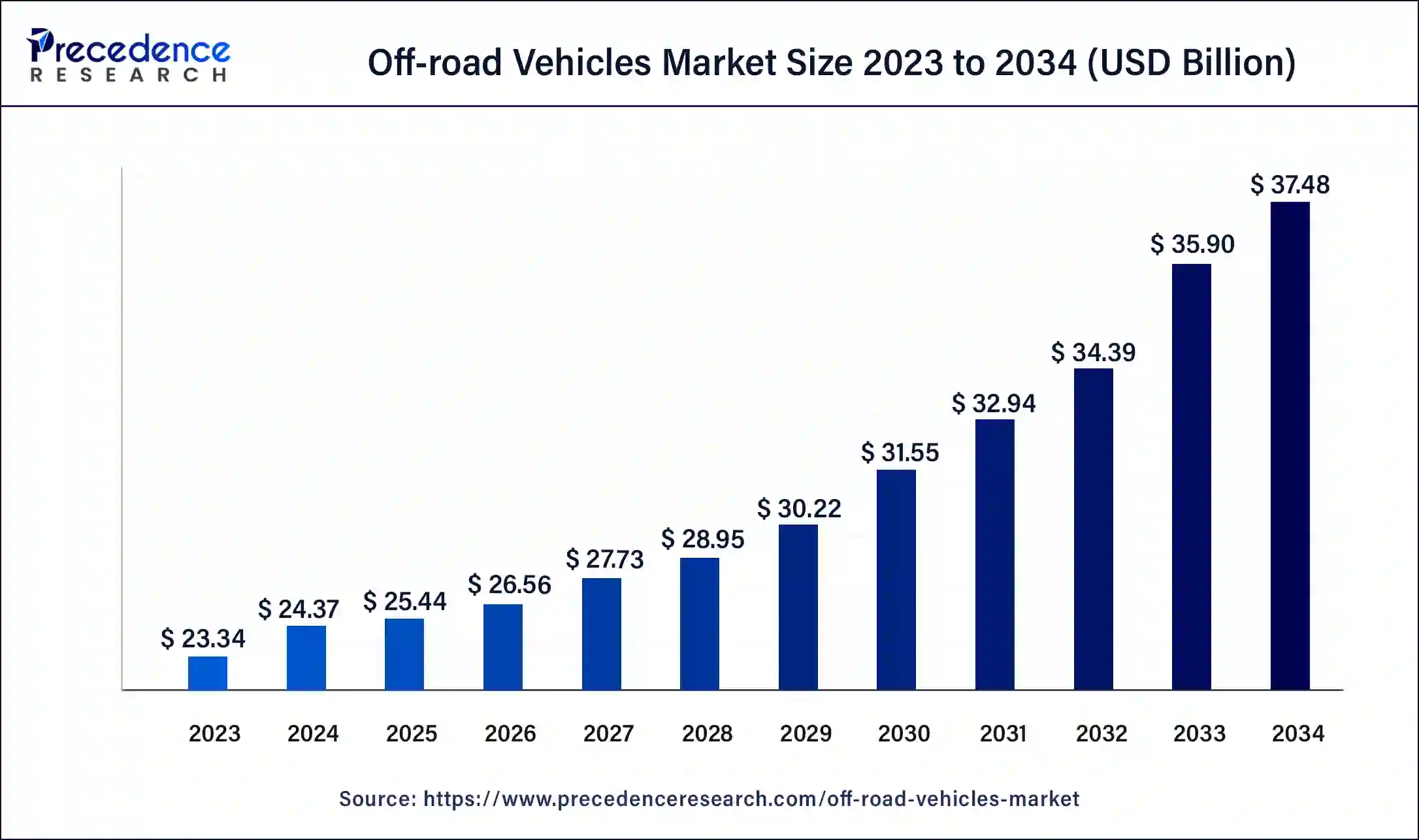

The global off-road vehicles market size reached USD 23.34 billion in 2023 and is projected to hit around USD 35.28 billion by 2033, growing at a CAGR of 4.21% from 2024 to 2033.

Key Points

- North America dominated the off-road vehicles market in 2023 and accounted 66% market share.

- Asia Pacific is expected to be the significantly growing marketplace during the forecast period.

- By product type, the three-wheeler segment dominated the off-road vehicles market in 2023 and contributed 46% market share.

The off-road vehicles market encompasses a wide range of vehicles designed for off-pavement driving, such as all-terrain vehicles (ATVs), utility terrain vehicles (UTVs), sport utility vehicles (SUVs), dirt bikes, and more. These vehicles are commonly used for recreational activities, adventure sports, agricultural and industrial tasks, and in defense applications. The market has seen steady growth due to the increasing popularity of outdoor activities and the rising demand for robust vehicles that can handle challenging terrains.

