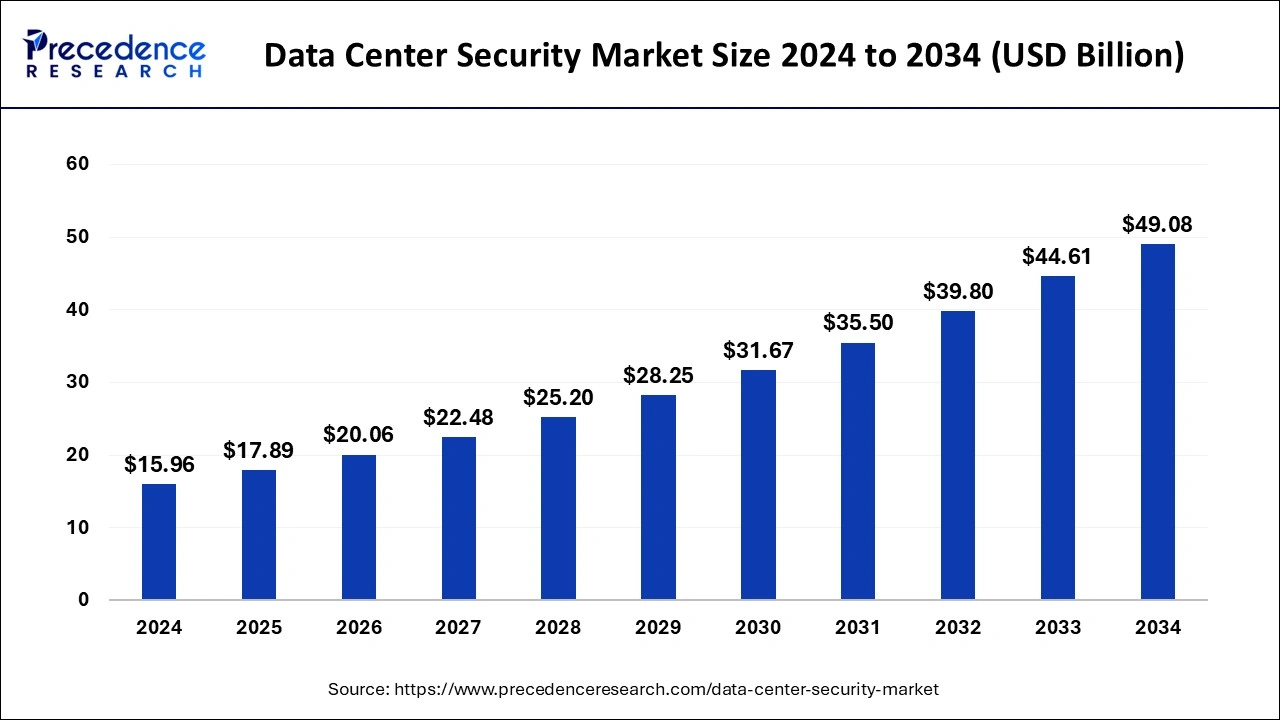

The global data center security market size reached USD 14.24 billion in 2023 and is projected to hit around USD 44.61 billion by 2033, growing at a CAGR of 12.01% from 2024 to 2033.

Key Points

- North America contributed more than 37% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the solution segment has held the largest market share of 76% in 2023.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By data center type, the small data center segment has generated over 46% of market share in 2023.

- By data center type, the large data center segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the BFSI segment has accounted over 21% of market share in 2023.

- By industry vertical, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The data center security market is witnessing significant growth driven by the increasing adoption of cloud computing, rising cyber threats, and stringent regulatory requirements for data protection. Data centers play a critical role in storing and processing vast amounts of sensitive information, making security a top priority for organizations across various industries. Data breaches can result in severe financial losses, reputational damage, and legal consequences, prompting businesses to invest in robust security solutions to safeguard their assets.

Get a Sample: https://www.precedenceresearch.com/sample/4020

Growth Factors:

Several factors contribute to the growth of the data center security market. Firstly, the proliferation of cloud-based services and the rapid expansion of data center infrastructure are driving the demand for advanced security solutions. As organizations migrate their workloads to the cloud, they require robust security measures to protect their data from unauthorized access, malware, and other cyber threats. Additionally, the increasing adoption of IoT devices and the proliferation of data generated by connected devices are further fueling the need for enhanced data center security.

Furthermore, the growing sophistication of cyber-attacks and the evolving threat landscape are prompting organizations to invest in innovative security solutions. Threat actors are constantly developing new techniques to exploit vulnerabilities in data center environments, necessitating proactive security measures such as intrusion detection systems, encryption technologies, and advanced threat analytics. Moreover, regulatory requirements such as GDPR, HIPAA, and PCI DSS mandate stringent data protection measures, driving the adoption of comprehensive security solutions in data centers.

Region Insights:

The data center security market exhibits strong growth across various regions, with North America leading the market due to the presence of a large number of data centers and the increasing focus on cybersecurity. The United States accounts for a significant share of the market, driven by the high adoption of cloud services, stringent regulatory frameworks, and the presence of major players offering advanced security solutions. Moreover, the Asia Pacific region is witnessing rapid growth in the data center security market, fueled by the increasing digitization, rising cyber threats, and the expansion of data center infrastructure in countries like China, India, and Japan.

