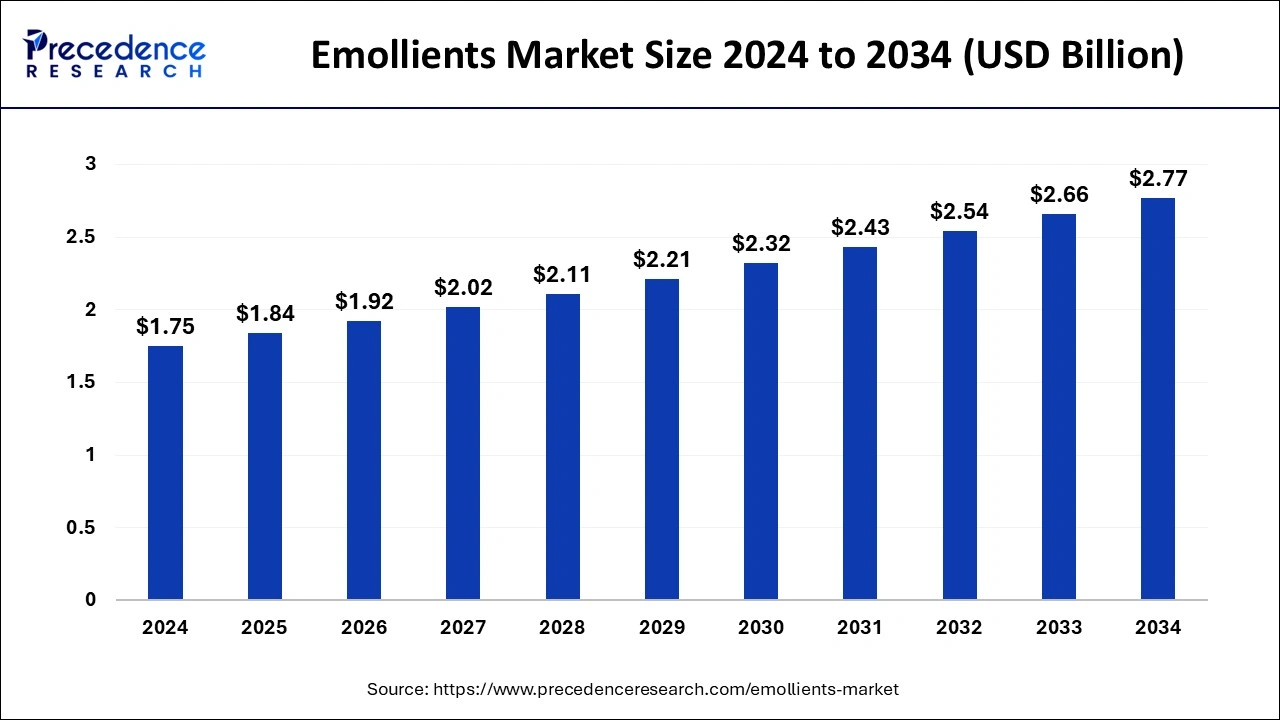

The global emollients market size reached USD 1.68 billion in 2023 and is projected to attain around USD 2.66 billion by 2033, growing at a CAGR of 4.73% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 34% in 2023.

- North America is expected to experience rapid CAGR of 4.84% over the forecast period.

- By form, the liquid segment has contributed more than 70% of the market share in 2023.

- By form, the solid segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the skin care segment has accounted the largest market share of 39% in 2023.

- By application, the hair care segment is expected to grow at the fastest rate during the projected period.

- By type, the easter segment dominated the market with the major market share of 41% in 2023.

- By type, the fatty acid segment is projected to experience the fastest growth during the forecast period.

The Emollients Market encompasses a broad spectrum of skincare and personal care products, serving as essential components in moisturizers, creams, lotions, and other topical applications. Emollients play a crucial role in maintaining skin health and hydration by forming a protective barrier and preventing moisture loss. With increasing consumer awareness of skincare and beauty routines, coupled with evolving preferences for natural and sustainable ingredients, the emollients market is witnessing steady growth globally.

Get a Sample: https://www.precedenceresearch.com/sample/4151

Growth Factors:

Several factors drive the growth of the emollients market. Rising disposable incomes, particularly in emerging economies, contribute to increased spending on personal care products, driving demand for emollients. Additionally, the growing aging population, coupled with changing lifestyles and environmental factors, fuels the demand for skincare solutions, thereby boosting the emollients market. Moreover, advancements in formulation technologies and the development of innovative emollient ingredients further propel market growth.