Get a Sample: https://www.precedenceresearch.com/sample/4082

Growth Factors

The growth of the off-road vehicles market can be attributed to several factors:

- Rising Outdoor Activities: As more people engage in outdoor activities such as camping, hiking, and off-road sports, the demand for off-road vehicles increases.

- Technological Advancements: Newer off-road vehicles are equipped with advanced features such as four-wheel drive, adaptive suspension, and electric powertrains, which enhance performance and safety.

- Expansion of Applications: Off-road vehicles are finding applications in industries such as agriculture, forestry, and mining, further driving market growth.

- Growing Demand for UTVs and ATVs: Utility terrain vehicles (UTVs) and all-terrain vehicles (ATVs) are becoming increasingly popular for recreational and utility purposes.

- Increase in Disposable Income: Higher disposable income allows consumers to invest in off-road vehicles for leisure and adventure.

Region Insights

The off-road vehicles market varies across regions due to differences in terrain, culture, and consumer preferences:

- North America: This region leads the market, driven by the popularity of outdoor sports and the presence of key manufacturers. The U.S. is a major contributor, with a large base of enthusiasts and recreational users.

- Europe: Europe is a significant market, with a focus on sustainability and electric off-road vehicles. Countries like Germany and the U.K. have a strong market presence due to their advanced automotive industries.

- Asia-Pacific: This region is expected to witness rapid growth due to increasing interest in off-road sports, growing disposable income, and the expanding tourism industry in countries such as China, India, and Australia.

- Latin America: The market is expected to grow as off-road vehicles gain popularity for adventure tourism and agricultural applications.

- Middle East and Africa: These regions are experiencing growth due to the adoption of off-road vehicles in industrial applications and the expansion of desert sports.

Off-road Vehicles Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 23.34 Billion |

| Global Market Size in 2024 | USD 24.32 Billion |

| Global Market Size by 2033 | USD 35.28 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Application, and By Propulsion Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Off-road Vehicles Market Dynamics

Drivers

- Rising Interest in Adventure Sports: The popularity of adventure sports such as off-road racing and rock crawling drives the demand for off-road vehicles.

- Technological Innovations: Advancements in vehicle performance, such as better suspension systems and lightweight materials, attract consumers.

- Increasing Demand for Utility Vehicles: The versatility and utility of UTVs and ATVs make them popular for both leisure and work purposes.

- Growth in Tourism: The expanding tourism industry, especially in regions with diverse landscapes, fuels the demand for off-road vehicles for tours and exploration.

Opportunities

- Electrification: Electric off-road vehicles present a significant opportunity for manufacturers to cater to the growing demand for sustainable options.

- Customization and Personalization: Offering customized vehicles and accessories to suit specific user preferences can provide a competitive edge.

- Expansion in Emerging Markets: Developing economies with growing interest in outdoor activities and adventure sports offer potential markets for off-road vehicles.

- Integration with Technology: Integrating smart technology such as GPS, remote monitoring, and advanced safety features can enhance the appeal of off-road vehicles.

Challenges

- Environmental Concerns: Off-road vehicles are often associated with environmental damage and habitat destruction, which may lead to stricter regulations.

- Safety Issues: Off-road vehicles can pose safety risks due to their high speeds and challenging terrains, necessitating improved safety features.

- Competition from Alternatives: Growing popularity of electric bicycles and scooters could pose competition to off-road vehicles in some applications.

- Economic Uncertainty: Economic downturns can affect consumer spending on recreational vehicles, impacting market growth.

Read Also: Intragastric Balloon Market Size to Reach USD 108.80 Mn by 2033

Recent Developments

- In August 2023, BYD declared the off-road SUV BAO 5 governed by the DMO tech and FANGCHENGBAO brand.

- In August 2022, all Volcon Inc.’s off-road utility terrain vehicles, notably the company’s flagship Volcon Stag UTV, which was unveiled to the public on July 1, 2022, will be powered by General Motors’ tried and accurate electric propulsion systems. Future GM electric propulsion systems will be used in the design and development of future models, which will include further iterations of the Stag and the company’s projected “Project X” vehicle. With GM’s electric propulsion, Volcon will be the first and, for now, the sole off-road power sports manufacturer to provide their entire lineup of vehicles.

Off-road Vehicles Market Companies

- Arctic Cat Inc. (Textron Inc.)

- ARGO

- BRP

- Deere & Company

- Electra Meccanica

- Harley-Davison, Inc.

- Honda Motor Co., Ltd.

- SSR Motorsports

- Taiga Motors Inc.

- Yamaha Motor Co., Ltd.

Segments Covered in the Report

By Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Application

- Utility

- Sports

- Recreation

- Military

By Propulsion Type

- Gasoline

- Diesel

- Electric

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/