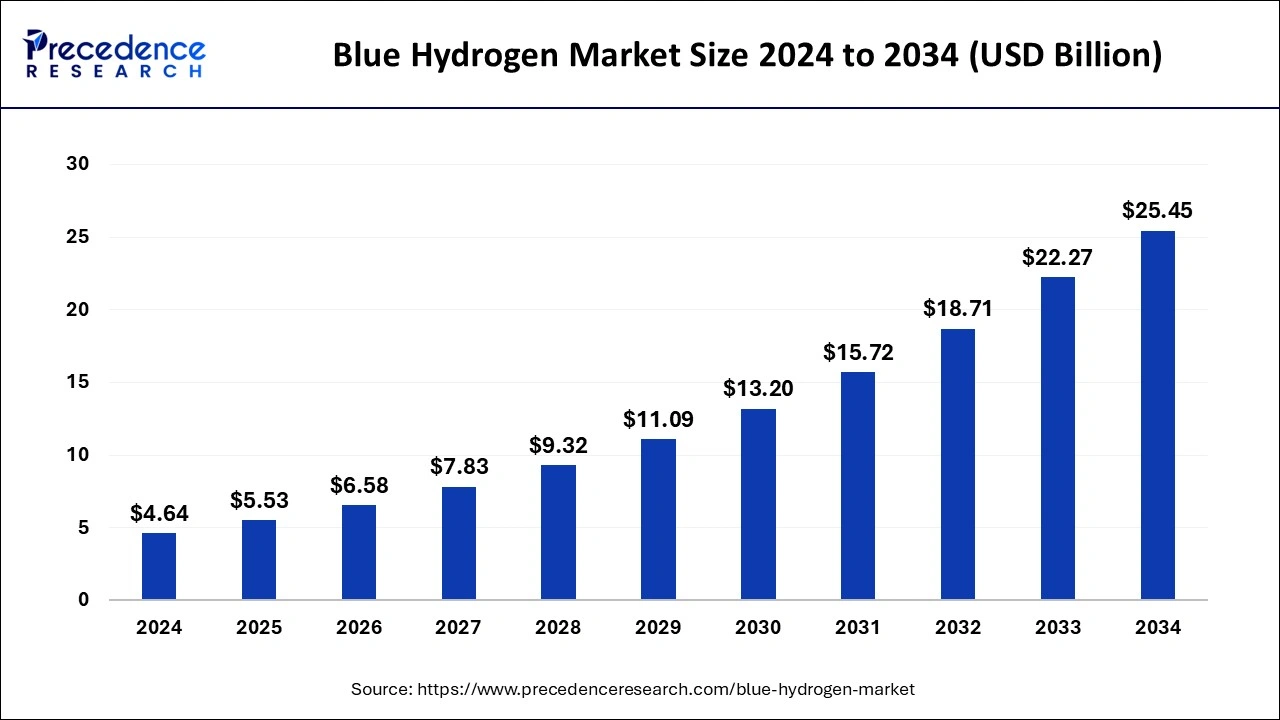

The global blue hydrogen market size reached USD 3.90 billion in 2023 and is projected to be worth around USD 22.27 billion by 2033, expanding at a CAGR of 19.03% from 2024 to 2033.

Key Points

- Middle East & Africa dominated the market with the largest revenue share of 35% in 2023.

- Europe is projected to grow at the fastest CAGR of 22.65% during the forecast period.

- By technology, the steam methane reforming segment has contributed more than 63% of revenue share in 2023.

- By technology, the auto thermal reforming segment is expected to grow at a significant rate in the market over the forecast period.

- By transportation mode, the pipeline segment has held the largest revenue share of 73% in 2023.

- By transportation mode, the cryogenic liquid tankers segment is expected to grow at the fastest rate during the forecast period.

- By application, the power generation segment has recorded more than 39% of revenue share in 2023.

- By application, the refinery segment is anticipated to grow at a solid CAGR of 20.62% over the projected period.

Blue hydrogen is a form of hydrogen produced from natural gas through the process of steam methane reforming (SMR), with carbon capture and storage (CCS) technology to mitigate carbon emissions. This approach combines the reliability and scalability of natural gas with a significant reduction in carbon footprint, making it a transitional solution towards a low-carbon economy. As industries and governments strive for cleaner energy solutions, blue hydrogen is gaining traction as a feasible and more environmentally friendly alternative to grey hydrogen, which is produced without CCS.

