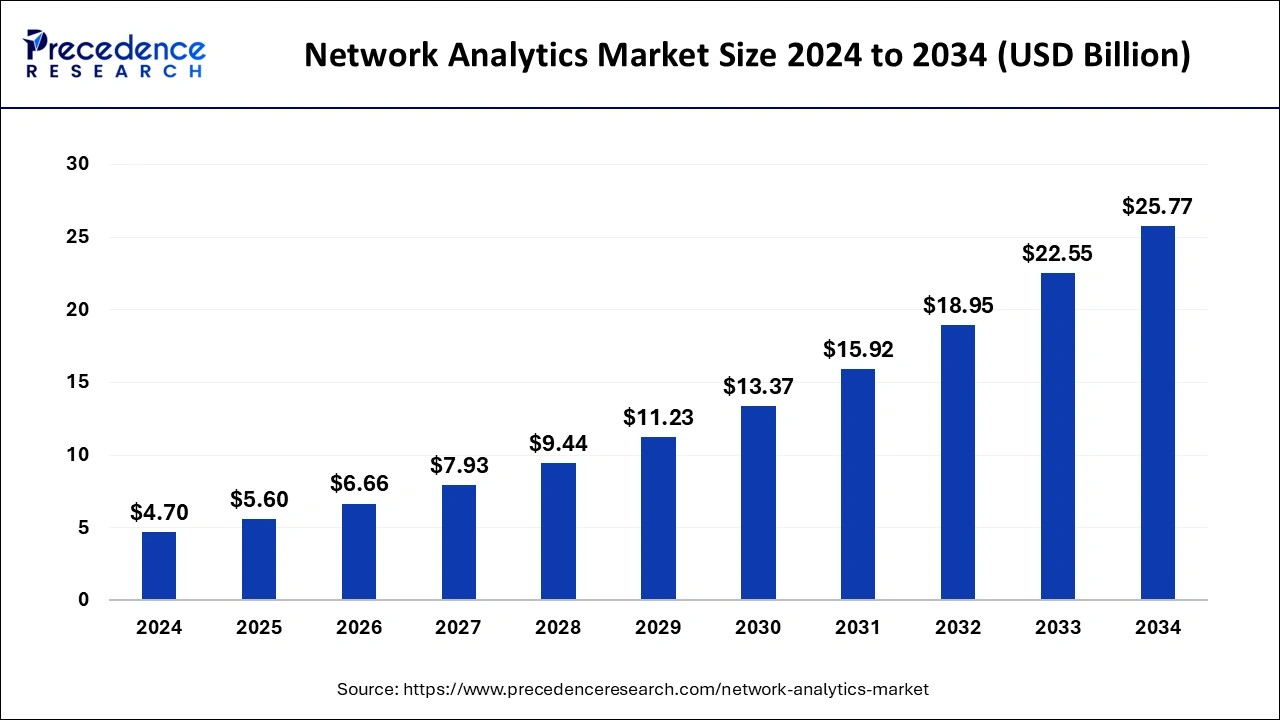

The global network analytics market size reached at USD 3.95 billion in 2023 and is expected to reach around USD 22.55 billion by 2033, expanding at a CAGR of 19.03% from 2024 to 2033.

Key Points

- North America has contributed over 35% of market share in 2023.

- Asia-Pacific is estimated to expand at the remarkable CAGR of 22% between 2024 and 2033.

- By component, the network intelligence solutions segment has held the biggest market share of 65% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 20.22% between 2024 and 2033.

- By enterprise size, the large enterprise segment has captured over 61% of market share in 2023.

- By enterprise size, the small and medium enterprises (SMEs) segment is projected to grow at the notable CAGR of 21.25% over the projected period.

- By end-user, the telecom providers segment has recorded more than 36% of market share in 2023.

- By end-user, the cloud service providers segment is growing at the remarkable CAGR of 19.43% over the projected period.

- By application, the network performance management segment has accounted over 31% of market share in 2023.

- By application, the quality management segment is expected to expand at the fastest CAGR of 21.03% over the projected period.

The network analytics market has emerged as a crucial component in today’s digital landscape, fueled by the exponential growth of data traffic, the proliferation of connected devices, and the increasing complexity of network infrastructures. Network analytics involves the use of advanced algorithms and tools to collect, monitor, analyze, and interpret data related to network traffic, performance, and security. It enables organizations to gain valuable insights into their networks, identify anomalies and potential threats, optimize performance, and enhance overall operational efficiency. As businesses and industries become more reliant on digital technologies, the demand for network analytics solutions continues to surge, driving significant growth in the market.

Network Analytics Market Data and Statistics

- In December 2022, Nokia extended its collaboration with BT in a five-year agreement, supplying its AVA Analytics software for fixed networks. This partnership aims to bolster BT’s network monitoring capabilities utilizing machine learning (ML) and artificial intelligence (AI).

- Cisco Systems reported that global mobile data traffic was approximately 19.01 exabytes per month in 2018. By 2022, this figure was projected to soar to around 77.5 exabytes per month, indicating a staggering compound annual growth rate of 46% over the period.

- In October 2022, Oracle launched the Oracle Network Analytics Suite, a new set of cloud-native analytics solutions. These solutions integrate various network function data with ML and AI to empower operators in making more informed, automated decisions concerning the stability and performance of their entire 5G network core.

- In June 2022, Zain Kuwait, a digital service provider, invested in technology from Accedian and Cisco, alongside other performance analytics and end-user experience solution providers. This investment aims to automate Zain Kuwait’s network, enhancing network visibility and service assurance.

