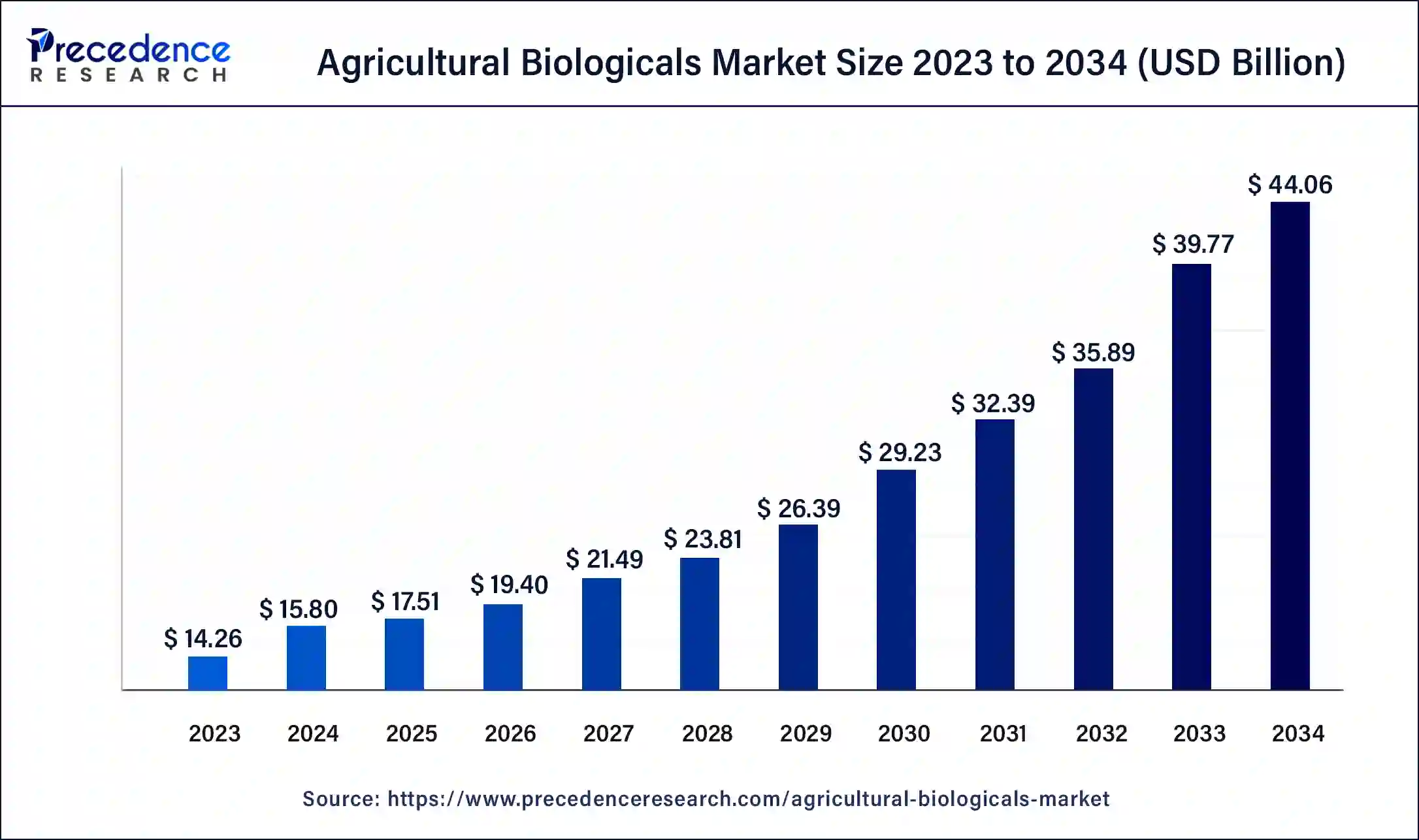

The global agricultural biologicals market size reached USD 14.26 billion in 2023 and is anticipated to attain around USD 39.59 billion by 2033, growing at a CAGR of 10.75% from 2024 to 2033.

Key Points

- The North America agricultural biologicals market size reached USD 5.22 billion in 2023 and is expected to be worth around USD 14.49 billion by 2033.

- North America led the agricultural biologicals market with the largest share of 36.6% in 2023.

- By Product, the biopesticides segment dominated the agricultural biologicals market with the largest share 57% in 2023.

- By Application, the foliar spray segment held the dominating share of around 64.5% in 2023.

- By Crop-type, the cereals & grains segment has accounted market share of around 37.4% in 2023.

- By end-user, the biological product manufacturers segment held the largest share of the market in 2023.

