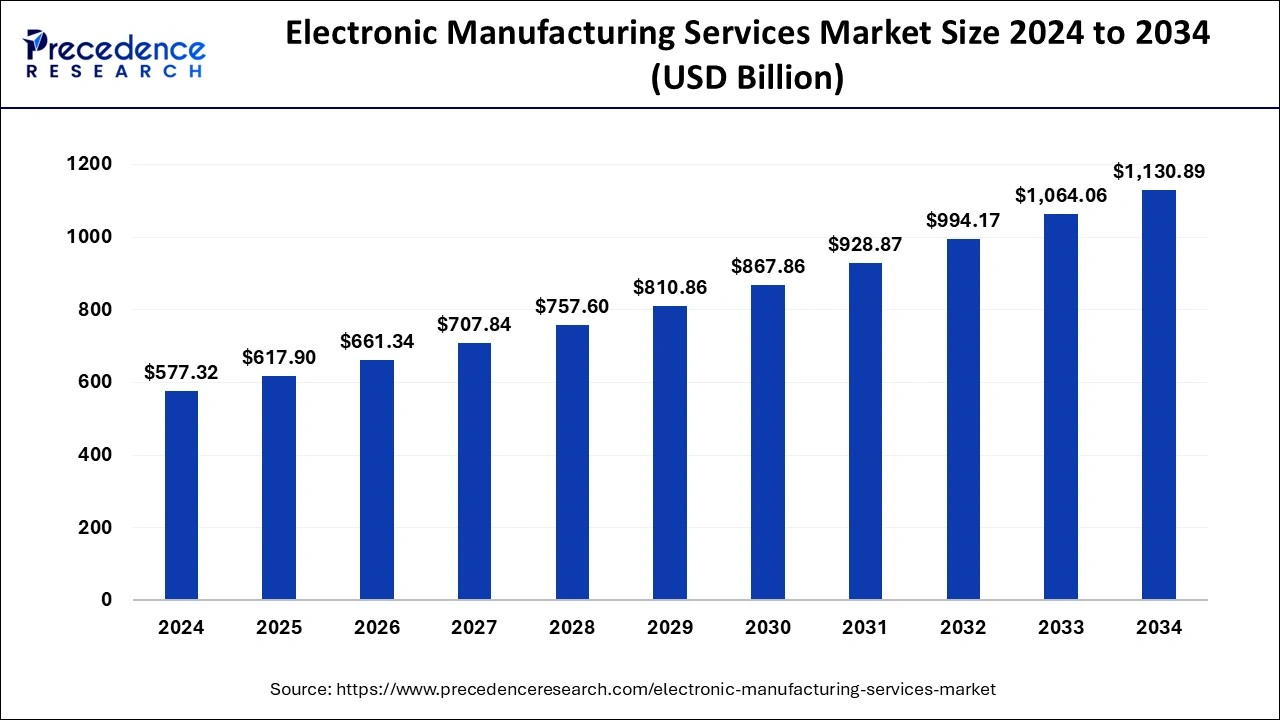

The global electronic manufacturing services market size was estimated at USD 539.40 billion in 2023 and is projected to reach around USD 1,064.06 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033.

Key Points

- Asia Pacific has held the largest market share of 36% in 2023.

- Europe is expected to show significant growth over the forecast period.

- By service type, the engineering services segment dominated the market in 2023.

- By service type, the electronics manufacturing services segment is projected to be the fastest-growing segment over the forecast period.

- By industry type, the IT and telecom segment dominated the market in 2023.

- By industry type, the automotive segment is experiencing notable growth in the market.

The Electronic Manufacturing Services (EMS) market encompasses a range of services provided by contract manufacturers to design, manufacture, test, distribute, and provide repair services for electronic components and assemblies. These services are crucial for companies looking to outsource their manufacturing processes to specialized providers, enabling them to focus on core competencies like product design and marketing. EMS providers play a pivotal role in the electronics industry by offering scalable and cost-effective solutions to meet the demand for complex electronic products.

Get a Sample: https://www.precedenceresearch.com/sample/4270

Growth Factors:

The EMS market is experiencing significant growth due to several key factors. Firstly, the increasing complexity and miniaturization of electronic devices require specialized manufacturing capabilities that EMS providers excel in. Secondly, the trend towards outsourcing manufacturing operations by OEMs (Original Equipment Manufacturers) to reduce costs and leverage expertise contributes to the expansion of the EMS sector. Additionally, the growing adoption of IoT (Internet of Things), wearable technology, and smart devices further fuels demand for EMS services.

