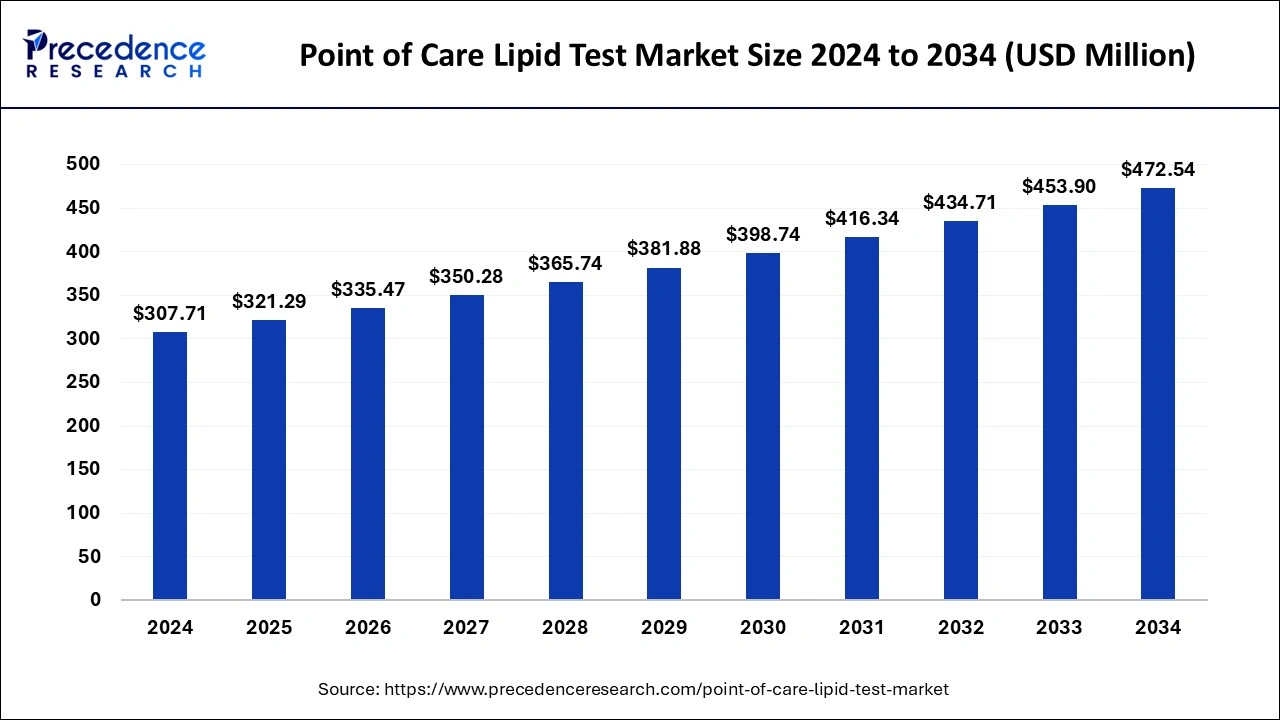

The global point of care lipid test market size reached USD 294.70 million in 2023 and is projected to hit around USD 453.90 million by 2033, growing at a CAGR of 4.41% from 2024 to 2033.

Key Points

- North America held a significant share of in the point of care lipid test market in 2023 with 38.6%.

- Asia Pacific is anticipated to experience the highest growth in the upcoming years.

- By product, the consumables type segment has accounted market share of 57% in 2023.

- By application, in 2023, the endogenous hyperlipidemia segment dominated the market with 46% revenue share.

- By end use, the diagnostic centers segment has held largest market share of 56% in 2023.

The Point of Care (POC) Lipid Test Market refers to the segment of the healthcare industry focused on providing rapid and convenient testing for lipid levels such as cholesterol and triglycerides at the point of care, typically in outpatient settings or community clinics. Lipid testing plays a crucial role in assessing an individual’s risk of cardiovascular diseases, which remain a leading cause of morbidity and mortality worldwide. The POC lipid test market encompasses various testing methods and devices designed to deliver accurate results quickly, enabling healthcare providers to make timely decisions regarding patient care and treatment strategies.

Get a Sample: https://www.precedenceresearch.com/sample/4076

Growth Factors

Several factors contribute to the growth of the POC lipid test market. Firstly, the increasing prevalence of cardiovascular diseases globally is driving the demand for efficient lipid testing solutions. As healthcare systems strive to improve patient outcomes and reduce the burden of cardiovascular morbidity and mortality, there is a growing emphasis on early detection and management of risk factors such as dyslipidemia. Additionally, the rise of personalized medicine and preventive healthcare practices has heightened the need for accessible and cost-effective lipid testing options that can be integrated into routine clinical workflows.

Furthermore, technological advancements have led to the development of innovative POC lipid testing devices that offer enhanced accuracy, sensitivity, and ease of use. Miniaturization of testing platforms, coupled with advancements in biosensor technology and data connectivity, has enabled the creation of portable and handheld devices capable of delivering rapid results with minimal sample volume. These technological innovations not only improve patient convenience but also empower healthcare providers with real-time data for informed decision-making.

Region Insights

The demand for POC lipid testing varies across different regions, influenced by factors such as healthcare infrastructure, disease prevalence, and regulatory environment. In developed regions such as North America and Europe, where cardiovascular diseases are major public health concerns, there is a robust market for POC lipid testing devices. The presence of well-established healthcare systems, high levels of awareness about preventive healthcare, and favorable reimbursement policies contribute to market growth in these regions.

