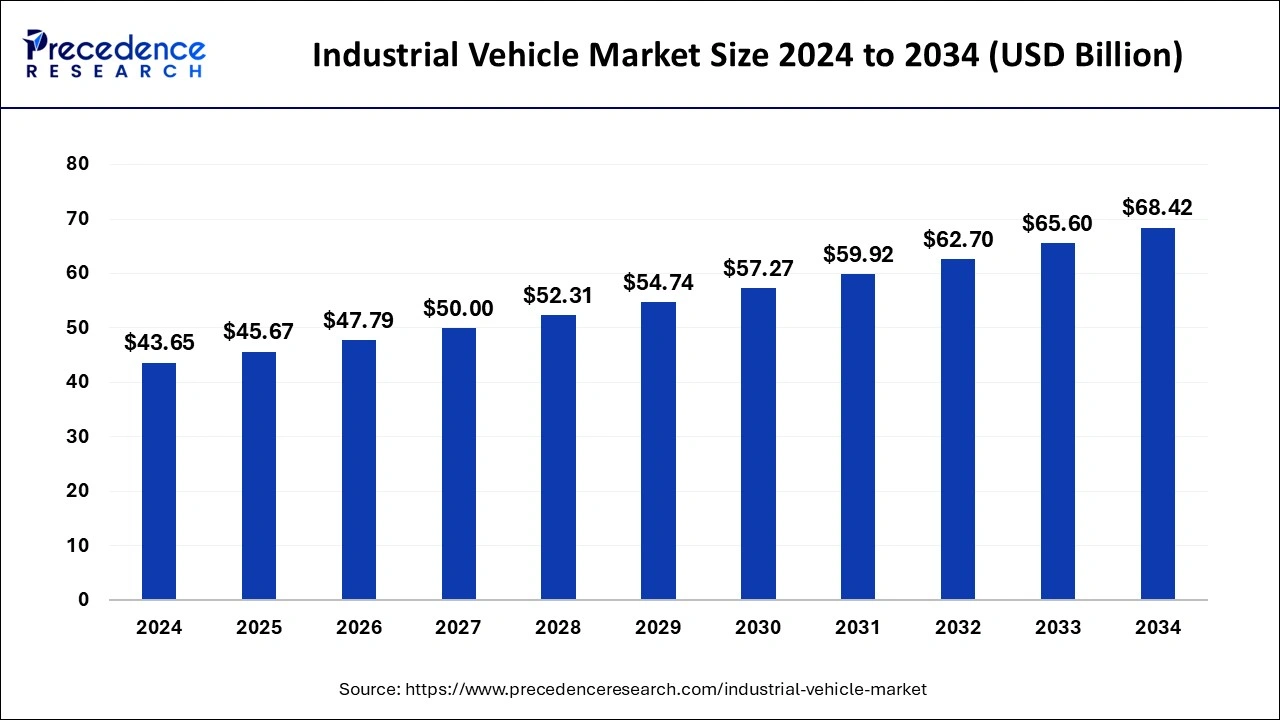

The global industrial vehicle market size was estimated at USD 41.72 billion in 2023 and is projected to reach around USD 65.60 billion by 2033, growing at a CAGR of 4.63% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 46% in 2023.

- North America is observed to expand at a rapid pace during the forecast period.

- By drive type, the ICE segment has held the major market share of 49% in 2023.

- By drive type, the battery-operated segment is expected to grow at a significant rate during the predicted timeframe.

- By the level of autonomy, the non/semi-autonomous segment held a significant share of the market in 2023.

- By the level of autonomy, the autonomous segment is observed to grow at a notable rate during the forecast period.

- By application, the manufacturing segment held the largest share of the market in 2023.

- By application, the warehousing segment is expected to grow fastest during the forecast period.

The industrial vehicle market encompasses a broad range of vehicles used in various industries such as manufacturing, construction, agriculture, and mining. These vehicles include forklifts, cranes, excavators, loaders, tractors, and other specialized equipment essential for material handling, transportation, and operations in industrial settings. The market is driven by the demand for efficient and versatile vehicles that can enhance productivity and streamline operations across different sectors.

