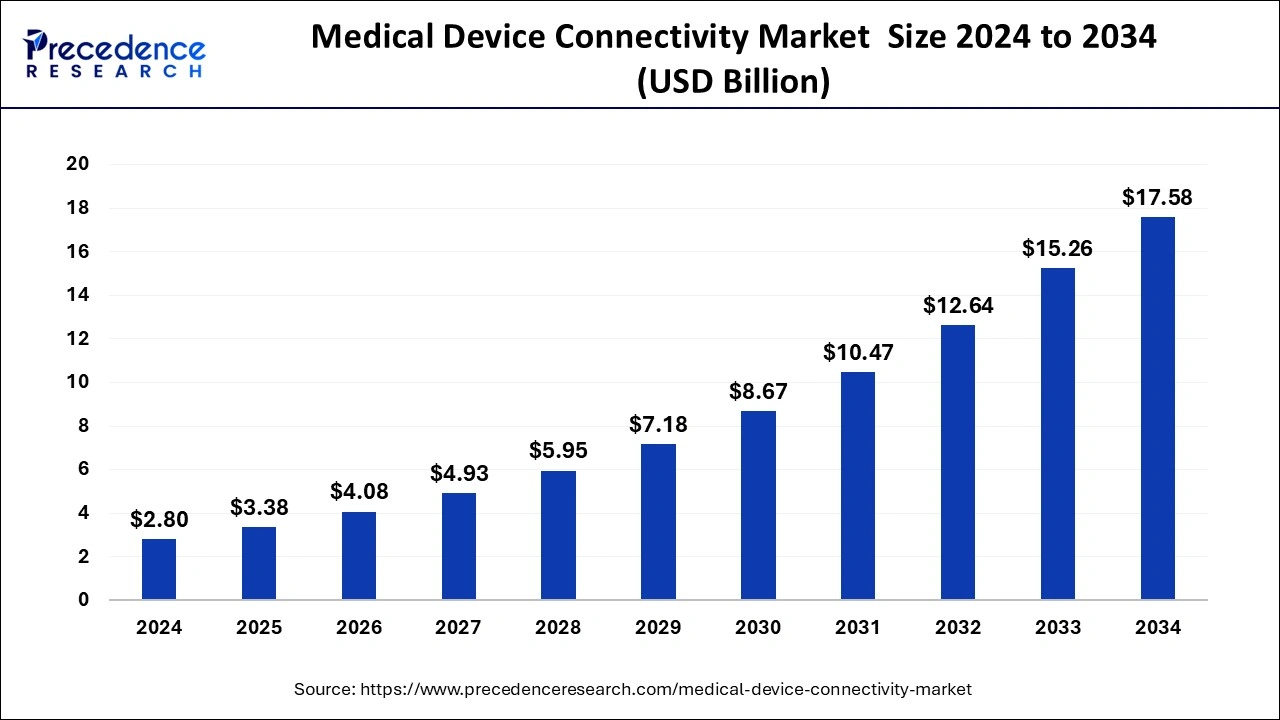

The global medical device connectivity market size reached USD 2.32 billion in 2023 and is projected to hit around USD 15.26 billion by 2033, growing at a CAGR of 20.74% from 2024 to 2033.

Key Points

- North America has contributed 36% of market share in 2023.

- Asia Pacific is estimated to expand the fastest CAGR of 25.7% between 2024 and 2033.

- By components, in 2023, the wireless segment held the highest market share of 48%.

- By components, the wired segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By application, the hospitals segment has held the biggest market share in 2023.

- By application, the ambulatory care centers segment is anticipated to witness significant growth over the projected period.

The medical device connectivity market has been witnessing significant growth in recent years, driven by the increasing adoption of healthcare information technology (IT) solutions and the growing demand for efficient patient data management systems. Medical device connectivity refers to the integration of medical devices with information systems, allowing for seamless data exchange and communication between devices, healthcare providers, and patients. This connectivity enables healthcare professionals to remotely monitor patients, streamline clinical workflows, and improve overall patient care.

Get a Sample: https://www.precedenceresearch.com/sample/3996

Growth Factors:

Several factors contribute to the growth of the medical device connectivity market. One key driver is the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory illnesses, which necessitate continuous monitoring and management. Medical device connectivity solutions facilitate real-time data collection and analysis, enabling timely interventions and personalized treatment plans for patients with chronic conditions. Additionally, the growing emphasis on value-based care and the need to reduce healthcare costs have spurred healthcare providers to invest in connected medical devices that enhance operational efficiency and optimize resource utilization.