Region Insights: The emollients market exhibits significant regional variations, with developed regions like North America and Europe commanding a substantial share due to high consumer awareness and spending power. However, emerging economies in Asia-Pacific, such as China and India, are experiencing rapid growth driven by a burgeoning middle class, urbanization, and increasing adoption of skincare products. Latin America and the Middle East & Africa are also witnessing growth opportunities as consumers become more health-conscious and seek effective skincare solutions.

Emollients Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.73% |

| Global Market Size in 2023 | USD 1.68 Billion |

| Global Market Size in 2024 | USD 1.75 Billion |

| Global Market Size by 2033 | USD 2.66 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emollients Market Dynamics

Drivers:

Several drivers underpin the growth of the emollients market. Increasing emphasis on skincare routines and personal grooming, driven by beauty trends and social media influence, is a key driver. Furthermore, rising concerns about skin health, including dryness, aging, and pollution-induced damage, drive consumers to seek products containing emollients for nourishment and protection. Additionally, the growing trend towards clean beauty and natural ingredients augments the demand for plant-based and organic emollients.

Opportunities:

The emollients market presents abundant opportunities for manufacturers and suppliers. Expanding distribution channels, including online retail platforms and specialty stores, enable companies to reach a wider consumer base and explore new markets. Moreover, the rising popularity of multifunctional skincare products and customizable formulations opens avenues for innovation and product diversification. Furthermore, collaborations with dermatologists and skincare experts can enhance product credibility and consumer trust.

Challenges:

Despite the promising growth prospects, the emollients market faces several challenges. Regulatory complexities and stringent quality standards pose challenges for manufacturers, particularly in ensuring compliance with varying regulations across different regions. Moreover, the growing competition from substitute ingredients and alternative skincare solutions necessitates continuous innovation to maintain market relevance. Additionally, concerns regarding the environmental impact of certain emollient ingredients raise sustainability challenges for the industry.

Read Also: Dental Digital X-Ray Market Size to Reach USD 13.17 Bn by 2033

Competitive Landscape:

The emollients market is characterized by intense competition, with numerous players vying for market share. Key players in the market include multinational corporations, specialty chemical companies, and ingredient suppliers, each offering a diverse range of emollient products catering to different consumer preferences and applications. Strategic initiatives such as product launches, mergers and acquisitions, and partnerships are prevalent among market players to strengthen their market position and expand their product portfolios. Additionally, investment in research and development to create novel formulations and sustainable solutions remains a focal point for competitive differentiation in the emollients market.

Emollients Market Recent Developments

- In November 2023, Sonneborn, LLC, introduced plant derived SonneNatural NXG emollient. Reportedly, the new product improves the formation of lip care and personal care items owing to their sensory & firmness features.

- In June 2023, Oleon is concentrating on the enzymatic esterification of ingredient development. Radia 7199ACT, an emollient and texture enhancer, and Jolee 7749ACT, a fatty ester that is good for skin and hair, are two of their most recent releases.

- In March 2023, Clariant launched Plantasens Pro LM, a novel natural emollient, in response to consumers’ increasing interest in and understanding of skincare across the globe. The skin feels pampered, enriched, and opulent both during and after using this product.

- In April 2022, Seppic launched EMOGREEN™ HP 40, a new bio-based & sustainable emollient that is highly pure and sustainable.

- In November 2022, Givaudan launched Sensityl™, a cosmetic active ingredient that addresses the negative effects of stress on the skin and provides a soothing effect.

- In September 2022, BASF and L’Oréal announced a partnership to develop sustainable bio-based surfactants for personal care applications, aiming to reduce the environmental impact of formulations.

Emollients Market Companies

- BASF SE

- Clariant

- Eastman Chemical Company

- The Lubrizol Corporation

- Covestro AG

- Evonik Industries AG

- Hallstar

- Croda International PLC

- Ashland Inc.

- Sasol

- Lonza

- Stepan Company

- Oleon Health and Beauty

- Solvay

- Vantage Speciality Chemicals.

Segments Covered in the Report

By Type

- Esters

- Fatty Alcohols

- Fatty Acids

- Ethers

- Silicones

- Others

By Form

- Solid

- Liquid

By Application

- Skincare

- Hair Care

- Deodorants

- Oral Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/