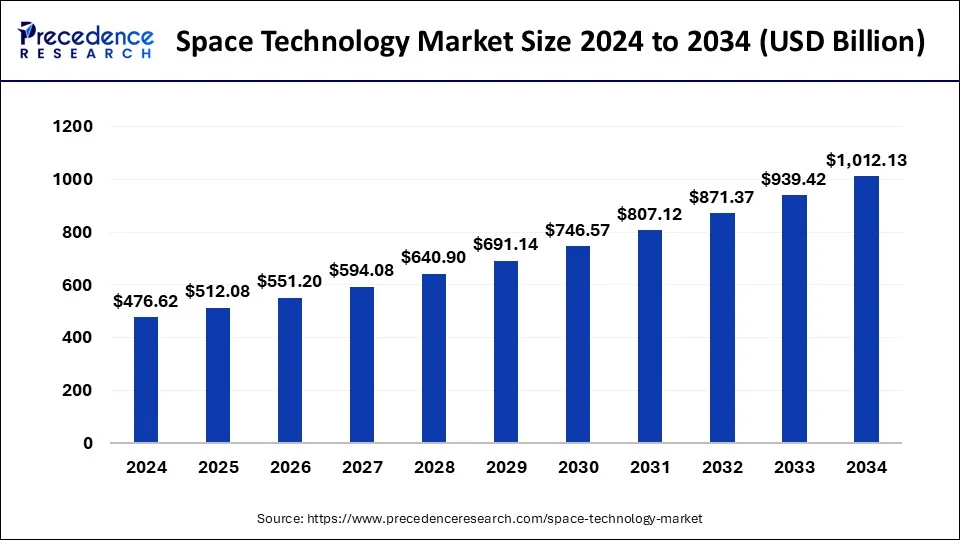

The global space technology market size reached USD 443.20 billion in 2023 and is projected to hit around USD 916.85 billion by 2033, growing at a CAGR of 7.54% from 2024 to 2033.

Key Points

- North America accounted more than 55% of the market share in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 9.05% between 2024 and 2033.

- By type, the space vehicles segment has held the major market share of 67% in 2023.

- By end use, in 2023, the commercial segment dominated the market with the largest market share of 62% in 2023.

- By application, the navigation and mapping segment led the market with the maximum market share of 21% in 2023.

The space technology market is witnessing unprecedented growth and innovation, driven by advancements in technology, increasing private sector involvement, and government initiatives to explore and commercialize space. Space technology encompasses a wide range of applications, including satellite communications, remote sensing, space exploration, and space tourism, with both governmental and commercial entities playing significant roles in shaping the industry. The market is characterized by rapid technological developments, cost reductions in space launches, and the emergence of new players offering innovative solutions for accessing and utilizing space assets. As the space industry continues to evolve, the space technology market presents immense opportunities for growth and innovation across various sectors and regions.

Get a Sample: https://www.precedenceresearch.com/sample/4052

Growth Factors

Several key factors are driving the growth of the space technology market. Firstly, advancements in satellite technology, including miniaturization, increased performance, and reduced launch costs, have expanded the capabilities and accessibility of satellite-based services such as communication, navigation, earth observation, and remote sensing. Moreover, the growing demand for high-speed internet connectivity in remote and underserved regions is driving investment in satellite broadband constellations, offering broadband internet access to millions of people worldwide. Additionally, the privatization of space launch services and the emergence of reusable rocket technology have significantly reduced the cost of launching payloads into space, enabling more frequent and cost-effective access to space for both commercial and scientific purposes. Furthermore, government initiatives to promote space exploration, planetary science, and human spaceflight missions are fueling investment in space technology research and development, spurring innovation and collaboration across the industry.

Regional Insights

The space technology market exhibits significant regional variations in terms of capabilities, infrastructure, and market dynamics. The United States remains a dominant player in the global space industry, home to leading space agencies such as NASA and prominent commercial space companies like SpaceX, Blue Origin, and Lockheed Martin. The U.S. government’s significant investment in space exploration, satellite communication, and national security space programs has propelled the country’s leadership in space technology innovation and market competitiveness. Europe, represented by the European Space Agency (ESA) and various national space agencies, is also a major player in the space technology market, with a focus on satellite navigation, earth observation, and space science missions. China has emerged as a rising power in space technology, with ambitious plans for lunar exploration, Mars missions, and the development of its own satellite navigation system. Other regions, including Russia, India, and Japan, also contribute to the global space technology market through their space agencies and industry partnerships.

Trends

Several trends are shaping the evolution of the space technology market. One prominent trend is the proliferation of small satellites, including CubeSats and nanosatellites, driven by miniaturization, cost reduction, and increasing demand for agile and affordable space-based solutions. Small satellites are revolutionizing various applications, including Earth observation, remote sensing, communications, and scientific research, offering flexibility, scalability, and rapid deployment capabilities. Another notable trend is the commercialization of space exploration, with private companies investing in lunar missions, asteroid mining, and space tourism ventures. The emergence of reusable rocket technology, exemplified by SpaceX’s Falcon 9 and Falcon Heavy rockets, is transforming the economics of space launches, enabling frequent and cost-effective access to space for commercial payloads and human spaceflight missions. Moreover, advancements in propulsion systems, robotics, and additive manufacturing are driving innovation in spacecraft design, propulsion, and in-situ resource utilization, opening new possibilities for sustainable space exploration and colonization.

