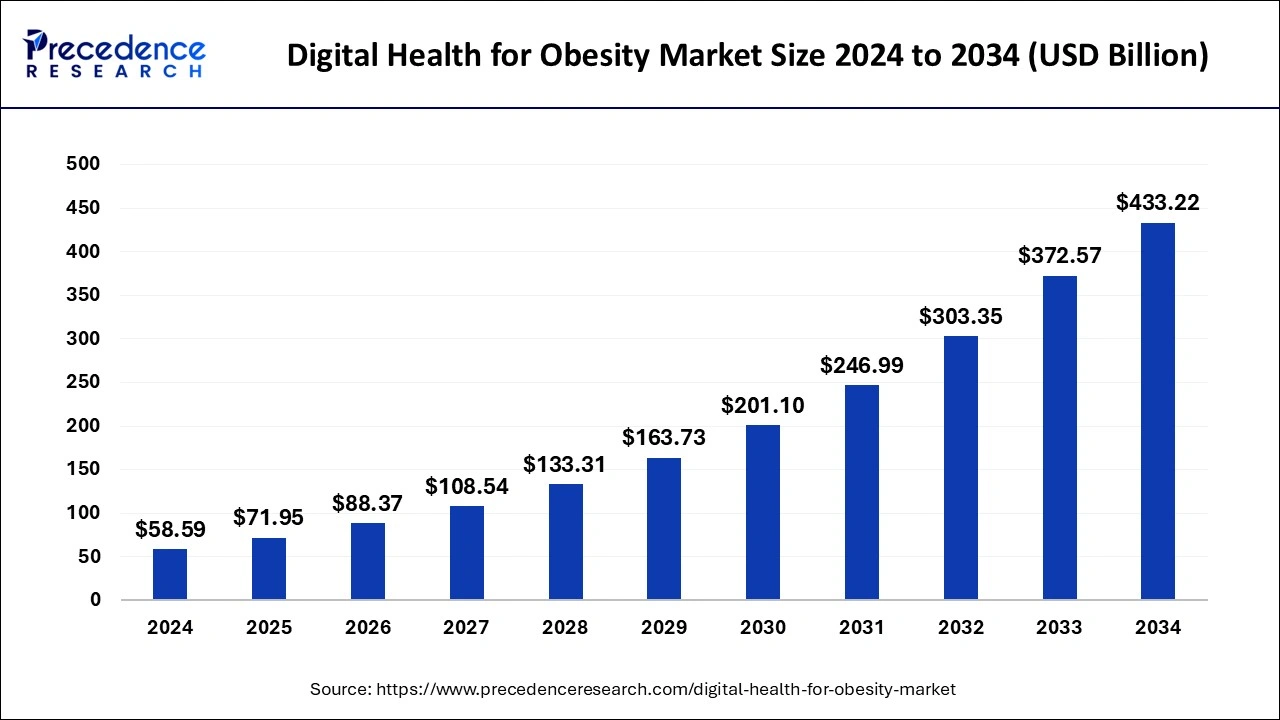

The global digital health for obesity market size was estimated at USD 47.70 billion in 2023 and is predicted to reach around USD 372.57 billion by 2033, growing at a CAGR of 22.82% from 2024 to 2033.

Key Points

- The North America digital health for obesity market size accounted for USD 17.17 billion in 2023 and is expected to rise around USD 134.13 billion by 2033.

- North America dominated the market with the largest market share of 36% in 2023.

- Asia Pacific is expected to grow at the highest CAGR in the market by region during the forecast period.

- By component, the services segment dominated the market in 2023.

- By component, the software segment is expected to grow at a rapid pace in the market by component during the forecast period.

- By end-use, the patients segment dominated the market by end-use in 2023.

The digital health for obesity market is experiencing significant growth driven by technological innovations and increasing awareness about obesity management. This market encompasses a range of digital solutions aimed at preventing, managing, and treating obesity through technology-enabled interventions. Key segments within this market include mobile apps, wearable devices, telemedicine platforms, and online coaching services. The market is characterized by a growing emphasis on personalized and data-driven approaches to address obesity-related challenges.