Get a Sample: https://www.precedenceresearch.com/sample/4367

Growth Factors

Several factors are driving the growth of the blue hydrogen market. Firstly, the increasing global focus on reducing greenhouse gas emissions is compelling industries to adopt cleaner energy sources. Governments worldwide are implementing policies and providing incentives to promote the use of low-carbon technologies, including blue hydrogen. Secondly, advancements in carbon capture and storage technologies are making it more cost-effective and efficient to produce blue hydrogen. Additionally, the rising demand for hydrogen in various sectors, such as transportation, industrial processes, and power generation, is further propelling market growth. The scalability of natural gas infrastructure also supports the rapid deployment of blue hydrogen production facilities.

Blue Hydrogen Market Scope

| Report Coverage | Details |

| Blue Hydrogen Market Size in 2023 | USD 3.90 Billion |

| Blue Hydrogen Market Size in 2024 | USD 4.64 Billion |

| Blue Hydrogen Market Size by 2033 | USD 22.27 Billion |

| Blue Hydrogen Market Growth Rate | CAGR of 19.03% from 2024 to 2033 |

| Largest Market | Middle East & Africa |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, Transportation Mode, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blue Hydrogen Market Dynamics

Regional Insights

The blue hydrogen market is witnessing varying levels of adoption across different regions. In North America, particularly the United States and Canada, significant investments are being made in blue hydrogen projects due to the abundant natural gas reserves and supportive government policies. Europe is also a key player, with countries like the United Kingdom, Germany, and the Netherlands leading the charge in adopting blue hydrogen as part of their broader hydrogen strategies to achieve net-zero targets. In the Asia-Pacific region, Japan and South Korea are actively investing in blue hydrogen to reduce their carbon emissions and enhance energy security. These regions are focusing on developing the necessary infrastructure and fostering international collaborations to accelerate the adoption of blue hydrogen.

Opportunities

The blue hydrogen market presents numerous opportunities for growth and innovation. One of the primary opportunities lies in the integration of blue hydrogen with renewable energy sources. By using excess renewable energy to power the carbon capture and storage processes, the overall carbon footprint of blue hydrogen can be further reduced. Additionally, there is a significant opportunity for technological advancements in CCS to enhance efficiency and reduce costs. The development of hydrogen infrastructure, such as pipelines and storage facilities, also presents a lucrative opportunity for market players. Moreover, the growing interest in hydrogen as a fuel for heavy-duty transportation, maritime applications, and industrial processes opens up new avenues for the blue hydrogen market.

Challenges

Despite the promising outlook, the blue hydrogen market faces several challenges. One of the main challenges is the high cost associated with carbon capture and storage technologies, which can make blue hydrogen less competitive compared to grey hydrogen and other renewable energy sources. Additionally, there are concerns regarding the long-term storage and potential leakage of captured carbon dioxide, which could undermine the environmental benefits of blue hydrogen. The development of the necessary infrastructure for hydrogen production, transportation, and storage is another significant challenge, requiring substantial investment and coordination among various stakeholders. Furthermore, public perception and acceptance of hydrogen as a safe and viable energy source remain critical hurdles that need to be addressed through education and awareness campaigns.

Read Also: Automatic Door Market Size to Reach USD 42.44 Billion by 2033

Blue Hydrogen Market Recent Developments

- In February 2023, Linde announced plans to develop a USD 1.8 billion blue hydrogen facility on the Texas Gulf Coast to feed ammonia production. The business intends to start production around 2025.

- In March 2022, Air Products Inc. announced its plans to construct and operate a new liquid hydrogen production plant in Casa Grande, Arizona. The facility will be designed to produce up to 30 tons per day of liquid hydrogen using Air Products’ proprietary natural gas liquefaction technology. The company has stated that the facility will be a zero-carbon plant powered entirely by renewable energy sources such as wind and solar power.

- In January 2022, Linde plc. and Yara signed an agreement to construct and deliver a 24 MW hydrogen plant. This is a significant development in the blue hydrogen market, as it demonstrates the growing interest and investment in this technology. The new hydrogen plant is expected to be operational in 2024 and will produce low-carbon hydrogen using natural gas with carbon capture and storage technology.

Blue Hydrogen Market Companies

- Linde Plc

- Shell Group of Companies

- Air Liquide

- Air Products and Chemicals, Inc.

- Engie

- Equinor ASA

- SOL Group

- Iwatani Corp.

- INOX Air Products Ltd.

- Exxon Mobil Corp.

Segments Covered in the Report

By Technology

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

By Transportation Mode

- Pipeline

- Cryogenic Liquid Tankers

By Application

- Chemicals

- Refinery

- Power Generation

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/