Data Center Security Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.10% |

| Global Market Size in 2023 | USD 14.24 Billion |

| Global Market Size by 2033 | USD 44.61 Billion |

| U.S. Market Size in 2023 | USD 3.95 Billion |

| U.S. Market Size by 2033 | USD 12.38 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Data Center Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center Security Market Dynamics

Drivers:

Several key drivers are driving the growth of the data center security market. Firstly, the escalating frequency and sophistication of cyber-attacks pose a significant threat to organizations, compelling them to invest in robust security solutions to safeguard their data assets. Additionally, the increasing adoption of cloud computing and virtualization technologies necessitates enhanced security measures to protect sensitive information stored in data centers. Moreover, regulatory compliance requirements mandate organizations to implement stringent data protection measures, driving the demand for advanced security solutions.

Furthermore, the growing trend of remote working and the proliferation of mobile devices have expanded the attack surface, making data centers more vulnerable to cyber threats. As a result, organizations are prioritizing investments in security technologies such as encryption, access control, and multi-factor authentication to mitigate risks and ensure data confidentiality. Moreover, the emergence of technologies such as artificial intelligence and machine learning is enabling organizations to detect and respond to security threats in real-time, driving the adoption of intelligent security solutions in data centers.

Opportunities:

The data center security market presents lucrative opportunities for vendors to capitalize on the growing demand for advanced security solutions. With the increasing digitization of business processes and the rising adoption of cloud services, organizations are seeking comprehensive security solutions to protect their data assets from cyber threats. Vendors can leverage this trend by offering innovative security technologies such as behavioral analytics, threat intelligence, and predictive security analytics to address the evolving threat landscape.

Moreover, the proliferation of IoT devices and the expansion of edge computing are creating new opportunities for security vendors to provide specialized solutions tailored to the unique security requirements of these environments. As organizations deploy more IoT devices and edge computing infrastructure, they require robust security measures to protect sensitive data and ensure regulatory compliance. Additionally, the growing adoption of hybrid cloud architectures presents opportunities for vendors to offer integrated security solutions that span across on-premises data centers and cloud environments.

Challenges:

Despite the growth prospects, the data center security market faces several challenges that could impede market growth. One of the key challenges is the complexity of modern data center environments, which consist of diverse infrastructure components, including servers, storage devices, networking equipment, and virtualized environments. Securing these heterogeneous environments requires comprehensive security strategies and technologies, which can be complex to implement and manage.

Moreover, the shortage of skilled cybersecurity professionals poses a significant challenge for organizations in effectively managing and maintaining their data center security infrastructure. As cyber threats continue to evolve, organizations struggle to find qualified professionals with the necessary expertise to identify and mitigate security risks. Additionally, the cost associated with implementing and maintaining robust security solutions can be prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to invest in advanced security technologies.

Furthermore, the increasing regulatory complexity and compliance requirements pose challenges for organizations in ensuring adherence to data protection regulations such as GDPR, HIPAA, and PCI DSS. Achieving compliance requires significant investments in security technologies, processes, and personnel, which can strain the resources of organizations, particularly SMEs. Moreover, the dynamic nature of cyber threats and the constant evolution of attack techniques pose challenges for organizations in staying ahead of emerging threats and vulnerabilities.

Read Also: Workforce Management Market Size to Reach USD 28.64 Bn by 2033

Recent Developments

- In August 2022, NVIDIA unveiled a novel data center solution in collaboration with Dell Technologies, tailored for the AI era. This innovation integrates Dell PowerEdge servers with NVIDIA BlueField DPUs and GPUs, along with NVIDIA AI Enterprise software. The comprehensive offering extends cutting-edge capabilities in AI training, inference, data processing, and data science, complemented by robust zero-trust security features, catering to enterprises worldwide. The solution is finely tuned for VMware vSphere 8 enterprise workload platform, promising enhanced performance and efficiency.

- In November 2023, Schneider Electric, renowned for its leadership in energy management and automation, announced a substantial $3 billion multi-year agreement with Compass Datacenters. This agreement extends their ongoing partnership, leveraging synergies between their supply chains to manufacture and deliver prefabricated modular data center solutions, bolstering scalability and agility in data center deployments.

- In March 2023, Cisco, a prominent provider of networking, cloud, and cybersecurity solutions, unveiled ambitious plans to strengthen its commitment to India. This initiative includes establishing a new data center in Chennai, introducing advanced risk-based capabilities across its security portfolio for hybrid and multi-cloud environments, and launching enhanced features for its Duo Risk-Based Authentication solution.

- In October 2023, leading cybersecurity firm Fortinet announced the establishment of two dedicated data centers in Pune and Bengaluru to expand its Universal SASE, AI-powered Security Services, and FortiCloud offerings across India and SAARC regions. This strategic move underscores Fortinet’s unwavering dedication to fortifying its presence and support infrastructure in India, complementing its existing investments in development and support centers in the country.

Data Center Security Market Companies

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- McAfee, LLC

- Juniper Networks, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Broadcom Inc.

- FireEye, Inc.

- Symantec Corporation

- F5 Networks, Inc.

- VMware, Inc.

Segments Covered in the Report

By Component

- Solution

- Service

By Data Center Type

- Small Data Center

- Medium Data Center

- Large Data Center

By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Media and Entertainment

- Government

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/