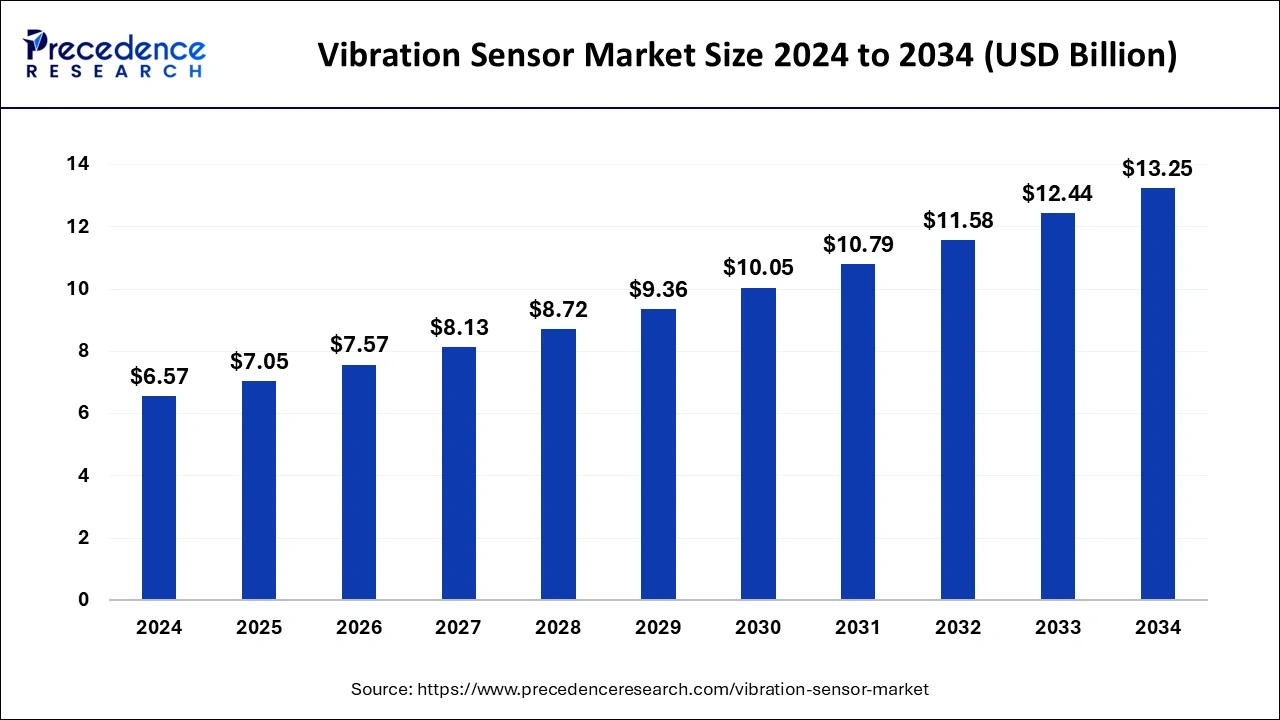

The global vibration sensor market size reached USD 6.12 billion in 2023 and is anticipated to hit around USD 12.44 billion by 2033, growing at a CAGR of 7.35% from 2024 to 2033.

Key Points

- North America dominated the market with the largest market share of 38% in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 8.62% between 2024 and 2033

- By type, the accelerometers segment has captured more than 45% in 2023.

- By type, the displacement sensors segment is expected to expand at a CAGR of 8.4% between 2024 and 2033.

- By technology, the piezoresistive sensors segment has generated 25% of market share in 2023.

- By technology, the tri-axial sensors segment is projected to grow at the fastest CAGR of 8.92% between 2024 and 2033.

- By end-use, the automobile segment has held a significant market share of 28% in 2023.

- By material, the quartz-based sensors segment has recorded more than 44% of the market share in 2023.

The vibration sensor market has experienced substantial growth in recent years, driven by the increasing adoption of predictive maintenance techniques, advancements in sensor technology, and the growing demand for condition monitoring across various industries. Vibration sensors play a critical role in detecting and monitoring mechanical vibrations in machinery and equipment, helping to prevent costly downtime, optimize asset performance, and ensure operational efficiency. As industries across sectors such as manufacturing, automotive, aerospace, and healthcare continue to prioritize asset reliability and efficiency, the demand for vibration sensors is expected to further accelerate, presenting lucrative opportunities for market players.

