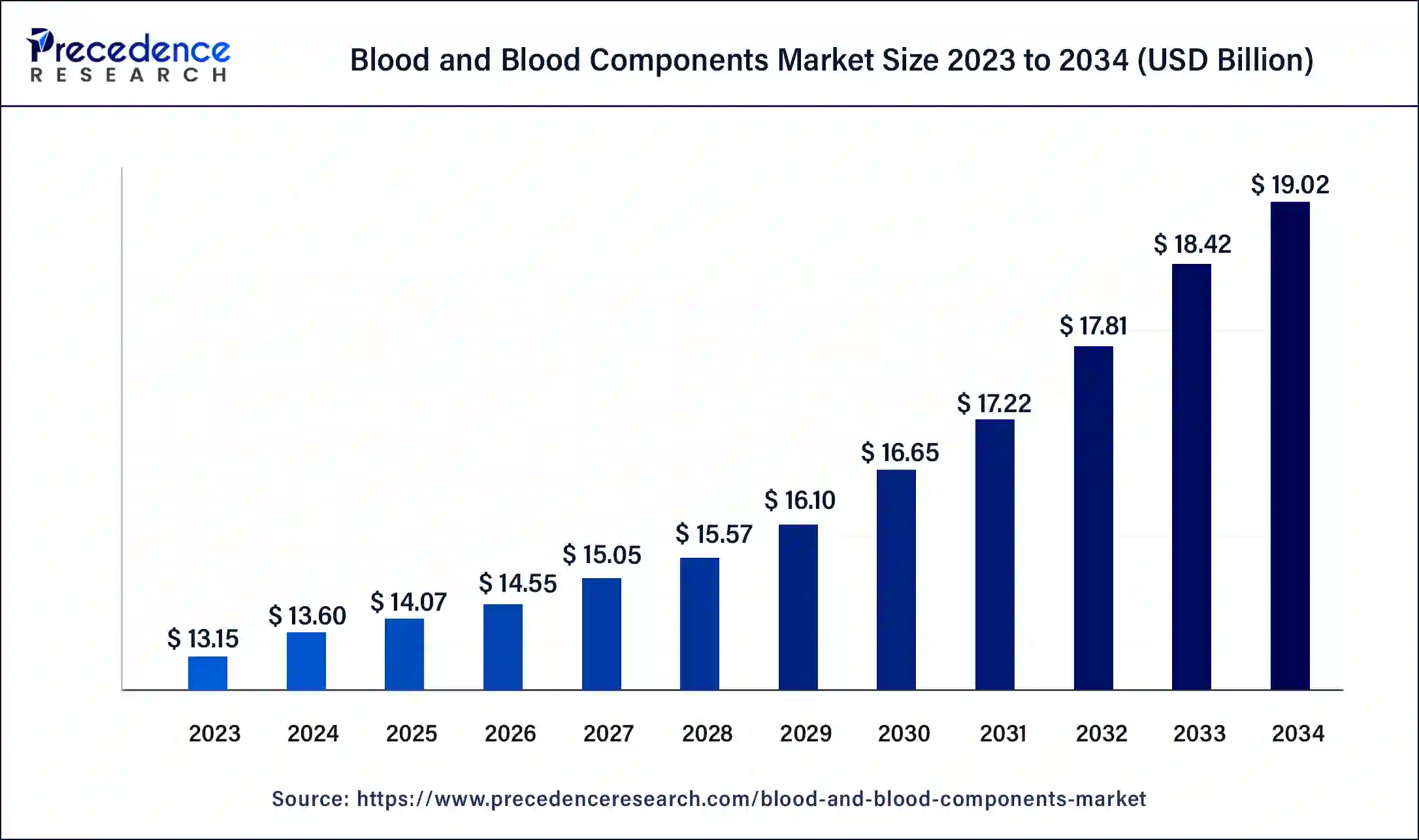

The global blood and blood components market size reached USD 13.15 billion in 2023 and is projected to be worth around USD 18.42 billion by 2033, growing at a CAGR of 3.43% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest revenue share of 35% in 2023.

- North America is expected to gain a significant share of the market during the forecast period.

- By product, the blood components segment held the largest revenue share in 2023.

- By product, the whole blood segment is expected to witness the fastest growth in the market during the forecast period.

- By end use, the hospitals segment dominated the market in 2023.

- By end use, the ambulatory surgical centers segment is expected to grow rapidly in the market during the forecast period.

