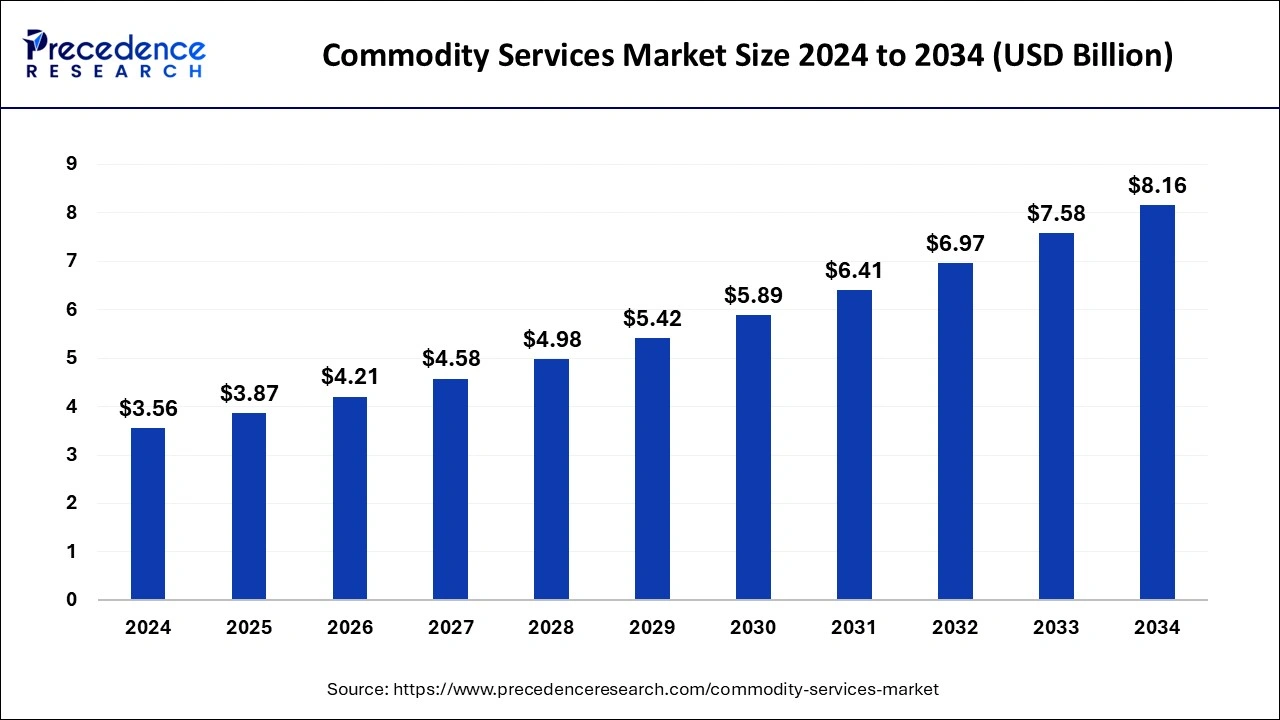

The global commodity services market size reached USD 3.27 billion in 2023 and is predicted to attain around USD 7.58 billion by 2033, growing at a CAGR of 8.76% from 2024 to 2033.

Key Points

- North America holds the largest share of the commodity services market.

- Asia Pacific is expected to witness rapid growth in the market.

- By type, the agriculture segment dominated the market in 2023.

- By type, the metal segment is expected to be the fastest growth in the market during the forecast period.

- By entity, the producers segment held the largest share of the market in 2023.

- By entity, the manufacturers segment is expected to grow rapidly in the market during the forecast period

The Commodity Services Market encompasses a broad range of services related to the trading and management of commodities such as agricultural products, energy resources, metals, and other raw materials. These services include brokerage, risk management, logistics, warehousing, and advisory services. The market is integral to the global economy as it facilitates the efficient exchange and distribution of commodities, ensuring supply meets demand across various sectors. It operates through a complex network of exchanges, financial institutions, and service providers, leveraging technology and expertise to optimize trading processes.