Region Insights:

The EMS market is globally distributed, with major regions including North America, Europe, Asia Pacific, and Latin America. Asia Pacific, particularly China, dominates the EMS landscape due to its established manufacturing infrastructure, skilled labor force, and favorable regulatory environment. North America and Europe also hold significant market shares, driven by strong demand from industries like automotive, aerospace, healthcare, and consumer electronics.

Electronic Manufacturing Services Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Electronic Manufacturing Services Market Size in 2023 | USD 539.40 Billion |

| Electronic Manufacturing Services Market Size in 2024 | USD 577.32 Billion |

| Electronic Manufacturing Services Market Size by 2033 | USD 1,064.06 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service Type and By Industry Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic Manufacturing Services Market Dynamics

Drivers:

Several drivers propel the growth of the EMS market. One key driver is the increasing demand for consumer electronics such as smartphones, tablets, and laptops, which require efficient and flexible manufacturing solutions. Moreover, the shift towards digital transformation across industries drives the need for EMS services to support technology integration and innovation. Additionally, the trend towards sustainable practices in manufacturing, including waste reduction and energy efficiency, influences EMS providers to adopt environmentally friendly processes.

Opportunities:

The EMS market presents promising opportunities for expansion and innovation. As technology evolves, EMS providers can capitalize on emerging trends such as 5G infrastructure development, electric vehicles, and renewable energy technologies. Diversification into new service areas such as aftermarket services and supply chain management also opens up avenues for growth. Furthermore, strategic partnerships with OEMs and investment in R&D can enhance capabilities and foster long-term competitiveness.

Challenges:

Despite its growth prospects, the EMS market faces several challenges. Intense competition among EMS providers leads to pricing pressures and margin constraints. Moreover, geopolitical uncertainties and trade tensions impact global supply chains, affecting the operations of EMS companies with international footprints. Additionally, ensuring compliance with regulatory standards and addressing cybersecurity risks pose ongoing challenges for EMS providers operating in highly regulated industries like healthcare and defense.

Read Also: Digital Textile Printing Market Size to Reach USD 11.42 Bn by 2033

Electronic Manufacturing Services Market Recent Developments

- In July 2023, Analog Devices, Inc., one of the global semiconductor leaders, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, announced the completion of a Memorandum of Understanding (MoU) to develop the next-generation digital car cockpit and a high-performance battery management system (BMS).

- In May 2023, Infineon Technologies AG, one of the global leaders in automotive semiconductors, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, aim to establish a partnership in the electric vehicles (EV) field to develop advanced electromobility with efficient and intelligent features jointly. The Memorandum of Understanding (MoU) aims to develop silicon carbide (SiC) and leverage Infineon’s automotive SiC innovations in automotive systems.

- In June 2022, Flex announced the development of its operations in the Mexican state of Jalisco’s automotive sector. The business is building a brand-new, cutting-edge 145,000-square-foot facility that will act as a strategic in-region automotive manufacturing hub to produce advanced electronic components that will hasten the transition to the era of electric and autonomous vehicles.

- In March 2022, Sanmina Corporation (Sanmina), a leading integrated manufacturing solutions company, and Reliance Strategic Business Ventures Limited (RSBVL), a wholly-owned subsidiary of Reliance Industries Limited (RIL), India’s largest private sector company, announced that they have agreed to create a joint venture through investment in Sanmina’s existing Indian entity (Sanmina SCI India Private Ltd, “SIPL”).

Electronic Manufacturing Services Market Companies

- Sanmina Corporation

- Vinatronic Inc.

- Inventec

- Hon Hai Precision Industry Co. Ltd

- Bharat FIH – A Foxconn Technology Group

- SIIX Corporation

- Benchmark Electronics Inc.

- Flex Ltd

- Quanta Computers Inc.

- Osram Opto Semiconductors GmbH

- Kimball Electronics Inc.

- Jabil Inc.

- Celestica Inc.

- Wistron Corporation

- General Electric Company

- Argus Systems

- Plexus Corporation

- Sparton Corporation

- Koninklijke Philips N.V.

- Integrated Microelectronics Inc

Segments Covered in the Report

By Service Type

- Electronics Manufacturing

- Engineering Services

- Test & Development Implementation

- Logistics Services

- Others

By Industry Type

- Computer

- Consumer Electronics

- Aerospace & Defense

- Medical & Healthcare

- IT & Telecom

- Automotive

- Semiconductor Manufacturing

- Robotics

- Heavy Industrial Manufacturing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/