Space Technology Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.54% |

| Global Market Size in 2023 | USD 443.20 Billion |

| Global Market Size in 2024 | USD 476.62 Billion |

| Global Market Size by 2033 | USD 916.85 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By End-use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Space Technology Market Dynamics

Drivers:

Several factors are driving investment and innovation in the space technology market. Firstly, the increasing demand for satellite-based services, including communication, navigation, earth observation, and remote sensing, is fueling investment in satellite technology and infrastructure. The proliferation of smartphones, mobile broadband, and internet-of-things (IoT) devices is driving demand for high-speed, reliable satellite broadband connectivity, particularly in remote and underserved areas. Moreover, the growing importance of space-based assets for national security, disaster management, environmental monitoring, and climate change research is driving government investment in space technology and infrastructure. Additionally, the emergence of commercial space ventures, including satellite constellations, space tourism, and lunar exploration, is attracting private investment and driving innovation in space technology, launch systems, and spacecraft design. Furthermore, advancements in materials science, propulsion systems, robotics, and artificial intelligence are enabling new capabilities and applications in space exploration, resource utilization, and human spaceflight.

Opportunities

The space technology market presents numerous opportunities for stakeholders across the value chain. Satellite manufacturers have the opportunity to capitalize on the growing demand for satellite-based services by developing innovative satellite platforms, payloads, and constellations optimized for communication, earth observation, and remote sensing applications. Launch service providers can leverage reusable rocket technology and increased launch frequency to offer cost-effective and reliable access to space for commercial and scientific payloads. Moreover, companies specializing in space tourism, lunar exploration, and asteroid mining have the opportunity to pioneer new markets and business models in the emerging space economy. Government agencies and research institutions can collaborate with commercial partners to advance space exploration, scientific research, and technology development, fostering innovation and knowledge exchange. Furthermore, advancements in space technology, including propulsion systems, robotics, and in-situ resource utilization, present opportunities for sustainable space exploration, colonization, and long-term human presence beyond Earth.

Challenges

Despite the significant growth and opportunities in the space technology market, several challenges remain that could hinder its realization of its full potential. One of the primary challenges is the high cost and complexity of space missions, including satellite development, launch services, and spacecraft operations, which can pose barriers to entry for smaller companies and emerging space nations. Additionally, the increasing congestion and potential for collisions in Earth orbit pose risks to satellite operations and space infrastructure, requiring international collaboration and regulatory frameworks to ensure space sustainability and debris mitigation. Moreover, geopolitical tensions and regulatory uncertainties, including export controls, spectrum allocation, and intellectual property rights, could impact international collaboration, market access, and technology transfer in the space industry. Furthermore, technological challenges related to radiation exposure, life support systems, and long-duration spaceflight pose risks to human space exploration and colonization efforts, requiring further research and development to ensure astronaut safety and mission success. Addressing these challenges will require collaboration among governments, industry stakeholders, and international organizations to foster a sustainable and inclusive space ecosystem that promotes innovation, cooperation, and responsible space exploration and utilization.

Read Also: Precious Metal Market Size to Reach USD 514.06 Bn by 2033

Recent Developments

- In September 2023, the Polar Satellite Launch Vehicle (PSLV-C57) successfully launched the Aditya-L1 spacecraft from the Second Launch Pad of Satish Dhawan Space Centre (SDSC), Sriharikota under the space mission of ISRO.

- In December 2023, Qualcomm Technologies, Inc., in collaboration with the Indian Space Research Organisation (ISRO), developed and tested select chipset platforms that support NavIC L1 signals. The initiative will help accelerate the adoption of NavIC and enhance the geo-location capabilities of mobile, automotive, and the Internet of Things (IoT) solutions in the region.

- In December 2023, NASA launched the James Webb Space Telescope. The telescope is designed to study the universe in infrared light, which allows us to see objects that are too faint or distant to be seen by other telescopes.

- In January 2023, SpaceX’s most spacecraft launched into space on a single mission, with 143 satellites. 3.

- SpaceX raised about USD2 billion with an ambitious plan for 2023, which includes 87 rocket launches, a sustained moon exploration project, and expansion of Starlink internet service.

Space Technology Market Companies

- Airbus SE

- Astra Space Inc.

- Ball Corporation

- Beijing Commsat Technology Development Co. Ltd.

- Blue Origin LLC

- Boeing

- China Aerospace Science and Technology Corporation

- General Dynamics Corporation

- Hedron

- Hindustan Aeronautics Limited

- Honeywell International Inc.

- ICEYE

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman Corporation

- OHB System AB

- Rocket Lab USA

- Safran S.A.

- Sierra Nevada Corporation

- SpaceX

- Thales Group

- Virgin Galactic

List of Space Agencies in the Space Technology Market

- National Aeronautics and Space Administration (NASA)

- European Space Agency

- China National Space Administration

- Indian Space Research Organization

- Japan Aerospace Exploration Agency

- Canadian Space Agency

- Italian Space Agency

- National Centre for Space Studies – France

- United Kingdom Space Agency

- Israel Space Agency

Segments Covered in the Report

By Type

- Space Vehicles

- Spacecraft

- Flyby Spacecraft

- Orbiter Spacecraft

- Atmospheric Spacecraft

- Lander Spacecraft

- Rover Spacecraft

- Others (Observatory Spacecraft, Penetrator Spacecraft, etc.)

- Satellites

- Weather Satellite

- Communication Satellite

- Navigation Satellites

- Earth Observation Satellite

- Astronomical Satellites

- Miniaturized Satellites

- Spacecraft

- Space Stations

- Orbital Launch Vehicles

- Deep-space communication

- In-space Propulsion

- Others (Support Infrastructure, Procedures, etc.)

By End-use

- Government

- Military

- Commercial

By Application

- Navigation & Mapping

- Meteorology

- Disaster Management

- Satellite Communication

- Satellite Television

- Remote Sensing

- Science & Engineering

- Earth Observation

- Military and National Security

- Data & Analytics

- Information Technology

- Internet Services

- Manufacturing

- Others (Space Medicine, Tele-Education, etc.)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/