In contrast, emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities for POC lipid test manufacturers. Rapid urbanization, changing lifestyles, and increasing adoption of Western dietary patterns contribute to the rising prevalence of cardiovascular risk factors in these regions. However, challenges such as limited access to healthcare services, affordability issues, and regulatory barriers pose constraints to market penetration and adoption of POC lipid testing technologies.

Point of Care Lipid Test Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 294.70 Million |

| Global Market Size in 2024 | USD 307.71 Million |

| Global Market Size by 2033 | USD 453.90 Million |

| Growth Rate from 2024 to 2033 | CAGR of 4.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Point of Care Lipid Test Market Dynamics

Drivers:

Several drivers fuel the expansion of the POC lipid test market. Firstly, the growing emphasis on preventive healthcare and population health management strategies drives the demand for accessible and efficient diagnostic tools for cardiovascular risk assessment. Healthcare providers and policymakers recognize the importance of early detection and intervention in reducing the burden of cardiovascular diseases and associated healthcare costs.

Moreover, advancements in digital health technologies and telemedicine solutions are facilitating the integration of POC lipid testing into remote patient monitoring and chronic disease management programs. By enabling decentralized testing and remote data transmission, these technologies enhance patient engagement, improve care coordination, and enable timely interventions based on real-time data insights.

Additionally, increasing investments in research and development by key market players aim to address unmet needs and enhance the performance and usability of POC lipid testing devices. By leveraging innovations in materials science, biotechnology, and data analytics, manufacturers are striving to develop next-generation testing platforms capable of delivering superior diagnostic accuracy, reliability, and user experience.

Opportunities:

The POC lipid test market presents numerous opportunities for growth and innovation. One key opportunity lies in expanding market access and penetration in underserved regions through strategic partnerships, collaborations, and market expansion initiatives. By leveraging local distribution networks, healthcare partnerships, and government collaborations, manufacturers can enhance market reach and address the needs of diverse patient populations.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) algorithms holds promise for enhancing the predictive value and clinical utility of POC lipid testing. By analyzing large datasets of lipid profiles, clinical outcomes, and patient demographics, AI-powered algorithms can identify patterns, trends, and risk factors that may not be apparent through conventional analysis methods. This enables more personalized risk assessment and tailored treatment recommendations, thereby improving patient outcomes and healthcare efficiency.

Furthermore, the shift towards value-based healthcare models and outcomes-based reimbursement frameworks creates opportunities for POC lipid test manufacturers to demonstrate the clinical and economic value of their products. By generating robust clinical evidence, conducting health economic analyses, and engaging with payers and healthcare decision-makers, manufacturers can position their solutions as integral components of value-driven care pathways aimed at improving patient outcomes while optimizing resource utilization.

Challenges:

Despite the promising growth prospects, the POC lipid test market faces several challenges that may impede market expansion and adoption. One significant challenge is ensuring the accuracy and reliability of POC lipid testing devices across diverse patient populations and clinical settings. Variability in sample quality, operator proficiency, and environmental conditions can affect test results and undermine clinical utility, leading to misdiagnosis or inappropriate treatment decisions.

Moreover, regulatory compliance and quality assurance requirements pose challenges for manufacturers seeking to commercialize POC lipid testing devices in multiple geographies. Harmonizing regulatory standards, navigating complex approval processes, and ensuring ongoing compliance with evolving regulations demand significant investments in regulatory affairs and quality management systems.

Additionally, market fragmentation and intense competition among POC lipid test manufacturers create pricing pressures and margin constraints, particularly in price-sensitive healthcare markets. To maintain competitiveness and sustain growth, manufacturers must differentiate their products through innovation, superior performance, and value-added services while optimizing manufacturing processes and supply chain efficiencies to reduce costs.

Read Also: Electric Vehicle Thermal Management Market Size, Share, Report By 2033

Recent Developments

- In October 2022 Genes2Me Pvt. Ltd launched Rapi-Q- Point of Care RT PCR solution for human papillomavirus (HPV) and tuberculosis. The device is easy to use and gives faster results in less than 45 minutes. This CE-IVD-marked POC solution delivers superior performance, high sensitivity, and stable detection.

- In March 2022, Visby Medical announced that it received funding of USD 25.5 million from the U.S. Biomedical Advanced Research and Development Authority to develop a rapid flu-COVID-19 PCR test for home use. At present, the test is in the under-developing phase, and the design is ready as a PCR device that can detect COVID-19, influenza A, and B from a single sample.

- In March 2022, Canada-based Company BioLytical Laboratories Inc. received a CE marking for the iStatis COVID-19 Antigen Home Test.

- In May 2022, Qiagen Inc. launched the NeuMoDxHSV 1/2 Quant Assay for the quantification and differentiation of herpes simplex virus type 1 (HSV-1) DNA and herpes simplex virus type 2 (HSV-2) with approval from the European Commission. The emergence of this assay is allowing the company to expand its product portfolio in laboratory testing, which ultimately helps the market grow owing to the innovative tests.

- In March 2022, Mindray launched the BC-700 Series, a hematology analyzer series that assists in both blood count and erythrocyte sedimentation rate tests.

Point of Care Lipid Test Market Com[panies

- Callegari Sinocare Inc.

- Abbott Laboratories

- Mico Bio Med

- Nova Biomedical Corporation

- VivaChek Biotech (Hangzhou) Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Zoetis Inc.

- Menarini Group

- SD Biosensor, Inc.

Segments Covered in the Report

By Product Type

- Devices

- Consumables

By Application

- Endogenous Hyperlipemia

- Combined Hyperlipidemia

- Familial Hypercholesterolemia

- Others

By End-user

- Hospitals And Clinics

- Diagnostic Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/