Get a Sample: https://www.precedenceresearch.com/sample/3969

Growth Factors:

Several key factors have contributed to the growth of the vibration sensor market. Firstly, the rising awareness of the importance of predictive maintenance in minimizing equipment failures and downtime has driven the adoption of vibration sensors. By continuously monitoring machinery for abnormal vibrations, these sensors enable early detection of potential faults or failures, allowing for timely maintenance and repairs, and ultimately reducing unplanned downtime and maintenance costs.

Moreover, advancements in sensor technology, such as the development of MEMS (Micro-Electro-Mechanical Systems) based vibration sensors, have led to smaller, more accurate, and cost-effective sensor solutions. These advancements have expanded the applicability of vibration sensors across a wide range of industries and applications, driving market growth.

Furthermore, the increasing integration of IoT (Internet of Things) and machine learning technologies into vibration monitoring systems has enhanced the capabilities and effectiveness of vibration sensors. IoT-enabled vibration sensors can collect and analyze real-time data from machinery, enabling predictive maintenance algorithms to identify patterns, trends, and anomalies indicative of potential equipment failures. This proactive approach to maintenance helps organizations optimize asset performance, extend equipment lifespan, and reduce maintenance costs.

Additionally, stringent regulatory requirements and industry standards mandating the implementation of condition monitoring systems in critical infrastructure and industrial equipment have boosted the demand for vibration sensors. Industries such as oil and gas, power generation, and transportation are increasingly investing in vibration monitoring solutions to comply with safety and reliability standards, driving market growth.

Region Insights:

The adoption of vibration sensors varies across regions, influenced by factors such as industrialization, technological advancements, and regulatory frameworks. In North America, the United States and Canada are major contributors to the vibration sensor market, owing to the presence of a robust manufacturing sector, extensive industrial infrastructure, and a high emphasis on predictive maintenance practices. The region’s automotive, aerospace, and manufacturing industries are significant end-users of vibration sensors, driving market growth.

In Europe, countries like Germany, the United Kingdom, and France are prominent markets for vibration sensors, supported by the region’s strong emphasis on industrial automation, smart manufacturing, and Industry 4.0 initiatives. The implementation of predictive maintenance strategies and the adoption of IoT-enabled vibration monitoring solutions are driving market growth in the region.

Asia Pacific is expected to witness significant growth in the vibration sensor market, driven by rapid industrialization, infrastructure development, and the increasing adoption of automation technologies across key industries. Countries such as China, Japan, and South Korea are investing heavily in manufacturing automation, smart infrastructure, and IoT-enabled industrial solutions, fueling demand for vibration sensors in the region.

In Latin America and the Middle East, the vibration sensor market is poised for growth, driven by increasing investments in oil and gas exploration, power generation, and infrastructure development. The adoption of vibration monitoring solutions in critical infrastructure such as pipelines, refineries, and power plants is expected to drive market expansion in these regions.

Vibration Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.35% |

| Global Market Size in 2023 | USD 6.12 Billion |

| Global Market Size by 2033 | USD 12.44 Billion |

| U.S. Market Size in 2023 | USD 1.74 Billion |

| U.S. Market Size by 2033 | USD 3.55 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, By End-use, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vibration Sensor Market Dynamics

Drivers:

Several drivers are shaping the growth of the vibration sensor market. One of the primary drivers is the increasing focus on predictive maintenance strategies to optimize asset performance and reduce operational costs. Vibration sensors play a crucial role in predictive maintenance programs by continuously monitoring machinery for signs of wear, misalignment, or imbalance, enabling proactive maintenance interventions to prevent costly equipment failures and downtime.

Moreover, the growing demand for condition monitoring solutions in industries such as manufacturing, automotive, and aerospace is driving the adoption of vibration sensors. As organizations seek to improve operational efficiency, ensure product quality, and comply with regulatory requirements, the need for real-time monitoring and analysis of machinery health becomes paramount, fueling demand for vibration sensor solutions.

Furthermore, the rise of Industry 4.0 and the increasing integration of IoT technologies into industrial processes are driving market growth. IoT-enabled vibration sensors can collect, transmit, and analyze large volumes of data from machinery in real-time, enabling predictive maintenance algorithms to identify potential faults or anomalies before they escalate into critical failures. This data-driven approach to maintenance helps organizations optimize asset performance, reduce downtime, and enhance overall productivity.

Additionally, the growing adoption of smart manufacturing and automation technologies is driving demand for vibration sensors. As industries embrace automation to improve production efficiency, quality control, and worker safety, the need for reliable and accurate condition monitoring solutions, such as vibration sensors, becomes essential to ensure the smooth operation of automated machinery and equipment.