The agricultural biologicals market has experienced significant growth in recent years, driven by increasing demand for sustainable agricultural practices and a shift towards organic farming methods. Agricultural biologicals, which include biopesticides, biofertilizers, and biostimulants, are derived from natural sources such as microorganisms, plant extracts, and beneficial insects. These products offer farmers an environmentally friendly alternative to conventional chemical inputs, while also promoting soil health, crop productivity, and overall sustainability in agriculture. As the global population continues to rise and environmental concerns become more pressing, the adoption of agricultural biologicals is expected to accelerate, shaping the future of farming worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4084

Growth Factors

Several factors contribute to the growth of the agricultural biologicals market. Firstly, increasing awareness among farmers about the adverse effects of synthetic chemicals on soil health, human health, and the environment has led to a growing demand for safer and more sustainable agricultural solutions. Additionally, stringent regulations on the use of chemical pesticides and fertilizers in many countries have prompted farmers to seek alternative options, further driving the adoption of agricultural biologicals. Moreover, advancements in biotechnology and microbial research have led to the development of more effective and affordable biological products, making them increasingly accessible to farmers across different regions.

Region Insights:

The agricultural biologicals market exhibits significant regional variation, influenced by factors such as agricultural practices, regulatory frameworks, and consumer preferences. North America and Europe are leading regions in terms of market share, driven by strong government support for sustainable agriculture and a well-established organic food market. In Asia-Pacific, rapid urbanization, changing dietary habits, and increasing environmental awareness are driving demand for organic produce, driving growth in the agricultural biologicals market. Latin America and Africa are also emerging markets for agricultural biologicals, supported by growing investments in agriculture and rising adoption of organic farming practices.

Agricultural Biologicals Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.75% |

| Global Market Size in 2023 | USD 14.26 Billion |

| Global Market Size in 2024 | USD 15.79 Billion |

| Global Market Size by 2033 | USD 39.59 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Crop-type, By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Agricultural Biologicals Market Dynamics

Drivers:

Several key drivers are fueling the growth of the agricultural biologicals market. One major driver is the increasing demand for organic food products, driven by consumer preferences for healthier and more environmentally friendly food options. This growing demand has incentivized farmers to transition towards organic farming methods, thereby boosting the adoption of agricultural biologicals. Additionally, the need to improve soil health and fertility amid concerns about soil degradation and erosion is driving farmers to incorporate biofertilizers and biostimulants into their agricultural practices. Furthermore, the rising incidence of pest and disease resistance to chemical pesticides has created a need for alternative pest management solutions, leading to increased demand for biopesticides.

Challenges:

Despite the promising growth prospects, the agricultural biologicals market faces several challenges that may hinder its expansion. One major challenge is the lack of awareness and understanding among farmers about the benefits and proper use of agricultural biologicals. Many farmers remain skeptical about the efficacy of biological products compared to conventional chemical inputs, leading to slower adoption rates. Additionally, the high costs associated with research, development, and production of agricultural biologicals pose a challenge for manufacturers, limiting their ability to scale up production and reduce prices. Moreover, regulatory hurdles and lengthy approval processes for new biological products can impede market growth, particularly in regions with stringent regulations on agricultural inputs.

Opportunities:

Despite the challenges, the agricultural biologicals market presents significant opportunities for growth and innovation. Technological advancements in biotechnology, including genetic engineering and microbial formulations, hold the potential to revolutionize the development of new and more effective agricultural biologicals. Moreover, strategic collaborations and partnerships between agricultural biotechnology companies, research institutions, and government agencies can facilitate knowledge exchange and accelerate product innovation. Additionally, increasing investments in sustainable agriculture initiatives and organic farming programs by governments and non-governmental organizations create a favorable environment for the expansion of the agricultural biologicals market. Furthermore, the growing trend towards precision agriculture and digital farming technologies presents opportunities for the integration of biological products into precision farming systems, enhancing their efficacy and value proposition for farmers.

Read Also: Smart Medical Devices Market Size to Reach USD 152.30 Bn by 2033

Recent Developments

- In March 2024, Certis Biologicals comes in a strategic collaboration with the SDS Biotech K.K. for the commercialization and development of the agricultural biological products. The partnership aiming the goal is to find the solution for the evolving challenges of the agriculture industry.

- In March 2024, IPL Biologicals launched its latest brand identity and Microbot™ Technology, to celebrate its 30-year-old journey. The latest logo shows the farming community with the representation of growth, sustainability, and nature.

- In June 2023, AgBiome tapped in the agreement with the Ginkgo Bioworks aiming to increase the development of latest agricultural biologicals and enhance existing product that uses in the production of crops.

Agricultural Biological Market Companies

- BASF SE (Germany)

- Syngenta AG (Switzerland)

- Bayer AG (Germany)

- UPL (India)

- Corteva Agriscience (US)

- The Mosaic Company (US)

- Pro Farm Group Inc. (US)

- Gowan Company (US)

- Vegalab SA (Switzerland)

- Lallemand Inc. (Canada)

- Valent BioSciences LLC (US)

Segments Covered in the Report

By Crop-type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Product

- Biopesticides

- Biochemicals

- Microbials

- Biostimulants

- Acid Based

- Seaweed Extract

- Microbials

- Others

- Biofertilizers

- Nitrogen Fixation

- Phosphate Solubilizing

- Others

- Others (Macro-organisms)

By Application

- Foliar Sprays

- Soil Treatment

- Seed Treatment

- Post-harvest

By End-User

- Biological Product Manufacturer

- Government Agencies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/