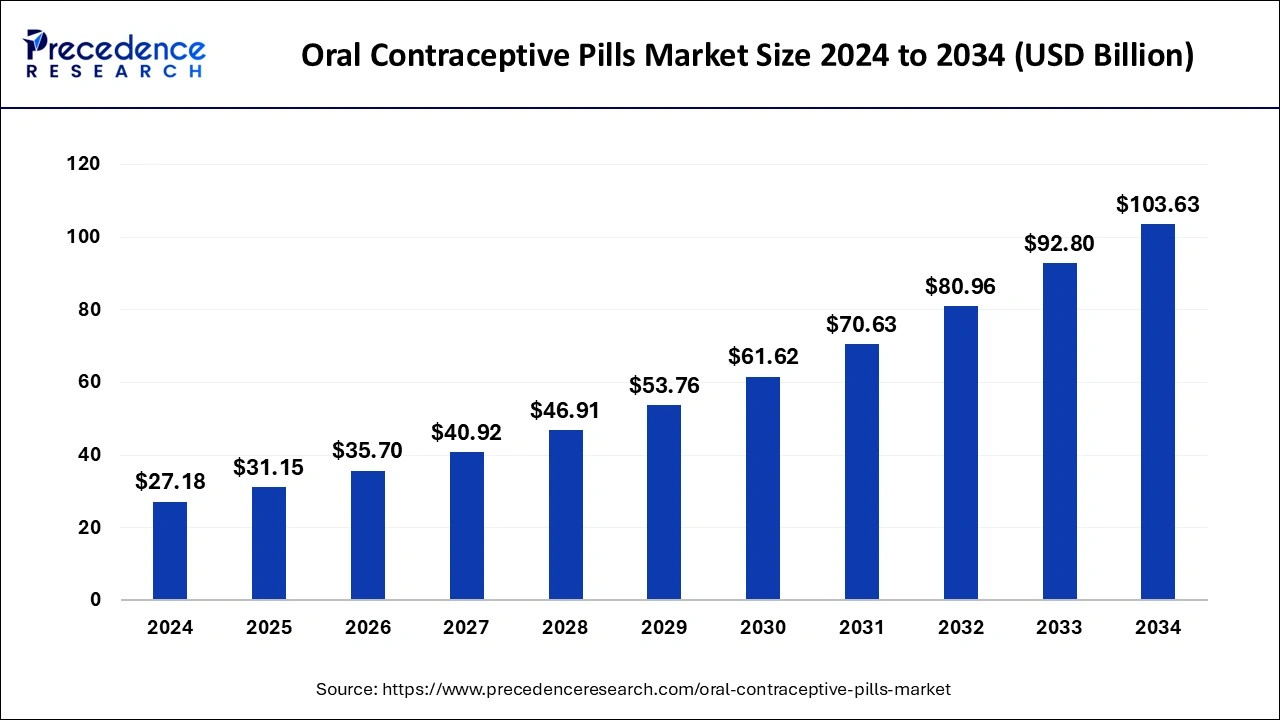

The global oral contraceptive pills market size reached USD 23.71 billion in 2023 and is projected to attain around USD 92.80 billion by 2033, expanding at a CAGR of 14.62% from 2024 to 2033.

Key Points

- North America dominated the oral contraceptive pills market in 2023.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By type, the progestin only segment held a significant share of the market in 2023.

- By category, the branded segment dominated the oral contraceptive pills market.

- By distribution channel, the retail pharmacy segment dominated the market in 2023.

The global oral contraceptive pills market is experiencing steady growth driven by increasing awareness about family planning, advancements in contraceptive technology, and expanding access to healthcare services worldwide. Oral contraceptive pills, also known as birth control pills, are among the most widely used methods of contraception, offering convenience, effectiveness, and reversible fertility control.

Get a Sample: https://www.precedenceresearch.com/sample/4159

Table of Contents

ToggleGrowth Factors:

Several factors contribute to the growth of the oral contraceptive pills market. Growing initiatives by governments and non-profit organizations to promote family planning and reproductive health education play a significant role. Moreover, advancements in pharmaceutical research have led to the development of safer and more effective contraceptive formulations with reduced side effects, improving patient acceptance and compliance. Additionally, the rising prevalence of conditions such as polycystic ovary syndrome (PCOS) and menstrual disorders has increased the demand for oral contraceptives as a treatment option, further driving market growth.

