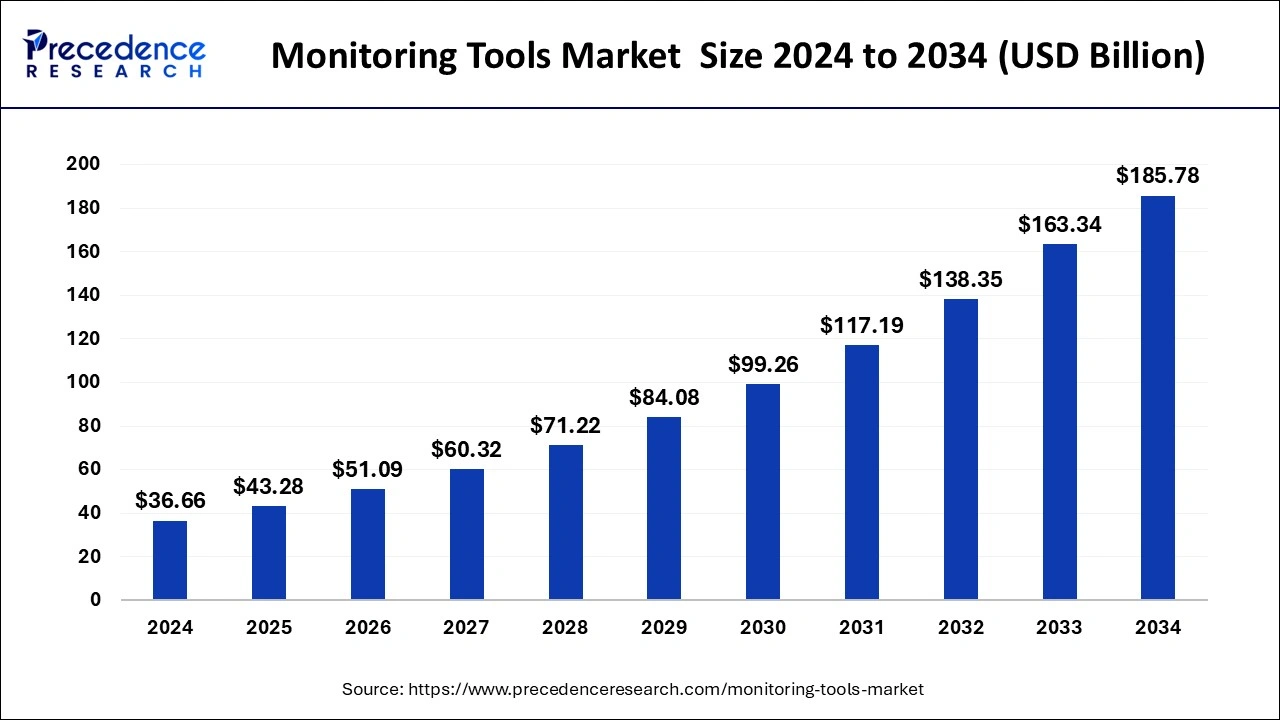

The global monitoring tools market size reached USD 31.05 billion in 2023 and is projected to hit around USD 163.34 billion by 2033, growing at a CAGR of 18.06% from 2024 to 2033.

Key Points

- North America contributed 38% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the software segment has held the largest market share of 77% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 19.7% between 2024 and 2033.

- By deployment, the on-premises segment has accounted over 60% of market share in 2023.

- By deployment, the cloud segment is expected to expand at the fastest CAGR over the projected period.

- By type, the security monitoring tools segment has generated over 38% of market share in 2023.

- By type, the infrastructure monitoring tools segment is expected to expand at the fastest CAGR over the projected period.

