The dental diagnostic and surgical equipment market encompasses a wide range of tools and devices used by dental professionals for diagnosing and treating dental diseases and conditions. These equipment include imaging systems, dental chairs, handpieces, sterilization equipment, lasers, and surgical instruments, among others. The market is driven by the increasing prevalence of dental diseases, advancements in technology, and a growing focus on oral health worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4114

Growth Factors

Key growth factors in the dental diagnostic and surgical equipment market include the rising incidence of dental disorders such as cavities, periodontal diseases, and oral cancers. Additionally, the increasing adoption of advanced diagnostic and treatment technologies, such as digital imaging and laser therapy, has boosted market growth. The aging population and the demand for cosmetic dentistry procedures also play a significant role in driving market expansion.

Region Insights

The dental diagnostic and surgical equipment market varies by region. North America holds a significant share of the market due to high healthcare expenditure, well-established healthcare infrastructure, and a large aging population. Europe follows closely, with a strong focus on preventive dental care and government initiatives to improve oral health. The Asia-Pacific region is expected to experience rapid growth, driven by an increasing population, rising disposable income, and greater awareness of oral health.

Dental Diagnostic and Surgical Equipment Market Scope

| Report Coverage |

Details |

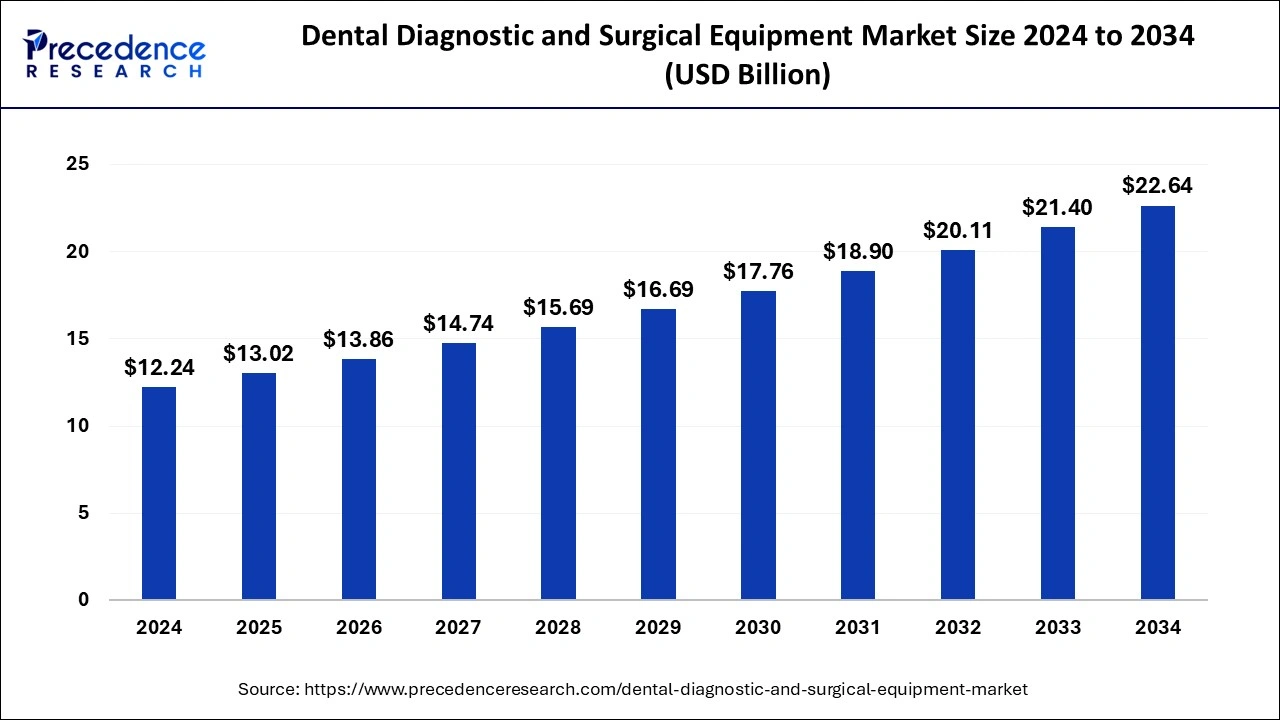

| Growth Rate from 2024 to 2033 |

CAGR of 6.40% |

| Global Market Size in 2023 |

USD 11.50 Billion |

| Global Market Size in 2024 |

USD 12.24 Billion |

| Global Market Size by 2033 |

USD 21.40 Billion |

| Largest Market |

North America |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Product and By End-use |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dental Diagnostic and Surgical Equipment Market Dynamics

Drivers

Key drivers of the dental diagnostic and surgical equipment market include technological advancements such as 3D imaging and computer-aided design/computer-aided manufacturing (CAD/CAM) systems. Additionally, increasing investments in healthcare infrastructure and a rising number of dental clinics contribute to market growth. The demand for minimally invasive procedures and cosmetic dentistry is also a major driver.

Opportunities

The market presents several opportunities for growth, including the development of innovative products such as portable and wireless dental equipment. Emerging markets offer potential for expansion, as rising awareness of oral health and increasing access to dental care drive demand. Additionally, tele-dentistry and artificial intelligence applications in diagnostics present opportunities for market players.

Challenges

Challenges in the dental diagnostic and surgical equipment market include the high cost of advanced equipment, which can limit access for some dental professionals and patients. Additionally, stringent regulatory requirements and the need for skilled professionals to operate advanced equipment may pose obstacles to market growth. Competition from alternative treatment options and economic uncertainties can also present challenges for the market.

Read Also: Brucellosis Vaccines Market Size to Reach USD 389.50 Mn by 2033

Dental Diagnostic and Surgical Equipment Market Recent Developments

- In August 2023, Dentylec, an Israeli tech company, announced its launch of transformative solutions with the potential to revolutionize dental diagnostics. Dentylec will provide clearer insights into patients’ oral health and have a positive impact on it. Diagnostic technologies will be integrated with artificial intelligence to provide a clear and comprehensive view of patient’s oral health.

- In November 2023, DEXIS, a leading company in dental imaging technologies, announced a demonstration of its new technologies: DEXIS OP 3D LX and DEXassist Solution. The company claimed that both of these technologies would be extremely beneficial in the dental diagnostic market.

Dental Diagnostic and Surgical Equipment Market Companies

- Danaher Corporation

- KaVo Kerr

- Biolase Technologies

- Zolar Dental Laser

- 3M Company

- Ivoclar Vivadent AG

- American Medicals

- Henry Schein

- Midmark Diagnostic Group

Segments Covered in the Report

By Product

- Dental Diagnostic Equipment

- CAD/CAM Systems

- Instrument Delivery Systems

- Extra Oral Radiology Equipment

- Intra Oral Radiology Equipment

- Cone Beam Computed Tomography (CBCT)

- Dental Surgical Equipment

- Dental Laser

- Dental Handpieces

- Dental Forceps & Pliers

- Curettes and Scalers

- Dental Probes

- Dental Burs

- Electrosurgical Equipment

- Others

By End-use

- Solo Practices

- DSO/Group Practices

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa