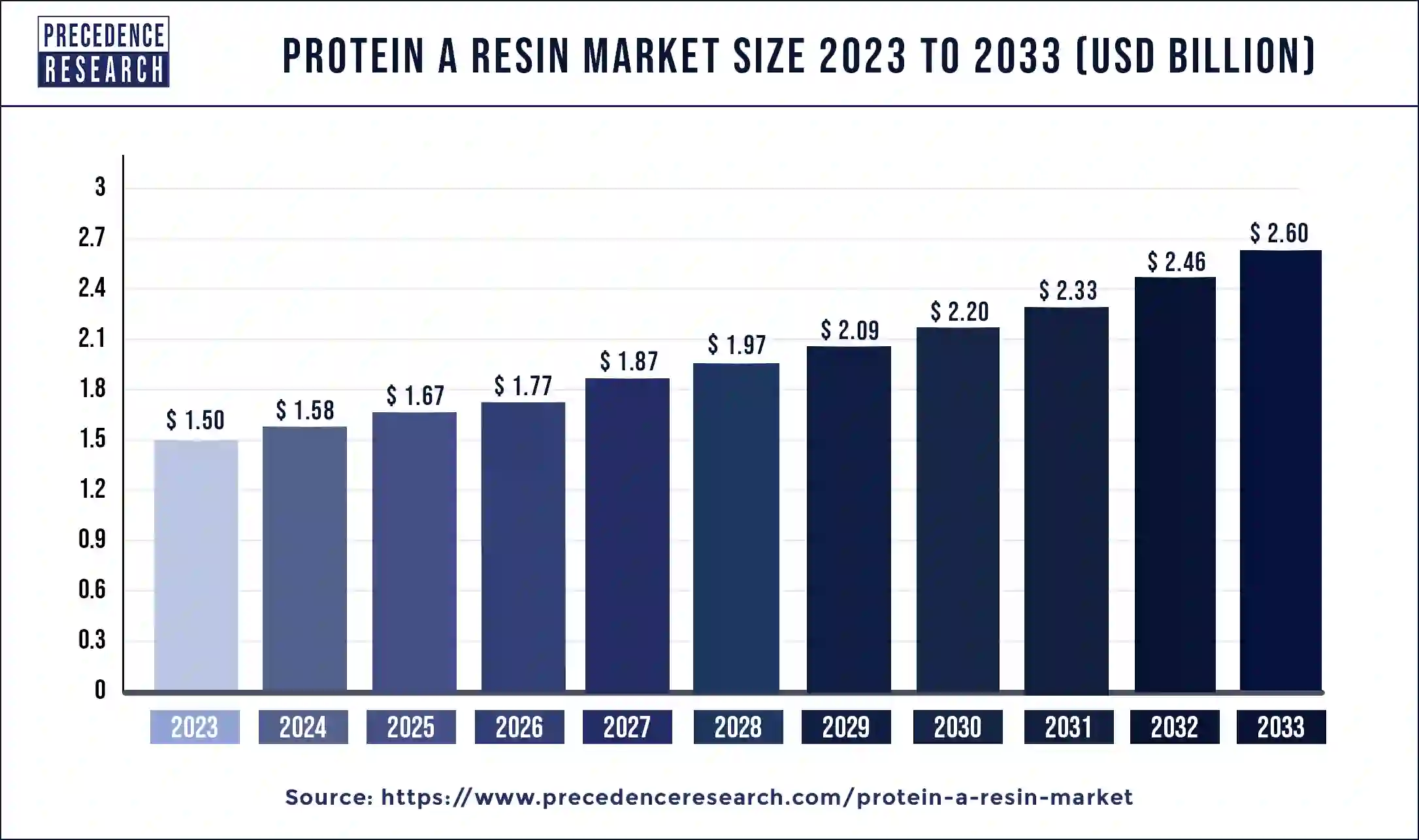

The global protein A resins market size reached USD 1.50 billion in 2023 and is anticipated to attain around USD 2.60 billion by 2033, growing at a CAGR of 5.65% from 2024 to 2033.

