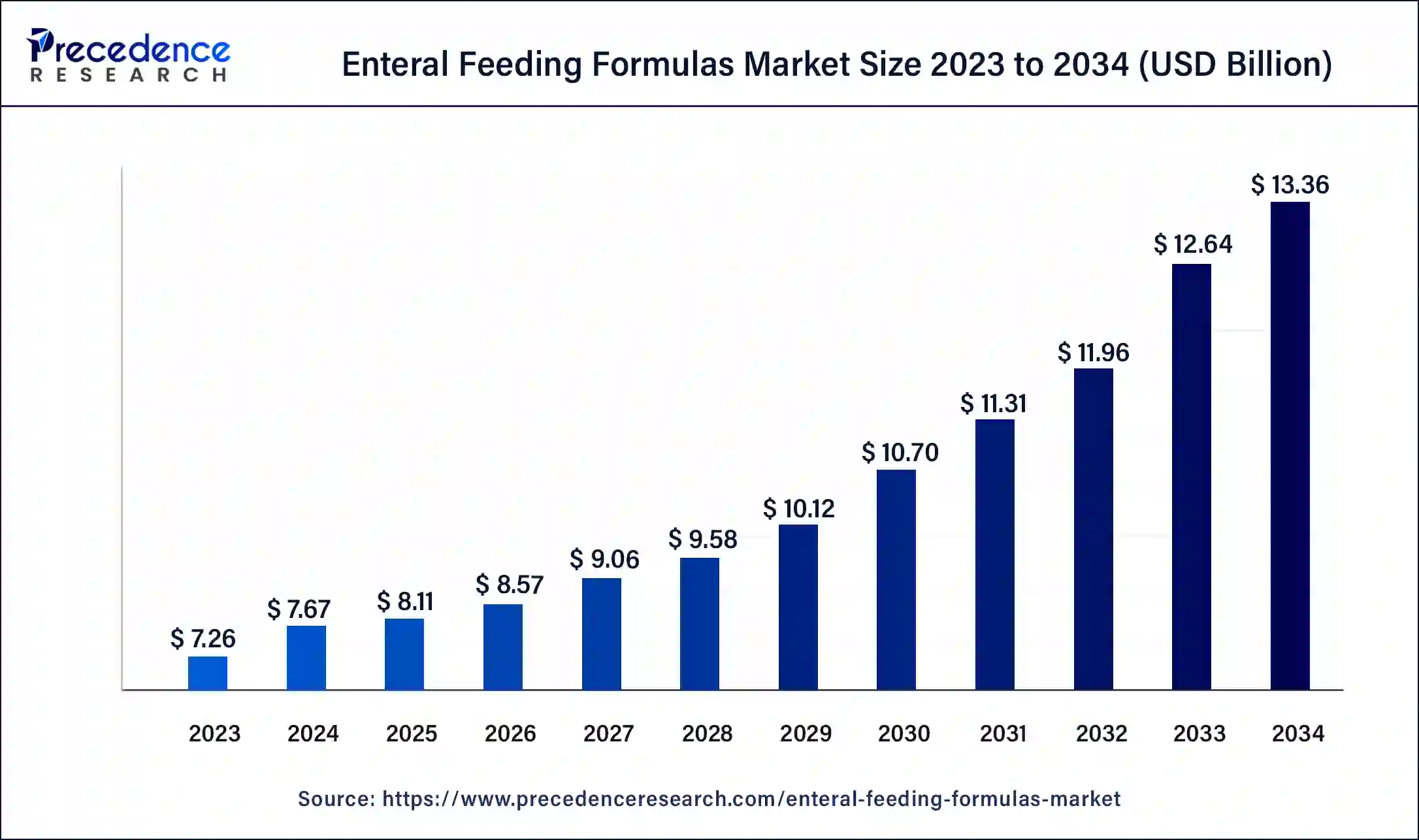

The global enteral feeding formulas market size reached USD 7.26 billion in 2023 and is projected to attain around USD 12.51 billion by 2033, growing at a CAGR of 5.59% from 2024 to 2033.

Key Points

- The North America enteral feeding formulas market size was estimated at USD 2.32 billion in 2023 and is expected to surpass around USD 4 billion by 2033.

- North America held the largest market share of 32% in 2023.

- By product, the standard formula segment dominated the market with the largest market share of 58% in 2023.

- By flow type, intermittent feeding flow segment has captured the largest market share of 90% in 2023.

- By stage, the adult segment has accounted for the largest share of 91% in 2023.

- By indication, the cancer care segment held a significant share of the market in 2023.

- By sales channel, the institutional segments dominated the market with the highest market share of 52% in 2023.

- By end use, the home care segment is expected to grow at the fastest CAGR of 5.92% over the forecast period.

The enteral feeding formulas market refers to the industry involved in the production, distribution, and consumption of specialized liquid nutrition products designed for enteral (tube) feeding. These formulas are specifically formulated to provide essential nutrients to individuals who are unable to consume food orally due to various medical conditions. The market encompasses a wide range of products, including standard formulas, disease-specific formulas, and specialized formulas for different age groups and medical needs.

