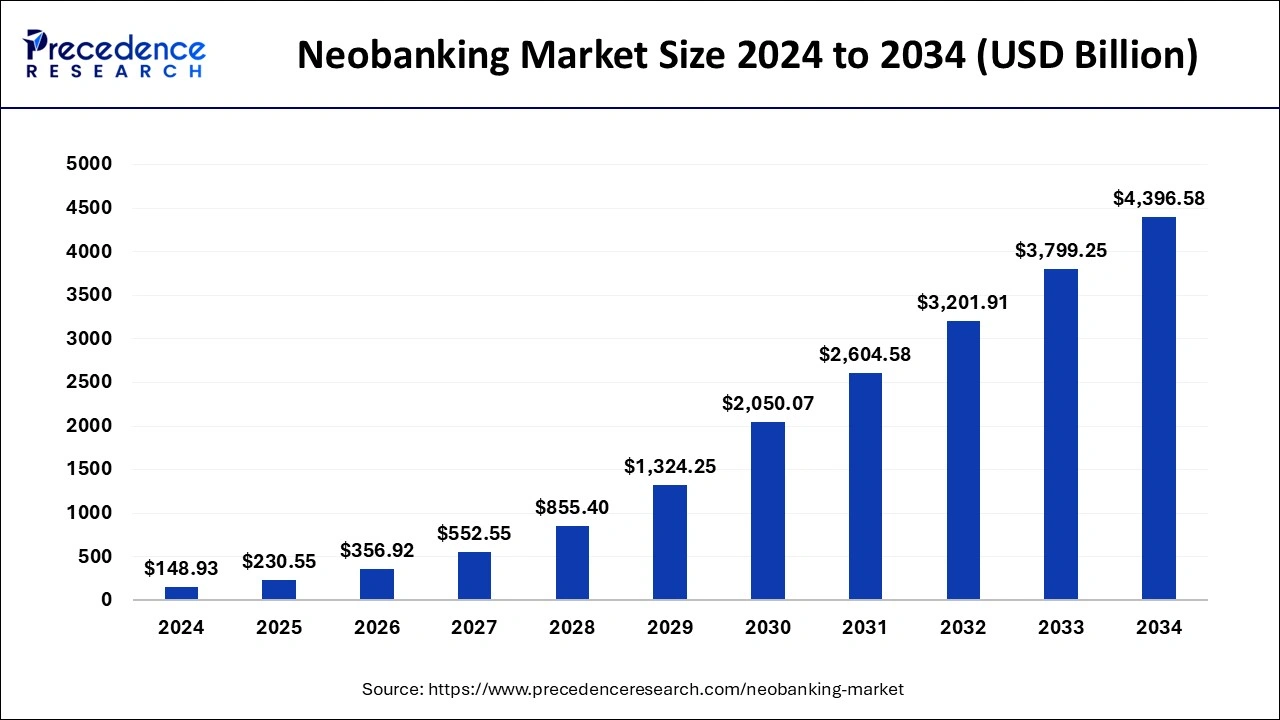

The global neobanking market size was estimated at USD 96.20 billion in 2023 and is projected to reach around USD 3,799.25 billion by 2033, growing at a CAGR of 44.42% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest revenue share of 34% in 2023.

- Asia Pacific is expected to experience significant expansion in the market in the upcoming years.

- By account type, the business account segment has held the major revenue share of 67% in 2023.

- By account type, the saving accounts segment is expected to witness significant growth in the market over the projected period.

- By application, the enterprise segment has recorded more than 52% of revenue share in 2023.

- By application, the personal segment is expected to witness the fastest growth in the market.

The neobanking market has witnessed significant growth in recent years, driven by technological advancements, changing consumer preferences, and increasing demand for digital banking solutions. Neobanks, also known as digital banks or challenger banks, operate exclusively online without physical branches, offering a range of financial services such as savings accounts, payments, loans, and budgeting tools. These fintech disruptors aim to provide a seamless and user-friendly banking experience through mobile apps and web platforms, catering to the needs of tech-savvy consumers seeking convenience, efficiency, and transparency in their financial transactions.