Key Points

- By region, North America led the protein A resins market with the largest market share of 42% in 2023.

- By region, Asia Pacific is expected to witness the fastest growth rate in the market during the forecast period.

- By application, the antibody purification segment dominated the protein A resins market in 2023 with market share of 60%.

- By product, the recombinant protein A segment had the largest share of around 58% in 20223.

- By matrix type, the agarose-based matrix segment dominated the market in 2023 with market share of 42.3%.

- By end-user, the pharmaceutical & biopharmaceutical companies segment dominated the market in 2023 with market share of 59%.

The protein A resins market is a crucial segment within the biopharmaceutical industry, providing essential materials for the purification of therapeutic proteins. These resins play a vital role in chromatography processes, facilitating the isolation and purification of monoclonal antibodies (mAbs) and other biologics. As the demand for biopharmaceuticals continues to rise, driven by factors such as aging populations, increasing prevalence of chronic diseases, and advancements in biotechnology, the protein A resins market is poised for significant growth. This article provides insights into the key growth factors, region-specific dynamics, drivers, opportunities, and challenges shaping the protein A resins market.\

Get a Sample: https://www.precedenceresearch.com/sample/4063

Growth Factors:

Several factors contribute to the growth of the protein A resins market. The expanding biopharmaceutical industry, fueled by the development of novel biologics and biosimilars, drives the demand for purification technologies, including protein A resins. The increasing adoption of therapeutic antibodies for the treatment of cancer, autoimmune disorders, and infectious diseases further propels market growth.

Moreover, advancements in protein A resin technology, such as improved binding capacities, enhanced selectivity, and higher resin durability, contribute to the efficiency and effectiveness of downstream bioprocessing. Additionally, the growing trend towards single-use and disposable chromatography systems in biomanufacturing facilities drives the demand for protein A resins designed for compatibility with these systems, thereby expanding market opportunities.

Region Insights:

The protein A resins market exhibits regional variations driven by factors such as biopharmaceutical production capacities, regulatory frameworks, and healthcare infrastructure.

In North America, particularly in the United States, the presence of a robust biopharmaceutical industry, coupled with significant investments in research and development, fuels market growth. The region’s favorable regulatory environment and well-established healthcare infrastructure further support the adoption of protein A resins for bioprocessing applications.

In Europe, countries such as Germany, Switzerland, and the United Kingdom are key contributors to the protein A resins market, owing to their strong biotechnology sectors and well-developed pharmaceutical manufacturing capabilities. The European Medicines Agency’s (EMA) regulatory framework encourages innovation and facilitates market access for biopharmaceutical products, driving demand for protein A resins in the region.

In the Asia-Pacific region, countries like China, India, and South Korea are witnessing rapid growth in biopharmaceutical manufacturing, driven by government initiatives, investments in healthcare infrastructure, and the presence of a large patient population. The emergence of contract manufacturing organizations (CMOs) and biopharmaceutical clusters further accelerates market expansion in the region.

Protein A Resins Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.65% |

| Global Market Size in 2023 | USD 1.50 Billion |

| Global Market Size in 2024 | USD 1.58 Billion |

| Global Market Size by 2033 | USD 2.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Product, By Matrix Type, By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Protein A Resins Market Dynamics

Drivers:

Several drivers propel the growth of the protein A resins market. The increasing prevalence of chronic diseases, such as cancer, autoimmune disorders, and infectious diseases, drives the demand for biopharmaceuticals, including monoclonal antibodies, which require purification using protein A resins. Additionally, the aging population worldwide contributes to the rising incidence of age-related diseases, further boosting market growth.

Furthermore, technological advancements in protein A resin manufacturing, such as the development of novel ligands, resin matrices, and process optimization strategies, enhance the efficiency, yield, and cost-effectiveness of downstream bioprocessing. The shift towards personalized medicine and targeted therapies also drives innovation in biopharmaceutical production, creating opportunities for protein A resin manufacturers to develop tailored solutions for specific therapeutic applications.

Opportunities:

The protein A resins market presents numerous opportunities for growth and innovation. With the increasing demand for biopharmaceuticals, particularly in emerging markets, there is a growing need for cost-effective and scalable purification solutions. Manufacturers have the opportunity to develop next-generation protein A resins with improved performance characteristics, such as higher binding capacities, enhanced selectivity, and increased resin longevity.

Moreover, the expansion of biomanufacturing capacity, driven by investments in biopharmaceutical production facilities and the emergence of contract development and manufacturing organizations (CDMOs), creates opportunities for protein A resin suppliers to collaborate with biopharmaceutical companies and service providers. Additionally, the adoption of continuous bioprocessing and integrated manufacturing platforms presents new avenues for innovation in protein A resin technology.

Challenges:

Despite the promising growth prospects, the protein A resins market faces several challenges. One of the primary challenges is the high cost associated with protein A resin purification, which contributes to the overall manufacturing cost of biopharmaceuticals. Manufacturers are under pressure to develop cost-effective purification solutions without compromising product quality or yield.

Moreover, concerns regarding resin leachables and extractables, as well as the environmental impact of resin disposal, present challenges for protein A resin manufacturers and end-users. Addressing these concerns requires ongoing research and development efforts to develop sustainable resin materials and purification processes.

Furthermore, competition from alternative purification technologies, such as protein L and protein G affinity chromatography, as well as non-affinity-based methods such as ion exchange chromatography and multimodal chromatography, poses a challenge to the dominance of protein A resins in bioprocessing applications. Manufacturers must innovate and differentiate their products to maintain a competitive edge in the market.

Read Also: Cosmetovigilance Market Size to Reach USD 17.60 Bn by 2033

Recent Developments

- In March 2024, Ultomiris received an approval from the United States for the long-term C5 complement inhibitor for the diagnostics of geriatric patients having anti-aquaporin-4 (AQP4) antibody-positive (Ab+) neuromyelitis optica spectrum disorder.

- In March 2024, Merck, a leading player in the life science technology company expanded its M LabTM Collaboration Center in Shanghai, China, it is the organization’s biggest in the global network of 10 interconnected labs. The investment worth € 14 million was added for the new biology application lab an upstream application lab and a process development training center to its M LabTM Collaboration Center in Shanghai.

- In April 2024, BioArctic AB collaborated with Eisai and announced the organization submitted the supplemental Biologics License Application (sBLA) for its drug Leqembi to the United States Food and Drug Administration (FDA).

- In April 2024, the US FDA approved and authorized the latest antibody drug named Pemgarda marketed by the biotech Invivyd, to protect immunocompromised individuals from COVID-19.

- In April 2024, Kemp Proteins LLC, a leading company in gene-to-protein services and monoclonal antibody development announced the strategic collaboration with the Columbia Biosciences of Frederick, Maryland.

- In April 2024, Sino Biological introduced a series of in vitro bioassay services for maintaining antibody drug development projects. Sino Biological offers different reagents and a range of n vitro efficacy evaluation services for meeting the demand for testing practices and trends.

Protein A Resins Market Companies

- GE Healthcare

- Merck Millipore

- PerkinElmer, Inc.

- GenScript Biotech Corp.

- Agilent Technologies

- Repligen Corp.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Abcam PLC.

- Novasep Holdings SAS

Segments Covered in the Report

By Application

- Antibody purification

- Immunoprecipitation

By Product

- Recombinant protein A

- Natural protein A

By Matrix Type

- Agarose-based matrix

- Glass or silica gel-based matrix

- Organic polymer-based matrix

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- Clinical research laboratories

- Academic research institutes

- Contract research organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/