The Monitoring Tools Market is witnessing substantial growth driven by the increasing complexity of IT infrastructure across various industries. These tools play a crucial role in monitoring and managing the performance of networks, systems, applications, and other IT resources. With the rising adoption of cloud computing, IoT devices, and virtualization, the demand for monitoring tools has surged as organizations seek efficient ways to ensure the reliability, availability, and performance of their digital assets. Furthermore, the proliferation of digital transformation initiatives and the growing importance of data-driven decision-making are also fueling the expansion of the monitoring tools market.

Get a Sample: https://www.precedenceresearch.com/sample/4002

Growth Factors

Several factors contribute to the growth of the monitoring tools market. Firstly, the escalating need for real-time monitoring and analysis to identify and mitigate performance issues promptly is driving the adoption of advanced monitoring solutions. Organizations are increasingly recognizing the importance of proactive monitoring to prevent downtime, optimize resource utilization, and enhance the overall user experience. Additionally, the growing complexity of IT environments, including hybrid infrastructures spanning on-premises and cloud-based systems, necessitates robust monitoring tools capable of providing comprehensive visibility and insights across diverse platforms and technologies.

Moreover, the rising prevalence of cyber threats and security breaches has underscored the importance of monitoring tools for detecting and responding to suspicious activities promptly. As cybersecurity concerns continue to mount, organizations are investing in monitoring solutions equipped with advanced threat detection capabilities to safeguard their digital assets and sensitive data. Furthermore, the advent of technologies such as artificial intelligence (AI) and machine learning (ML) is revolutionizing the monitoring landscape by enabling predictive analytics and anomaly detection, thereby empowering organizations to anticipate and address potential issues before they escalate.

Region Insights

The monitoring tools market exhibits significant regional variations, influenced by factors such as technological advancements, regulatory frameworks, and economic conditions. North America dominates the market, attributed to the presence of a robust IT infrastructure, high adoption of cloud services, and stringent regulatory requirements across industries such as healthcare, finance, and telecommunications. Moreover, the region boasts a thriving ecosystem of monitoring tool vendors, ranging from established players to innovative startups, contributing to market growth.

In Europe, the monitoring tools market is buoyed by the increasing emphasis on digitalization and the adoption of Industry 4.0 practices across manufacturing and industrial sectors. Government initiatives promoting cybersecurity and data privacy compliance further drive the demand for advanced monitoring solutions in the region. Asia-Pacific emerges as a lucrative market opportunity, fueled by rapid urbanization, expanding internet penetration, and the proliferation of mobile devices. Developing economies such as China, India, and Southeast Asian countries are witnessing robust growth in demand for monitoring tools, propelled by the burgeoning IT infrastructure and the growing adoption of cloud-based services.

Monitoring Tools Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.06% |

| Global Market Size in 2023 | USD 31.05 Billion |

| Global Market Size by 2033 | USD 163.34 Billion |

| U.S. Market Size in 2023 | USD 8.85 Billion |

| U.S. Market Size by 2033 | USD 46.86 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Deployment, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Monitoring Tools Market Dynamics

Drivers

Several key drivers propel the growth of the monitoring tools market. Firstly, the escalating adoption of cloud computing and virtualization technologies is driving the demand for monitoring solutions capable of providing visibility into dynamic and distributed IT environments. Cloud-based monitoring tools offer scalability, flexibility, and cost-effectiveness, making them increasingly attractive to organizations seeking to optimize their IT operations. Additionally, the proliferation of IoT devices across various industry verticals, including manufacturing, healthcare, and transportation, necessitates advanced monitoring capabilities to ensure the performance, security, and reliability of interconnected systems.

Furthermore, the increasing complexity of IT infrastructures, characterized by hybrid environments comprising on-premises data centers, public and private clouds, edge computing nodes, and IoT endpoints, underscores the need for comprehensive monitoring solutions. Organizations require holistic visibility and unified management capabilities to monitor diverse components and dependencies effectively. Moreover, the growing significance of DevOps practices and agile methodologies in software development drives the adoption of monitoring tools integrated into the CI/CD pipeline, enabling continuous monitoring and feedback loops to optimize application performance and reliability.