Get a Sample: https://www.precedenceresearch.com/sample/4277

Growth Factors

Several factors contribute to the growth of the industrial vehicle market. One key driver is the ongoing expansion of manufacturing and construction activities globally, especially in emerging economies. This growth necessitates the adoption of advanced industrial vehicles to meet increased demand and optimize operational efficiency. Additionally, technological advancements such as automation, electrification, and telematics are revolutionizing industrial vehicles, making them more efficient, environmentally friendly, and capable of autonomous operation.

Region Insights

The industrial vehicle market exhibits regional variations influenced by economic conditions, infrastructure development, and industry trends. Developed regions like North America and Europe have a mature market with high adoption rates of advanced industrial vehicles, driven by stringent safety regulations and a focus on sustainability. In contrast, Asia-Pacific is a rapidly growing market due to rapid industrialization, urbanization, and infrastructure investments in countries like China and India.

Industrial Vehicle Market Scope

| Report Coverage | Details |

| Industrial Vehicle Market Size in 2023 | USD 41.72 Billion |

| Industrial Vehicle Market Size in 2024 | USD 43.65 Billion |

| Industrial Vehicle Market Size by 2033 | USD 65.60 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drive Type, By Level of Autonomy, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Vehicle Market Dynamics

Drivers

Several drivers propel the growth of the industrial vehicle market. These include the increasing demand for automation and robotics in industrial operations to enhance efficiency and safety. Furthermore, stringent regulations regarding emissions and environmental sustainability are pushing manufacturers to develop electric and hybrid industrial vehicles. Additionally, the rise of e-commerce and logistics sectors necessitates efficient material handling solutions, driving demand for industrial vehicles.

Opportunities

The industrial vehicle market offers promising opportunities fueled by technological innovation and industry trends. The shift towards electrification presents a significant opportunity for manufacturers to develop sustainable and cost-effective electric vehicles tailored for industrial applications. Moreover, the integration of IoT (Internet of Things) and telematics enables enhanced connectivity and data-driven insights, opening avenues for predictive maintenance and optimized fleet management.

Challenges

Despite growth opportunities, the industrial vehicle market faces several challenges. One major challenge is the high initial cost associated with adopting advanced technologies like electric vehicles and autonomous systems. Additionally, regulatory complexities, especially concerning safety standards and emissions regulations, pose challenges for manufacturers. Furthermore, the integration of new technologies requires skilled labor and adequate infrastructure, which can be a constraint in some regions.

Read Also: Serverless Architecture Market Size to Reach USD 106.12 Bn by 2033

Industrial Vehicle Market Recent Developments

- In June 2023, Hangcha announced the launch of the XE series electric forklifts to the global market. This is an adaptable, durable, comfortable, and affordable material handling solution that can go anywhere and do anything. The XE series covers from 1.5-3.8t, with a battery capacity of up to 80V/608Ah.

- In May 2024, Volvo CE secured an order from the Swedish Defense Materiel Administration (FMV) for 81-wheel loaders. The order is the first procurement in a seven-year framework agreement signed earlier this year and valued at USD 110 million that will enhance collaboration and strengthen the security of supply, both in times of peace and crises, thereby safeguarding people, resources, and societies. Volvo CE will be supplying a variety of wheel loaders and attachments and the machines will be produced at its plants in Arvika, Sweden, and Konz in Germany which specialize in the production of wheel loaders.

Industrial Vehicle Market Companies

- Anhui Heli Co. Ltd

- Crown Equipment Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling

- Jungheinrich

- Konecranes

- Daifuku

- Ross Electric Vehicles

- SSI SCHAEFER

- Taylor-Dunn

- Hyster-Yale Group, Inc.,

- Jungheinrich AG

- Kion Group AG

- Mitsubishi Heavy Industries, Ltd.

- Toyota Industries Corporation

- Doosan Corporation

- Hyundai Construction Equipment

- Polaris Inc.

Segments Covered in the Report

By Drive Type

- ICE

- Battery-Operated

- Gas-Powered

By Level of Autonomy

- Non/Semi-Autonomous

- Autonomous

By Application

- Manufacturing

- Warehousing

- Freight and Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/