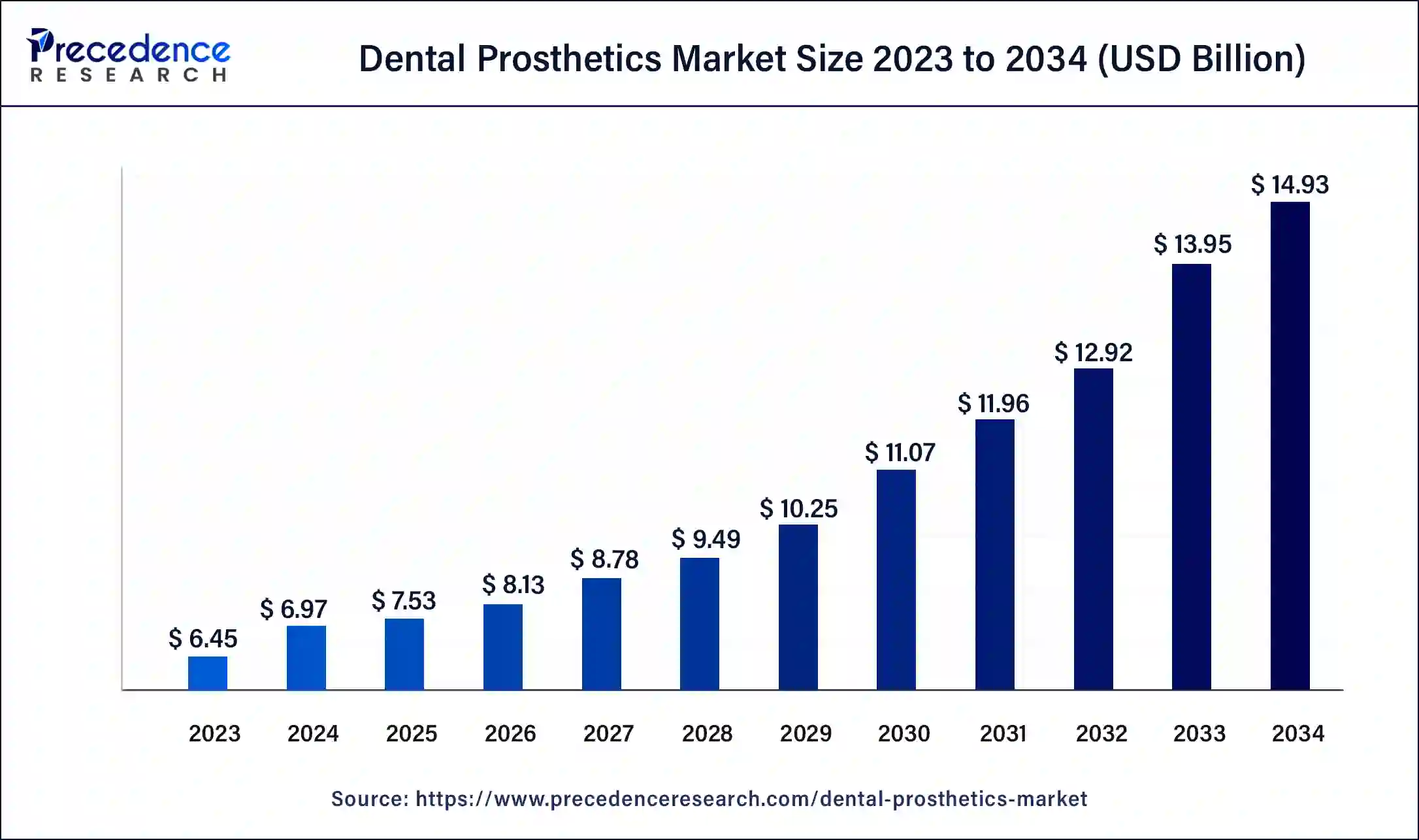

The global dental prosthetics market size reached USD 6.45 billion in 2023 and is projected to attain around USD 13.95 billion by 2033, growing at a CAGR of 8.02% from 2024 to 2033.

Key Points

- The North America dental prosthetics market size accounted for USD 2.19 billion in 2023 and is expected to attain around USD 4.81 billion by 2033.

- North America has held the largest share of 34% in 2023.

- By region, Asia Pacific is also expected to grow rapidly during the forecast period.

- By type, the fixed dental prosthetic segment has contributed more than 57% of market share in 2023.

- By type, the removable dental prosthetic segment is expected to obtain a significant share of the market during the forecast period.

- By material type, the ceramics segment held a significant share of the market in 2023.

- By end use, the dental hospital & clinics segment held the largest share of the market in 2023 and is expected to maintain its dominance during the forecast period.