Get a Sample: https://www.precedenceresearch.com/sample/4123

Growth Factors

Several factors contribute to the growth of the enteral feeding formulas market. One significant factor is the increasing prevalence of chronic diseases and conditions that impair normal eating and swallowing functions, such as neurological disorders, cancer, and gastrointestinal diseases. As the global population ages and the incidence of these conditions rises, the demand for enteral feeding formulas is expected to increase.

Furthermore, advancements in medical technology and healthcare infrastructure have improved the accessibility of enteral feeding tubes and devices, facilitating easier administration of enteral nutrition. Additionally, growing awareness among healthcare professionals about the benefits of enteral nutrition in improving patient outcomes, reducing complications, and enhancing quality of life has led to greater adoption of enteral feeding formulas.

Region Insights

The enteral feeding formulas market exhibits regional variations influenced by factors such as healthcare infrastructure, prevalence of medical conditions requiring enteral nutrition, regulatory environment, and socio-economic factors. Developed regions like North America and Europe dominate the market due to high healthcare expenditures, favorable reimbursement policies, and advanced healthcare facilities.

In contrast, emerging economies in Asia-Pacific, Latin America, and Africa are experiencing rapid growth in the enteral feeding formulas market. Factors driving growth in these regions include improving healthcare infrastructure, rising disposable incomes, increasing prevalence of chronic diseases, and growing awareness about enteral nutrition among healthcare professionals and patients.

Enteral Feeding Formulas Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.59% |

| Global Market Size in 2023 | USD 7.26 Billion |

| Global Market Size in 2024 | USD 7.67 Billion |

| Global Market Size by 2033 | USD 12.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Flow Type, By Stage, By Indication, By End-use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enteral Feeding Formulas Market Dynamics

Divers

The enteral feeding formulas market is characterized by a diverse range of products tailored to meet the specific nutritional needs of different patient populations. These products vary in terms of composition, caloric density, macronutrient content, and micronutrient supplementation. Manufacturers offer standard formulas for general nutritional support as well as specialized formulas for patients with specific medical conditions such as diabetes, renal failure, and liver disease.

Moreover, the market is witnessing a trend towards the development of innovative formulations that address niche requirements, such as hypoallergenic formulas for patients with food allergies or intolerances, immune-modulating formulas for critically ill patients, and peptide-based formulas for individuals with compromised digestive function.

Opportunities

The enteral feeding formulas market presents several opportunities for growth and innovation. One significant opportunity lies in catering to the nutritional needs of specific patient demographics, such as pediatric patients, geriatric patients, and individuals with unique dietary requirements. Manufacturers can develop age-appropriate formulas with optimized nutrient profiles to support growth, development, and overall health.

Furthermore, expanding into emerging markets offers opportunities for market expansion and penetration. As healthcare infrastructure improves and awareness of enteral nutrition grows in these regions, there is a growing demand for high-quality enteral feeding formulas. By establishing partnerships with local distributors, manufacturers can gain access to these markets and address unmet needs.

Challenges

Despite the promising growth prospects, the enteral feeding formulas market faces several challenges. One challenge is the regulatory landscape, which varies across different regions and countries. Manufacturers must navigate complex regulatory requirements to ensure compliance with safety, quality, and labeling standards, which can increase time-to-market and costs.

Another challenge is the competition from alternative forms of nutrition, such as parenteral nutrition and oral nutritional supplements. While enteral nutrition is preferred whenever feasible due to its physiological benefits and cost-effectiveness, these alternatives remain viable options in certain clinical scenarios, posing a competitive threat to the enteral feeding formulas market.

Additionally, reimbursement policies and healthcare financing mechanisms can impact the affordability and accessibility of enteral feeding formulas, particularly in regions with limited healthcare resources or underdeveloped reimbursement systems. Manufacturers must work closely with healthcare stakeholders to advocate for adequate reimbursement and coverage for enteral nutrition products.

Read Also: Dental Compressors Market Size to Reach USD 620.95 Mn by 2033

Enteral Feeding Formulas Market Recent Developments

- In September 2023, Abbott announced the plan to boost the manufacturing of various adult enteral formulas for the retail market to counteract low supply in the institutional sector.

- In February 2023, Nestlé and EraCal Therapeutics initiated a research collaboration to identify novel nutraceuticals for controlling food intake.

- In September 2022, Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

- In September 2022, Kate Farms raised $75 million in a Series C funding round led by life-science investor Novo Holdings. With this, Kate Farms will be able to increase its efforts in developing plant-based clinical nutrition research, product innovation, and development into more channels.

Enteral Feeding Formulas Market Companies

- Nestlé S.A.

- Abbott Laboratories

- Mead Johnson Nutrition Company

- Fresenius Kabi AG

- Danone S.A.

- Victus Inc.

- Hormel Foods, LLC

- B. Braun Melsungen AG

- Global Health Product Inc.

- Aveanna Healthcare

- Meiji Holdings Co., Ltd.

- Nutricia

Segments Covered in the Report

By Product

- Standard Formula

- Disease-specific Formulas

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By Flow Type

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By End-use

- Hospitals

- Cardiology

- Neurology

- Critical Care (ICU)

- Oncology

- Others

- Home Care

- Long-Term Care Facilities

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/