Get a Sample: https://www.precedenceresearch.com/sample/4245

Growth Factors

Several factors contribute to the growth of the digital health for obesity market. Technological advancements in wearable sensors, mobile health apps, and artificial intelligence are empowering individuals to monitor and manage their weight effectively. Rising obesity rates globally, coupled with the need for remote healthcare solutions, are driving demand for digital health tools. Additionally, supportive government initiatives promoting digital healthcare adoption and increasing investments by healthcare organizations in obesity management contribute to market expansion.

Region Insights

The market for digital health solutions targeting obesity varies across regions. In developed economies like North America and Europe, robust healthcare infrastructure and high adoption of digital technologies propel market growth. Emerging markets in Asia-Pacific and Latin America present significant growth opportunities due to increasing healthcare expenditure and rising awareness about obesity-related health risks. Each region has its unique regulatory landscape and consumer preferences, influencing the adoption and development of digital health solutions for obesity management.

Digital Health for Obesity Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 22.82% |

| Digital Health for Obesity Market Size in 2023 | USD 47.70 Billion |

| Digital Health for Obesity Market Size in 2024 | USD 58.59 Billion |

| Digital Health for Obesity Market Size by 2033 | USD 372.57 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Health for Obesity Market Dynamics

Drivers

Key drivers of the digital health for obesity market include the growing prevalence of obesity globally, which has created a pressing need for scalable and accessible healthcare solutions. Advances in mobile technology and wireless connectivity have facilitated real-time monitoring and remote coaching for obesity management. Moreover, the shift towards value-based care models incentivizes healthcare providers to leverage digital solutions to improve patient outcomes and reduce healthcare costs associated with obesity-related complications.

Opportunities

The market offers substantial opportunities for digital health companies and healthcare providers. Collaborations between technology firms and healthcare organizations can lead to innovative solutions tailored for obesity prevention and management. Expansion into untapped markets, especially in developing regions, presents opportunities to address unmet healthcare needs and expand customer base. Moreover, leveraging data analytics and machine learning algorithms can enhance the effectiveness of digital health interventions for personalized obesity management.

Challenges

Despite the promising growth outlook, the digital health for obesity market faces challenges. Data privacy concerns and regulatory complexities surrounding health data governance can impede the adoption of digital health solutions. Limited access to high-speed internet and digital literacy in certain regions may hinder the widespread adoption of these technologies. Furthermore, ensuring the effectiveness and long-term sustainability of digital interventions for obesity management requires continuous research and validation.

Read Also: Medical Foods Market Size to Reach USD 34 Billion By 2033

Digital Health for Obesity Market Recent Developments

- In February 2024, Ease Healthcare, a leading women’s health ecosystem in Asia, launched Elevate, the latest digital health platform, which aims to address metabolic health and weight management issues specifically tailored for women. The platform integrates various elements, including modern medical practices, expert guidance, community support, and digital tools to provide women with effective solutions for sustainable weight loss and improved metabolic health

- In January 2024, Eli Lilly and Company announced LillyDirect™, a new digital healthcare experience for patients in the U.S. living with obesity, migraine, and diabetes. LillyDirect offers disease management resources, including access to independent healthcare providers*, tailored support, and direct home delivery of select Lilly medicines through third-party pharmacy dispensing services.

- In December 2023, Digital health company Hims & Hers launched its much-anticipated weight loss program this week, which includes digital tracking tools, educational content, and access to medications. The new offering, however, does not include prescriptions for the buzzy new weight loss medications known as GLP-1s, at least for now.

- In September 2022, Digital health specialist Kry teamed up with pharma group Novo Nordisk on the development of resources that can help people with obesity manage their condition and adhere to treatment. The partners anticipate that the digital obesity program will launch later this autumn in Sweden, ahead of a broader rollout in other European markets before the end of the year. It is estimated that more than half (53%) of the adults living in the EU are considered to be overweight or obese.

Digital Health for Obesity Market Companies

- WW International

- MyFitnessPal

- Teladoc Health, Inc.

- Fitnesskeeper Inc.

- Healthify (My Diet Coach)

- Fitbit, Inc.

- Noom

- PlateJoy HEALTH

- Tempus

- WellDoc

- Sidekick Health

- BioAge Labs

Segment Covered in the Report

By Component

- Software

- Hardware

- Services

By End-use

- Patients

- Providers

- Payers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/