Get a Sample: https://www.precedenceresearch.com/sample/4315

Growth Factors

Several factors contribute to the growth of the neobanking market. The widespread adoption of smartphones and the internet has facilitated easy access to digital banking services, enabling neobanks to reach a broader customer base globally. Additionally, the increasing dissatisfaction with traditional banks, characterized by cumbersome processes, hidden fees, and limited innovation, has driven consumers to explore alternative banking options offered by neobanks. Moreover, regulatory developments favoring open banking and fintech innovation have created a conducive environment for neobanks to thrive, fostering competition and innovation in the financial services industry.

Region Insights:

The growth of the neobanking market varies across regions, influenced by factors such as regulatory environment, technological infrastructure, and consumer behavior. In developed markets like North America and Europe, neobanks have gained significant traction, leveraging advanced digital infrastructure and favorable regulatory frameworks to disrupt traditional banking incumbents. Meanwhile, emerging markets in Asia-Pacific and Latin America present immense growth opportunities for neobanks, driven by the increasing smartphone penetration, rising demand for financial inclusion, and evolving regulatory landscapes promoting fintech innovation.

Neobanking Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 44.42% |

| Neobanking Market Size in 2023 | USD 96.20 Billion |

| Neobanking Market Size in 2024 | USD 148.93 Billion |

| Neobanking Market Size by 2033 | USD 3,799.25 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Account Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Neobanking Market Dynamics

Drivers

Several drivers propel the expansion of the neobanking market. One key driver is the growing preference for digital-first banking experiences among millennials and Gen Z consumers, who prioritize convenience, accessibility, and personalized financial services. Moreover, the increasing focus on financial literacy and empowerment encourages individuals to seek transparent and user-centric banking solutions offered by neobanks. Additionally, strategic partnerships between neobanks and technology companies, fintech startups, or traditional financial institutions enable them to enhance their product offerings, expand their customer base, and drive innovation in the digital banking space.

Opportunities

The neobanking market presents numerous opportunities for growth and innovation. With the rise of embedded finance and open banking ecosystems, neobanks can capitalize on partnerships with third-party developers, merchants, and service providers to offer integrated financial solutions, such as embedded payments, lending, and insurance, within non-financial applications and platforms. Furthermore, expanding into underserved segments such as small and medium-sized enterprises (SMEs), freelancers, and gig economy workers enables neobanks to address specific financial needs and capture niche markets with tailored products and services.

Challenges

Despite the promising growth prospects, neobanks face several challenges in scaling their operations and achieving sustainable profitability. One major challenge is regulatory compliance and licensing requirements, as neobanks must navigate complex regulatory frameworks and ensure adherence to stringent compliance standards, which can vary significantly across jurisdictions. Moreover, building trust and credibility among consumers remains a challenge for neobanks, especially amidst concerns about data privacy, security breaches, and financial stability. Additionally, competition from traditional banks and established fintech players, coupled with pressure to acquire and retain customers cost-effectively, poses challenges for neobanks in gaining market share and achieving long-term viability.

Read Also: Dental Suction Systems Market Size to Reach USD 1,047.02 Mn by 2033

Neobanking Market Recent Developments

- In May 2024, Monzo, a British neobank, announced on Wednesday that it has raised a further $190 million, bringing its total fundraising this year to $610 million. The business informed CNBC that it had secured funding from new investors, among them Hedosophia, a supporter of prominent European fintechs such as N26 and Qonto. Alphabet’s separate growth fund, CapitalG, took part in the deal as well.

- In February 2024, Swedish customers can now access the services of Saldo Bank, a Finnish neobank that is overseen by the Bank of Lithuania and has its headquarters in Lithuania. Saldo Bank’s strategy centers on providing competitive interest rates, with the goal of drawing clients in with its alluring offers.

Neobanking Market Companies

- Monzo

- N26

- Revoult

- Atom bank

- Starling bank

- Chime

- Simple

- Moven

- Webank

Segment Covered in the Report

By Account Type

- Business Account

- Saving Account

By Application

- Enterprises

- Personal

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/