Region Insights:

The medical device connectivity market exhibits regional variations in terms of adoption rates and market dynamics. North America dominates the market, driven by the presence of advanced healthcare infrastructure, favorable government initiatives promoting healthcare IT adoption, and a high prevalence of chronic diseases. Europe follows closely, with increasing investments in healthcare IT infrastructure and interoperability standards. Asia Pacific is expected to witness rapid growth, fueled by improving healthcare infrastructure, rising healthcare expenditure, and increasing awareness about the benefits of medical device connectivity solutions in emerging economies such as China and India.

Medical Device Connectivity Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 20.74% |

| Global Market Size in 2023 | USD 2.32 Billion |

| Global Market Size by 2033 | USD 15.26 Billion |

| U.S. Market Size in 2023 | USD 580 Million |

| U.S. Market Size by 2033 | USD 3,850 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Components and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Device Connectivity Market Dynamics

Drivers:

Several drivers propel the growth of the medical device connectivity market. One of the primary drivers is the need for remote patient monitoring solutions, especially in the wake of the COVID-19 pandemic, which has accelerated the adoption of telehealth and remote monitoring technologies. Medical device connectivity enables healthcare providers to remotely monitor patients’ vital signs, medication adherence, and disease progression, thereby reducing the need for frequent hospital visits and enhancing patient convenience. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into medical device connectivity solutions enables predictive analytics and personalized healthcare interventions, driving market growth.

Opportunities:

The medical device connectivity market presents numerous opportunities for stakeholders across the healthcare ecosystem. With the increasing focus on interoperability and data exchange standards, there is a growing demand for interoperable medical device connectivity solutions that can seamlessly integrate with electronic health records (EHRs) and other healthcare IT systems. Moreover, the proliferation of wearable devices and mobile health applications opens up new avenues for remote patient monitoring and consumer-driven healthcare. Additionally, advancements in wireless communication technologies such as 5G and the Internet of Things (IoT) present opportunities for the development of innovative medical device connectivity solutions with improved speed, reliability, and security.

Restraints:

Despite the promising growth prospects, the medical device connectivity market faces certain challenges and restraints. One significant restraint is the concern regarding data privacy and security, particularly in light of increasing cyber threats and data breaches in the healthcare sector. Ensuring the confidentiality, integrity, and availability of patient data transmitted through connected medical devices is paramount to maintaining patient trust and regulatory compliance. Additionally, interoperability issues and lack of standardized protocols pose challenges to seamless data exchange and integration across disparate healthcare IT systems. Addressing these interoperability challenges requires concerted efforts from industry stakeholders, regulatory bodies, and standards organizations to establish common data exchange standards and interoperability frameworks.

Read Also: Cord Blood Banking Market Size to Rake USD 27.55 Bn by 2033

Recent Developments

- In October 2023, Philips unveiled new interoperability features aimed at providing hospitals with a comprehensive patient health overview for enhanced monitoring and care coordination. By integrating Philips Capsule Medical Device Information Platform (MDIP) with Philips Patient Information Center iX (PIC iX), the company offers a unique patient monitoring ecosystem, bringing together diverse medical devices and systems onto a single interface. This interoperability allows clinicians to access streaming data from various device manufacturers on an open, secure platform, offering a new clinical perspective.

- In February 2023, the province of Nova Scotia collaborated with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) to implement an integrated electronic care record system across the province, facilitated by Oracle Cerner. This technology aims to improve healthcare professionals’ access to patient information.

- In 2021, Koninklijke Philips N.V. entered into an agreement to acquire Capsule Technologies Inc., a leading provider of medical device integration and data technologies to healthcare organizations. This strategic move was intended to bolster Philips’ position in delivering connectivity solutions for patient care management within hospital settings.

- In 2021, Masimo Corporation introduced iSirona, a connectivity solution designed to integrate with electronic medical records (EMRs), surveillance monitoring, alarm management, mobile notifications, smart displays, and analytics.

Medical Device Connectivity Market Companies

- Cerner Corporation (U.S.)

- Medtronic (Ireland)

- Masimo (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- General Electric (U.S.)

- Stryker (U.S.)

- iHealth Labs Inc., (U.S.)

- Cisco Systems, Inc. (U.S.)

- Lantronix Inc. (U.S.)

- Infosys Limited (India)

- Silicon & Software Systems Ltd. (Ireland)

- Hill-Rom Services Inc. (U.S.)

- Silex Technology America, Inc (Japan)

- Digi International Inc. (U.S.)

- Baxter (U.S.)

- TE Connectivity (Switzerland)

- Bridge-Tech (U.S)

- MediCollector (U.S.)

Segments Covered in the Report

By Components

- Wireless

- Wired

- Hybrid Technologies

By Application

- Hospitals

- Home Healthcare Centers

- Diagnostic Centers

- Ambulatory Care Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/