Region Insights:

The oral contraceptive pills market exhibits regional variations influenced by factors such as cultural attitudes towards contraception, healthcare infrastructure, and regulatory frameworks. Developed regions such as North America and Europe dominate the market, with high levels of awareness, accessibility to healthcare services, and favorable reimbursement policies. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing rapid market growth due to increasing urbanization, changing lifestyle patterns, and efforts to improve reproductive healthcare services.

Oral Contraceptive Pills Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.62% |

| Global Market Size in 2023 | USD 23.71 Billion |

| Global Market Size in 2024 | USD 27.18 Billion |

| Global Market Size by 2033 | USD 92.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Category, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oral Contraceptive Pills Market Dynamics

Drivers:

Several drivers propel the growth of the oral contraceptive pills market. Increasing awareness about reproductive health and family planning, coupled with efforts to empower women with greater control over their fertility, drive demand for contraceptive options. Moreover, the convenience and efficacy of oral contraceptive pills compared to other contraceptive methods, such as condoms or intrauterine devices (IUDs), contribute to their popularity among women of reproductive age. Additionally, the availability of generic formulations at affordable prices expands access to oral contraceptives, particularly in low- and middle-income countries.

Opportunities:

The oral contraceptive pills market presents opportunities for pharmaceutical companies to innovate and develop new formulations with improved safety profiles and patient adherence. Expanding market penetration in untapped regions through partnerships with healthcare providers and government agencies can further drive growth. Moreover, educating healthcare professionals and consumers about the benefits and proper use of oral contraceptives can enhance acceptance and uptake rates, especially among marginalized populations with limited access to reproductive healthcare services.

Challenges:

Despite the growth opportunities, the oral contraceptive pills market faces challenges such as regulatory hurdles, particularly in conservative regions with stringent policies on reproductive health and contraception. Adverse effects associated with oral contraceptives, including cardiovascular risks and hormonal imbalances, raise concerns among healthcare providers and consumers, impacting prescription patterns and market demand. Additionally, social and cultural stigmas surrounding contraception and reproductive rights in certain societies hinder open discussions and awareness campaigns, posing barriers to market growth and acceptance. Addressing these challenges requires collaborative efforts from governments, healthcare organizations, and pharmaceutical companies to ensure equitable access to safe and effective contraceptive options globally.

Read Also: Dental Cleaning Tablets Market Size, Share, Report by 2033

Oral Contraceptive Pills Market Recent Developments

- In March 2024, the over-the-counter birth control drug Perrigo Opill has been dispatched to major retailers and pharmacies in the United States and will be available in shops and online later. Opill is scheduled to hit store shelves that focus on consumer self-care items.

- In December 2023, a ground-breaking step toward shared responsibility in contraception, UK researchers launched the first stage of testing for a novel non-hormonal birth control tablet for men.

- In April 2023, in an open letter signed on Monday, executives from over 300 biotech and pharmaceutical companies, including Pfizer and Biogen, called for the reversal of a federal judge’s order to halt the sale of the abortion drug mifepristone.

Oral Contraceptive Pills Market Companies

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis AG

- AbbVie Inc.

- Bayer AG

- Sanofi S.A.

- GlaxoSmithKline PLC

- Zydus Lifesciences Ltd

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd.

- Church & Dwight Co Inc.

- Aurobindo Pharma Limited

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd

- Ferring B.V

- Amneal Pharmaceuticals LLC

- Lupin Pharmaceuticals Inc.

- Vardhaman Lifecare Pvt. Ltd

- Glenmark Pharmaceuticals

- Piramal Enterprises Ltd.

- Mankind Pharma Ltd.

- Sopharma AD

- Mayne Pharma

- HLL Lifecare Limited

- Famy Care Ltd

- Syzygy Healthcare

- V Care Pharma

- Actavis PLC

- Mylan N.V.

Segments Covered in the Report

By Type

- Combination

- Monophasic

- Triphasic

- Others

- Progestin Only

- Others

By Category

- Generic

- Branded

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Clinics

- Online

- Public Channel And NGO

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/