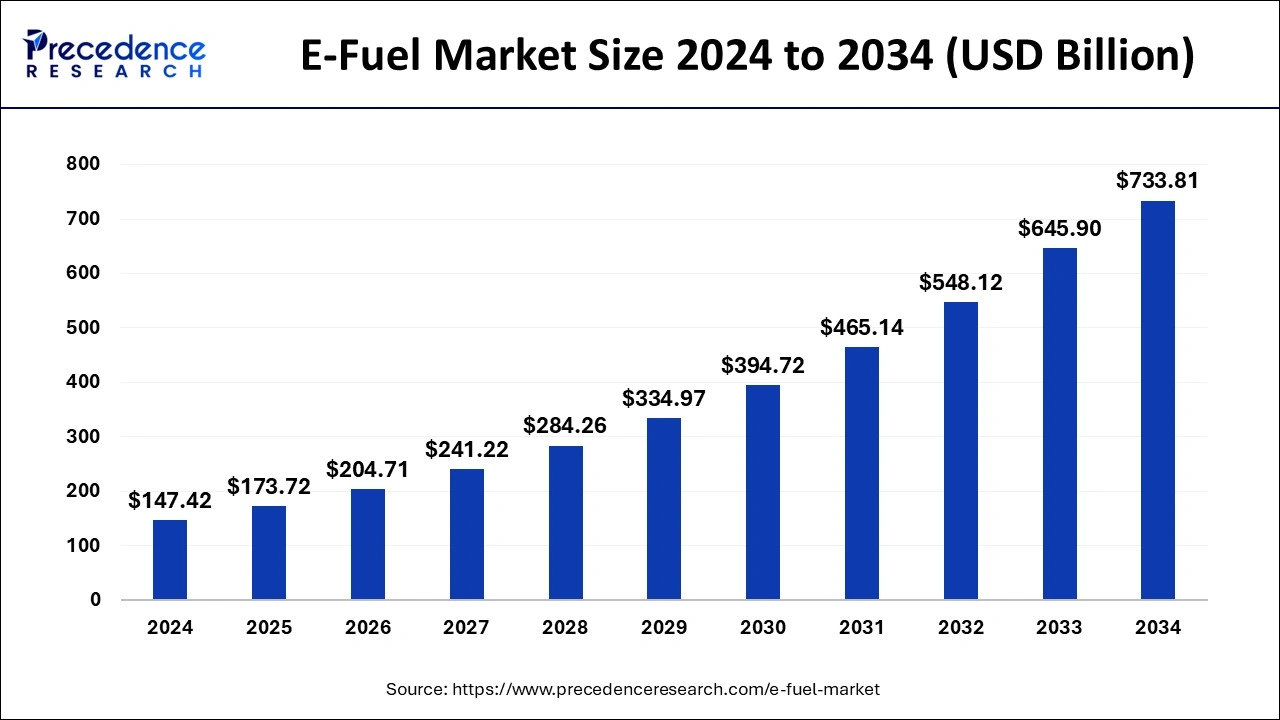

The global e-fuel market size reached USD 125.10 billion in 2023 and is anticipated to attain around USD 645.90 billion by 2033, expanding at a CAGR of 17.83% from 2024 to 2033.

Key Points

- In Europe, the e-fuel market is experiencing rapid growth and significant momentum, dominating the global market with a 47% revenue share in 2023.

- Germany has accounted market share of over 21.3% in 2023.

- North America is expected to witness the fastest growth in the global market during the projected period.

- Based on a product, in 2023, the ethanol segment has dominated the market with market share of 27% in 2023.

- Based on state, the liquid segment held the largest market share of 76.9% in 2023.

- Based on production method, the market was dominated by the power-to-liquid segment in 2023 with market share of 38.7%.

- Based on technology, the hydrogen technology segment has contributed the largest revenue share of around 59% in 2023.

- Based on a carbon source, the point source segment accounted for the largest market share of over 81.4% in 2023.

- Based on carbon capture, the pre-combustion segment has held the largest market share of 68.3% in 2023.

- Based on end use, the automotive segment dominated the market of around 28.5% in 2023.

The e-fuel market represents a burgeoning sector within the broader renewable energy landscape, aiming to provide sustainable alternatives to conventional fossil fuels. E-fuels, also known as synthetic fuels or electrofuels, are produced through electrochemical processes using renewable energy sources such as solar or wind power. These fuels hold promise as a means to decarbonize transportation and industry sectors, thereby mitigating greenhouse gas emissions and addressing climate change concerns.

Get a Sample: https://www.precedenceresearch.com/sample/4068

Growth Factors:

Several factors contribute to the growth of the e-fuel market. Firstly, increasing environmental awareness and regulatory pressures to reduce carbon emissions have propelled the demand for sustainable alternatives to traditional fossil fuels. E-fuels offer a viable solution by utilizing renewable energy sources to produce clean, carbon-neutral fuels for various applications.

Moreover, advancements in technology and declining costs of renewable energy infrastructure have made the production of e-fuels more economically feasible. Innovations in electrolysis, catalysis, and carbon capture techniques have improved the efficiency and scalability of e-fuel production processes, driving growth in the market.