- By end use, the dental laboratories are also expected to show significant growth during the forecast period.

The dental prosthetics market is a segment within the broader healthcare industry focused on the manufacturing and distribution of prosthetic devices used to restore or replace missing teeth. These prosthetics include dentures, crowns, bridges, and implants, which are essential for restoring oral function and aesthetics in patients with missing or damaged teeth. The market encompasses a wide range of products and services, catering to various patient needs and preferences. Advancements in materials, technology, and dental procedures have significantly transformed the landscape of dental prosthetics, leading to improved outcomes and patient satisfaction.

Get a Sample: https://www.precedenceresearch.com/sample/4143

Growth Factors:

Several factors contribute to the growth of the dental prosthetics market. Firstly, the aging global population, coupled with increasing prevalence of dental disorders and tooth loss, drives the demand for prosthetic solutions. Additionally, growing awareness about dental health and aesthetics, along with rising disposable incomes in emerging economies, fuel the adoption of dental prosthetics. Moreover, advancements in dental materials and manufacturing technologies enhance the quality, durability, and esthetics of prosthetic devices, further stimulating market growth.

Region Insights:

The dental prosthetics market exhibits regional variations influenced by factors such as healthcare infrastructure, prevalence of dental disorders, economic development, and cultural attitudes towards dental care. Developed regions like North America and Europe dominate the market due to higher healthcare expenditures, advanced dental technologies, and a greater emphasis on aesthetics. However, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth attributed to improving healthcare infrastructure, rising disposable incomes, and growing awareness about dental health.

Dental Prosthetics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.02% |

| Global Market Size in 2023 | USD 6.45 Billion |

| Global Market Size in 2024 | USD 6.97 Billion |

| Global Market Size by 2033 | USD 13.95 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Material Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Dental Prosthetics Market Dynamics

Drivers:

Several drivers propel the growth of the dental prosthetics market. Technological advancements, such as digital dentistry and computer-aided design/computer-aided manufacturing (CAD/CAM), streamline the prosthetic manufacturing process, leading to precise fitting and customization. Additionally, increasing demand for minimally invasive procedures and cosmetic dentistry drives the adoption of dental implants and aesthetic prosthetics. Moreover, supportive reimbursement policies and insurance coverage for dental procedures encourage patient uptake of prosthetic solutions.

Opportunities:

The dental prosthetics market presents numerous opportunities for manufacturers, suppliers, and dental practitioners. Expanding product portfolios to include innovative materials and designs, catering to specific patient demographics, can unlock new growth avenues. Furthermore, tapping into emerging markets with unmet dental needs and investing in research and development to develop next-generation prosthetic solutions offer promising opportunities for market expansion. Collaborations between dental professionals, researchers, and technology companies can also drive innovation and improve patient outcomes.

Challenges:

Despite the promising growth prospects, the dental prosthetics market faces several challenges. Cost constraints associated with prosthetic treatments, especially for advanced procedures like dental implants, pose a barrier to adoption, particularly in developing regions. Moreover, regulatory complexities and varying reimbursement policies across different regions add to the operational challenges for market players. Additionally, the shortage of skilled dental professionals proficient in prosthetic procedures limits market growth and access to care in certain regions.

Read Also: Fluorosurfactant Market Size to Reach USD 1,194.35 Mn by 2033

Dental Prosthetics Market Recent Developments

- In February 2024, Japan saw the launch of TSX® Implant by ZimVie Inc., a leading global life sciences company in the dentistry and spine sectors. Japan is a very important strategic market for ZimVie, being the largest dental implant market in APAC and the sixth largest worldwide. With the introduction of TSX in Japan, the business can now take on premium market leaders in the dental implant industry head-to-head.

- In October 2023, With the release of OnX Tough 2, the first and only 3D printing resin with US Food and Drug Administration (FDA) 510(k) clearance for fixed, implant-supported denture prosthetics, SprintRay, a leader in digital dentistry and dental 3D printing solutions, has taken a significant step forward for the dental industry.

Dental Prosthetics Market Companies

- Institut Straumann AG

- Envista Holdings Corporation

- DENTSPLY Sirona, Inc.

- 3M Company

- ZimVive Inc.

- Henry Schein, Inc.

- Mitsui Chemicals Inc.

Segment Covered in the Report

By Type

- Fixed Dental Prosthetics

- Crowns

- Bridges

- Abutments

- Dentures

- Others

- Removable Dental Prosthetic

- Dentures

- Partial Dentures

- Dental Implants

- Veeners

By Material Type

- Ceramics

- Cement

- Composites

By End-user

- Dental Hospital & Clinics

- Dental Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/