- By application, the cancer treatment segment held a significant share of the market in 2023.

- By application, the anemia segment is expected to grow rapidly during the forecast period.

The blood and blood components market encompasses the collection, processing, storage, and distribution of whole blood and its various components such as red blood cells, white blood cells, platelets, and plasma. These components are crucial for a variety of medical procedures, including surgeries, trauma care, cancer treatment, and managing blood disorders like anemia and hemophilia. The market is driven by the increasing demand for blood transfusions and the advancements in blood processing technologies that enhance the safety and efficacy of blood products.

Get a Sample: https://www.precedenceresearch.com/sample/4355

Growth Factors

Several factors contribute to the growth of the blood and blood components market. The rising prevalence of chronic diseases and conditions that require blood transfusions, such as cancer and cardiovascular diseases, significantly boosts the demand. Technological advancements in blood collection and processing equipment have improved the efficiency and safety of blood transfusions. Additionally, increased awareness and government initiatives promoting blood donation have expanded the donor pool, further supporting market growth. The development of novel therapeutic applications of blood components also opens new avenues for market expansion.

Region Insights

Regionally, North America dominates the blood and blood components market, attributed to its well-established healthcare infrastructure, high awareness about blood donation, and substantial investments in research and development. Europe follows closely, with countries like Germany and the UK leading in blood transfusion practices and technological adoption. The Asia-Pacific region is expected to witness significant growth due to the rising healthcare needs of its large population, increasing prevalence of chronic diseases, and improving healthcare facilities. Countries such as China and India are particularly noteworthy for their expanding healthcare sectors and growing emphasis on blood donation and storage infrastructure.

Blood and Blood Components Market Scope

| Report Coverage | Details |

| Blood and Blood Components Market Size in 2023 | USD 13.15 Billion |

| Blood and Blood Components Market Size in 2024 | USD 13.60 Billion |

| Blood and Blood Components Market Size by 2033 | USD 18.42 Billion |

| Blood and Blood Components Market Growth Rate | CAGR of 3.43% from 2024 to 2033 |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood and Blood Components Market Dynamics

Drivers

The primary drivers of the blood and blood components market include the increasing global incidence of trauma and surgeries requiring blood transfusions, and the growing prevalence of blood-related disorders. The aging population also plays a critical role, as elderly individuals are more likely to require blood transfusions. Furthermore, the ongoing advancements in blood component separation techniques and the development of pathogen reduction technologies enhance the safety of blood products, encouraging their widespread use.

Opportunities

The market presents several opportunities for growth and innovation. The increasing use of blood components in emerging therapeutic areas, such as regenerative medicine and cell therapy, offers significant potential. Advancements in biotechnology could lead to the development of synthetic blood products, addressing the issue of blood shortages. Additionally, expanding blood donation campaigns and improving healthcare access in developing regions create opportunities for market expansion. Partnerships between public health organizations and private companies can further enhance blood collection and distribution networks.

Challenges

Despite the positive outlook, the blood and blood components market faces several challenges. The risk of transfusion-transmitted infections remains a concern, necessitating stringent screening and testing protocols. The high cost of advanced blood processing technologies can be a barrier for widespread adoption, particularly in developing regions. Additionally, the market is heavily dependent on voluntary blood donations, which can be inconsistent and insufficient to meet demand. Regulatory hurdles and the need for compliance with various national and international standards also pose significant challenges to market players.

Read Also: Corrugated Boxes Market Size to Reach USD 92.30 Billion by 2033

Blood and Blood Components Market Recent Developments

- In January 2024, Today, Inspira Technologies OXY B.H.N Ltd., a leader in life support technology with the goal of replacing conventional mechanical ventilators, announced its intention to provide a single-use, disposable blood oxygenation kit (the “Kit”) for its INSPIRA ART medical device series.

- In January 2024, in a race with Apple Inc. and other electronic behemoths, Samsung Electronics Co. is pursuing the development of continuous blood pressure monitoring and noninvasive glucose monitoring. The company has high aspirations for the healthcare industry.

Blood and Blood Components Market Companies

- European Blood Alliance

- Australian Red Cross

- Indian Red Cross

- American Association of Blood Banks

- South African National Blood Service

Segment Covered in the Report

By Product

- Whole Blood

- Blood Components

By End-use

- Hospitals

- Ambulatory Surgical Centers

By Application

- Anemia

- Trauma & Surgery

- Cancer Treatment

- Bleeding Disorders

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/