Get a Sample: https://www.precedenceresearch.com/sample/4364

Growth Factors

The growth of the Commodity Services Market is driven by several key factors. One of the primary drivers is the increasing volatility in commodity prices, which heightens the demand for risk management and hedging services. Technological advancements, such as the adoption of blockchain and AI in trading platforms, are also significant contributors, enhancing transparency, efficiency, and security. Additionally, the growing global population and industrialization, particularly in emerging markets, are escalating the demand for various commodities, thereby boosting the need for comprehensive commodity services. Regulatory changes and environmental considerations are further shaping the market, prompting innovations in sustainable commodity trading practices.

Region Insights

Regionally, the Commodity Services Market exhibits diverse dynamics. North America, with its well-established infrastructure and leading financial markets, remains a dominant player. The United States, in particular, hosts major commodity exchanges such as the Chicago Mercantile Exchange (CME). Europe also holds a significant share, driven by its robust financial institutions and regulatory frameworks. Meanwhile, the Asia-Pacific region is witnessing rapid growth, fueled by the burgeoning economies of China and India, which are major consumers of various commodities. Latin America and Africa, rich in natural resources, are emerging as crucial regions, contributing significantly to the global supply chain.

Commodity Services Market Scope

| Report Coverage | Details |

| Commodity Services Market Size in 2023 | USD 3.27 Billion |

| Commodity Services Market Size in 2024 | USD 3.56 Billion |

| Commodity Services Market Size by 2033 | USD 7.58 Billion |

| Commodity Services Market Growth Rate | CAGR of 8.76% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Entity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Commodity Services Market Dynamic

Drivers

Key drivers of the Commodity Services Market include economic growth and increasing globalization, which expand trade opportunities and the need for sophisticated commodity services. The rise in commodity trading volumes and the complexity of supply chains necessitate advanced risk management solutions. Additionally, the integration of digital technologies, such as trading algorithms and big data analytics, enhances market operations and decision-making processes. Environmental, social, and governance (ESG) criteria are becoming increasingly important, driving the development of sustainable commodity trading practices.

Opportunities

The Commodity Services Market presents numerous opportunities, particularly in the realm of technology adoption. Blockchain technology offers the potential to revolutionize trading by providing enhanced transparency and traceability. There is also significant potential in expanding services to emerging markets, where increasing industrialization and consumption patterns are driving demand. Developing tailored financial products and services that cater to specific commodity sectors or regional needs can further capture market share. Additionally, the growing emphasis on ESG factors creates opportunities for services focused on sustainability and ethical trading practices.

Challenges

Despite its growth prospects, the Commodity Services Market faces several challenges. Price volatility and market uncertainties can pose significant risks, affecting profitability and stability. Regulatory compliance is another major challenge, as varying regulations across different regions require firms to navigate complex legal landscapes. Technological disruptions, while beneficial, also introduce risks related to cybersecurity and the need for continuous investment in technology upgrades. Moreover, geopolitical tensions and trade disputes can disrupt supply chains and impact market dynamics. Finally, environmental concerns and the push for sustainability necessitate adaptations in traditional commodity trading practices, which can be resource-intensive.

Read Also: Autonomous Forklift Market Size to Reach USD 13.91 Billion by 2033

Commodity Services Market Recent Developments

- In February 2024, First-of-its-kind daily, spot market U.S. lithium carbonate price assessments have been made available by Platts, a division of S&P Global Commodity Insights, the premier independent source of information, data, analysis, benchmark prices, and workflow solutions for the commodities, energy, battery metals, and energy transition markets.

- In February 2024, With the introduction of the DoubleLine Commodity Strategy ETF and the Fortune 500 Equal Weight ETF, there are now six DoubleLine ETFs available. The DoubleLine Opportunistic Bond ETF, DoubleLine Mortgage ETF, DoubleLine Commercial Real Estate ETF, and DoubleLine Shiller CAPE U.S. Equities ETF1 are the other four exchange-traded funds.

Commodity Services Market Companies

- Cargill

- Gunvor

- Louis Dreyfus Company

- Mercuria energy group

- Trafigura

- Archer Daniels Midland

- Bunge limited

- Mabanaft

- Wilmar International

- COFCO Group

- Koch industries

- Hedgers

- Glencore

- Vitol

- Arbitrageurs

Segment Covered in the Report

By Type

- Metal

- Energy

- Agricultural

- Livestock

- Meat

- Others

By Entity

- Investors

- Consumers

- Manufacturers

- Traders

- Business Entities

- Producers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/