- IDC predicts that by 2023, 60% of enterprises will have implemented AI-enabled network analytics to manage their network complexities effectively.

- As per a survey by Enterprise Management Associates, 80% of enterprises consider real-time network analytics crucial for their business operations.

Growth Factors:

Several key factors are driving the growth of the network analytics market. One of the primary drivers is the escalating volume of data generated by various sources, including IoT devices, social media platforms, mobile applications, and cloud services. This data deluge necessitates robust analytics solutions to extract actionable insights and ensure optimal network performance. Additionally, the growing adoption of cloud computing and virtualization technologies is driving the need for advanced network analytics tools to monitor and manage complex, distributed IT environments. Moreover, the rising concerns regarding cybersecurity threats and the need for proactive threat detection and mitigation further propel the demand for network analytics solutions with robust security features.

Region Insights:

The network analytics market exhibits significant regional variation, with certain regions witnessing higher adoption rates and market growth than others. North America holds a dominant position in the market, driven by the presence of a large number of technology companies, early adoption of advanced analytics solutions, and stringent regulations pertaining to data security and privacy. Europe follows closely behind, fueled by the rapid digital transformation across industries and increasing investments in cybersecurity infrastructure. In the Asia-Pacific region, burgeoning economies such as China, India, and South Korea are experiencing rapid expansion in the network analytics market, driven by the growing adoption of cloud services, IoT technologies, and digital initiatives across sectors.

Network Analytics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.03% |

| Global Market Size in 2023 | USD 3.95 Billion |

| Global Market Size in 2024 | USD 4.70 Billion |

| Global Market Size by 2033 | USD 22.55 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Enterprise Size, By End-user, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network Analytics Market Dynamics

Drivers:

Several drivers contribute to the growth and adoption of network analytics solutions across industries. One of the primary drivers is the escalating complexity of network infrastructures due to the proliferation of connected devices, distributed IT environments, and hybrid cloud architectures. This complexity necessitates advanced analytics tools to monitor, analyze, and optimize network performance effectively. Furthermore, the increasing reliance on data-driven decision-making processes across organizations drives the demand for network analytics solutions that can provide actionable insights in real-time. Additionally, the rising prominence of artificial intelligence (AI) and machine learning (ML) technologies enables more sophisticated analysis of network data, enhancing the capabilities of network analytics platforms.

Opportunities:

The network analytics market is ripe with opportunities for vendors and organizations looking to capitalize on the growing demand for advanced analytics solutions. One significant opportunity lies in the development of industry-specific analytics solutions tailored to the unique requirements and challenges of various sectors, such as healthcare, finance, manufacturing, and telecommunications. By addressing industry-specific pain points and providing tailored analytics capabilities, vendors can unlock new revenue streams and gain a competitive edge in the market. Furthermore, the integration of emerging technologies such as edge computing, 5G networking, and Internet of Things (IoT) presents opportunities to enhance the capabilities and scope of network analytics solutions, enabling real-time analysis and decision-making at the network edge.

Challenges:

Despite the promising growth prospects, the network analytics market also faces several challenges that could hinder its expansion. One such challenge is the increasing complexity and diversity of network environments, which pose difficulties in collecting, correlating, and analyzing data from disparate sources. This complexity is further compounded by the dynamic nature of modern networks, where configurations, traffic patterns, and security threats are constantly evolving. Moreover, privacy and regulatory concerns surrounding the collection and use of network data present challenges for organizations and vendors alike, requiring robust data governance frameworks and compliance measures. Additionally, the shortage of skilled professionals with expertise in network analytics and cybersecurity poses a challenge for organizations seeking to leverage advanced analytics solutions effectively.

Read Also: Insulated Gate Bipolar Transistors (IGBT) Market Size Report by 2033

Recent Developments

- In March 2023, IBM and Nokia forged a partnership aimed at assisting the burgeoning sector. Their collaboration seeks to empower enterprises with secure, tailored connectivity services facilitated by a highly resilient 5G cloud network.

- In November 2023, Vodafone Group Plc joined forces with Accenture to commercialize Vodafone’s shared operations. This strategic alliance aims to expedite growth, elevate customer service, and generate substantial efficiencies for Vodafone’s operating companies and partner markets. Additionally, it aims to create fresh career opportunities for Vodafone’s workforce.

- On April 2023, Accenture entered into a partnership with Google Cloud to bolster businesses’ defenses against persistent cyber threats and safeguard critical assets more effectively.

- In June 2023, Cisco introduced the Networking Cloud Platform, designed to streamline the management of networking equipment via a unified interface. This platform rollout coincides with enhancements to various Cisco products, including the ThousandEyes infrastructure monitoring service and the Catalyst portfolio.

- In November 2023, Accenture unveiled a network of generative AI studios in North America. These studios serve as hubs where companies can explore opportunities to optimize and transform their businesses responsibly through the adoption of generative AI applications.

Network Analytics Market Companies

- Cisco Systems

- Nokia Corporation

- Oracle Corporation

- IBM Corporation

- Accenture

- Google LLC

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- SAS Institute Inc.

- Juniper Networks, Inc.

- Splunk Inc.

- Extreme Networks, Inc.

- Nokia Solutions and Networks

- Broadcom Inc.

- Ericsson AB

Segments Covered in the Report

By Component

- Network Intelligence Solutions

- Services

- Professional Services

- Managed Service

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-user

- Cloud Service Providers

- Managed Service Providers

- Telecom Providers

- Others

By Application

- Customer Analysis

- Risk Management

- Fault Detection

- Network Performance Management

- Quality Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/