Region Insights:

The adoption and growth of the e-fuel market vary across different regions, influenced by factors such as energy policies, infrastructure development, and market demand. In Europe, stringent emissions regulations and ambitious climate targets have spurred investments in renewable energy and e-fuel production facilities. Countries like Germany, Denmark, and Norway have emerged as leaders in e-fuel production and adoption, supported by favorable regulatory frameworks and government incentives.

In North America, initiatives to reduce dependence on imported oil and combat climate change have led to increasing interest in e-fuels. States like California have implemented low-carbon fuel standards and incentives for renewable fuels, driving investment in e-fuel production infrastructure and technology development.

In Asia-Pacific, rapid urbanization, growing transportation demand, and concerns about air quality have prompted governments to explore alternative fuels like e-fuels. Countries such as Japan, South Korea, and China are investing in research and pilot projects to evaluate the feasibility and scalability of e-fuel production technologies.

E-Fuel Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.83% |

| Global Market Size in 2023 | USD 125.10 Billion |

| Global Market Size in 2024 | USD 147.42 Billion |

| Global Market Size by 2033 | USD 645.90 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By State, By Production Method, By Technology, By End-use, By Carbon Source and By Carbon Capture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

E-Fuel Market Dynamics

Drivers:

Several drivers are propelling the growth of the e-fuel market. Firstly, the need to decarbonize transportation and industry sectors to mitigate climate change is a significant driver. E-fuels offer a sustainable alternative to fossil fuels, enabling sectors such as aviation, shipping, and heavy-duty transport to reduce their carbon footprint.

Additionally, energy security concerns and the volatility of oil prices have incentivized the development of domestic renewable energy sources and alternative fuels like e-fuels. By diversifying the energy mix and reducing reliance on imported fossil fuels, countries can enhance energy independence and resilience to supply disruptions.

Furthermore, technological advancements and economies of scale are driving down the costs of e-fuel production, making them increasingly competitive with conventional fuels. As the cost of renewable energy continues to decline and efficiency improvements are realized in e-fuel production processes, the market is poised for further growth and adoption.

Opportunities:

The e-fuel market presents significant opportunities for innovation, investment, and market expansion. One opportunity lies in leveraging excess renewable energy capacity to produce e-fuels during periods of low demand or grid oversupply. By integrating e-fuel production with renewable energy generation, stakeholders can maximize the utilization of renewable resources and enhance the economics of both sectors.

Moreover, partnerships between renewable energy developers, technology providers, and end-users can accelerate the commercialization and adoption of e-fuels. Collaborative efforts to demonstrate the feasibility, scalability, and environmental benefits of e-fuels in real-world applications can help overcome barriers to market entry and drive industry growth.

Furthermore, international cooperation and knowledge sharing can facilitate the exchange of best practices, standards, and regulatory frameworks to support the global expansion of the e-fuel market. By aligning policies and incentives across regions, stakeholders can create a conducive environment for investment and innovation in e-fuel technologies.

Challenges:

Despite the opportunities presented by e-fuels, several challenges must be addressed to realize their full potential. One challenge is the high upfront capital costs associated with e-fuel production infrastructure, including electrolyzers, carbon capture systems, and storage facilities. The scale-up of e-fuel production capacity requires significant investment and long-term financing commitments, which may pose challenges for project developers and investors.

Moreover, the availability and affordability of renewable energy sources, such as solar and wind power, can impact the cost competitiveness of e-fuels. Variability in renewable energy generation and grid integration challenges may result in fluctuations in e-fuel production costs and supply reliability, requiring innovative solutions and grid management strategies.

Furthermore, regulatory uncertainty and policy inconsistency across different jurisdictions can hinder market development and investment in e-fuel projects. Harmonizing regulations, establishing clear sustainability criteria, and providing long-term policy support are essential to create a stable and predictable regulatory environment for the e-fuel industry.

Read Also: Wind Turbine Composite Materials Market Size, Growth, Report By 2033

Recent Developments

- In March 2024, indiaOil launched ETHANOL 100 as an alternative automotive fuel. The Indian government made this courageous move in the automotive sector to reduce its dependency on fossil fuels, thus contributing to the global target of seizing carbon emissions and making the climate free from environmental toxication by internal combustion of conventionally working vehicles.

- In April 2023, Norwegian Air Shuttle ASA collaborated with Norsk e-fuel in Norway. The target of launching this new plant is to cater to the aviation industry by producing sustainable e-fuels by 2026. Through this collaboration, enterprises are expected to scale up their e-fuel production while holding high positions in the global market.

E-Fuel Market Companies

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Clean Fuels Alliance America

- Climeworks AG

- E-Fuel Corporation

- eFuel Pacific Limited

- Hexagon Agility

- Neste

- Norsk e-Fuel AS

Segments Covered in the Report

By Product

- E-diesel

- E-gasoline

- Ethanol

- Hydrogen

- E-kerosene

- E-methane

- E-methanol

- Others

By State

- Liquid

- Gas

By Production Method

- Power-to-liquid

- Power-to-gas

- Gas-to-liquid

- Biologically derived fuels

By Technology

- Hydrogen technology (Electrolysis)

- Fischer-tropsch

- Reverse-water-gas-shift (RWGS)

By End-use

- Automotive

- Marine

- Industrial

- Railway

- Aviation

- Others

By Carbon Source

- Point source

- Smokestack

- Gas well

- Direct air capture

By Carbon Capture

- Post-combustion

- Pre-combustion

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com