Furthermore, stringent regulatory requirements and industry standards mandating the implementation of condition monitoring systems are driving market growth. Industries such as oil and gas, power generation, and aerospace are subject to regulatory scrutiny regarding equipment safety, reliability, and environmental compliance, leading to increased investments in vibration monitoring solutions to meet regulatory requirements and mitigate operational risks.

Opportunities:

The vibration sensor market presents numerous opportunities for stakeholders across the value chain. One of the significant opportunities lies in the development of advanced sensor technologies that offer higher accuracy, sensitivity, and reliability. Innovations in MEMS technology, wireless connectivity, and data analytics are driving the evolution of vibration sensors, enabling new applications and market opportunities.

Moreover, the growing demand for IoT-enabled vibration monitoring solutions presents opportunities for sensor manufacturers, software developers, and service providers. IoT platforms that integrate vibration sensor data with other sensor inputs, such as temperature, pressure, and humidity, offer comprehensive insights into machinery health and performance, enabling predictive maintenance strategies and operational optimizations.

Furthermore, the expansion of the Industrial Internet of Things (IIoT) and cloud-based analytics platforms is driving demand for cloud-connected vibration sensor solutions. Cloud-based vibration monitoring platforms offer scalability, accessibility, and real-time data insights, allowing organizations to monitor equipment health remotely, optimize maintenance schedules, and improve overall operational efficiency.

Additionally, the increasing adoption of vibration sensors in emerging applications such as structural health monitoring, vehicle health monitoring, and wearable devices presents new growth opportunities for market players. Vibration sensors integrated into smart buildings, bridges, and infrastructure assets can detect structural defects, monitor environmental conditions, and ensure safety and reliability.

Furthermore, partnerships and collaborations between sensor manufacturers, technology providers, and industry stakeholders can drive innovation and market expansion. Collaborative efforts to develop integrated sensor solutions, predictive maintenance algorithms, and industry-specific applications can unlock new value propositions and address evolving customer needs in the vibration sensor market.

Challenges:

Despite the growth prospects, the vibration sensor market faces several challenges that need to be addressed to realize its full potential. One of the primary challenges is the lack of standardized testing and calibration procedures for vibration sensors. Variations in sensor performance, accuracy, and reliability can impact the effectiveness of condition monitoring systems, leading to false alarms, missed detections, or inaccurate diagnostic results.

Moreover, interoperability issues between different sensor technologies, data formats, and communication protocols pose challenges to the seamless integration of vibration sensors into existing industrial systems and IoT platforms. Compatibility issues between sensors, gateways, and software applications can hinder data interoperability, data analytics, and decision-making processes, limiting the effectiveness of vibration monitoring solutions.

Furthermore, concerns regarding data security, privacy, and data ownership present challenges to the widespread adoption of cloud-connected vibration sensor solutions. Organizations are increasingly cautious about sharing sensitive

Read Also: Cardiac Rhythm Management Devices Market Size, Report by 2033

Recent Developments

- In January 2023, HARMAN International unveiled its sound and vibration sensor and external microphone products, designed to enhance the auditory experience in and around vehicles for various applications, including identifying emergency vehicle sirens and detecting glass breakage or collisions.

- In March 2022, SAMSUNG released the Galaxy A53 5G smartphone, which features an octa-core processor, a 120 Hz refresh rate display, and a sharp resolution of 1080 x 2400 pixels.

- In May 2022, Sensoteq announced the Kappa X Wireless Vibration Sensor. This compact sensor has a replaceable battery and can detect faults, making it suitable for various industrial applications.

Vibration Sensor Market Companies

- Dytran Instruments, Inc.

- PCB Piezotronics, Inc. (IMI Sensors division)

- Hansford Sensors Ltd.

- TE Connectivity Ltd. (formerly Measurement Specialties, Inc.)

- Honeywell International Inc.

- Robert Bosch GmbH

- National Instruments Corporation

- Analog Devices, Inc.

- Meggitt PLC

Segment Covered in the Report

By Type

- Accelerometers

- Velocity Sensors

- Displacement Sensors

By Technology

- Piezoresistive Sensors

- Tri-Axial Sensors

By End-use

- Automotive Sector

- Aerospace And Defense

- Consumer Electronics

By Material

- Quartz-based Sensors

- Doped Silicon Sensors

- Piezoelectric Ceramics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/