Opportunities

The monitoring tools market presents ample opportunities for vendors to capitalize on emerging trends and technological advancements. With the proliferation of containerization and microservices architectures, there is a growing demand for monitoring solutions tailored to the unique requirements of dynamic and ephemeral workloads. Container orchestration platforms such as Kubernetes have become ubiquitous in modern IT environments, creating opportunities for vendors to offer specialized monitoring tools for containerized applications.

Additionally, the convergence of monitoring, analytics, and automation presents new avenues for innovation in the market. Advanced monitoring solutions leveraging AI and ML algorithms can analyze vast volumes of telemetry data in real-time to identify patterns, anomalies, and performance trends proactively. By incorporating automation capabilities, these solutions can automate remediation actions, optimize resource allocation, and enhance operational efficiency. Furthermore, the integration of monitoring tools with emerging technologies such as edge computing and serverless architectures opens up new frontiers for delivering insights and actionable intelligence closer to the point of data generation.

Challenges

Despite the promising growth prospects, the monitoring tools market faces several challenges that warrant attention. One of the primary challenges is the increasing complexity and heterogeneity of IT environments, which poses difficulties in achieving comprehensive visibility and monitoring coverage. Organizations struggle to integrate disparate monitoring tools and platforms, leading to fragmented insights and inefficiencies in troubleshooting and incident response. Moreover, the lack of skilled personnel proficient in operating and managing monitoring tools exacerbates the challenge, hindering organizations’ ability to harness the full potential of these solutions.

Another significant challenge is the evolving threat landscape and the sophistication of cyber attacks, which necessitate continuous innovation and adaptation in monitoring capabilities. Traditional monitoring approaches may struggle to detect and mitigate advanced threats such as zero-day exploits, ransomware, and insider attacks effectively. Vendors must invest in developing advanced threat detection algorithms and techniques to stay ahead of emerging threats and provide robust security posture to their customers. Furthermore, the increasing regulatory scrutiny and compliance requirements pertaining to data privacy, cybersecurity, and IT governance impose additional challenges for organizations in deploying and managing monitoring solutions effectively.

Read Also: Edible Insects Market Size to Reach USD 7,600.17 Mn by 2033

Recent Developments

- In February 2023, Tech Mahindra Limited, an Indian multinational information technology services and consulting company, introduced SANDSTORM, a robust tool designed to enhance customer experiences by providing real-time insights into device performance for businesses of all sizes.

- In June 2023, IBM completed the acquisition of Apptio, a move aimed at enhancing IBM’s existing offerings in resource optimization, observability, and application management. This acquisition is expected to deliver increased value to clients and generate significant synergies across various growth areas within IBM.

- In March 2023, Cisco and Lightspin forged a strategic alignment with a shared objective of assisting customers in modernizing their cloud environments. Together, they aim to provide comprehensive security and observability solutions spanning from the initial build phase to runtime.

Monitoring Tools Market Companies

- SolarWinds

- Nagios

- Datadog

- Zabbix

- PRTG Network Monitor

- Splunk

- New Relic

- Dynatrace

- BMC Software

- Icinga

- AppDynamics

- ManageEngine

- Prometheus

- Microsoft System Center Operations Manager (SCOM)

- LogicMonitor

Segments Covered in the Report

By Component

- Software

- Services

By Deployment

- Cloud

- On-premises

By Type

- Infrastructure Monitoring Tools

- Network Monitoring

- Storage Monitoring

- Server Monitoring

- Cloud Infrastructure Monitoring

- Others

- Application Performance Monitoring Tools

- Database Monitoring

- Web Application Monitoring

- Mobile Application Monitoring

- Code Level Monitoring

- Others

- Security Monitoring Tools

- Intrusion Detection and Prevention Systems (IDPS)

- Log Monitoring and Analysis

- Vulnerability Assessment and Management

- Others

- End-user Experience Monitoring Tools

- Synthetic Monitoring

- Real User Monitoring

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/