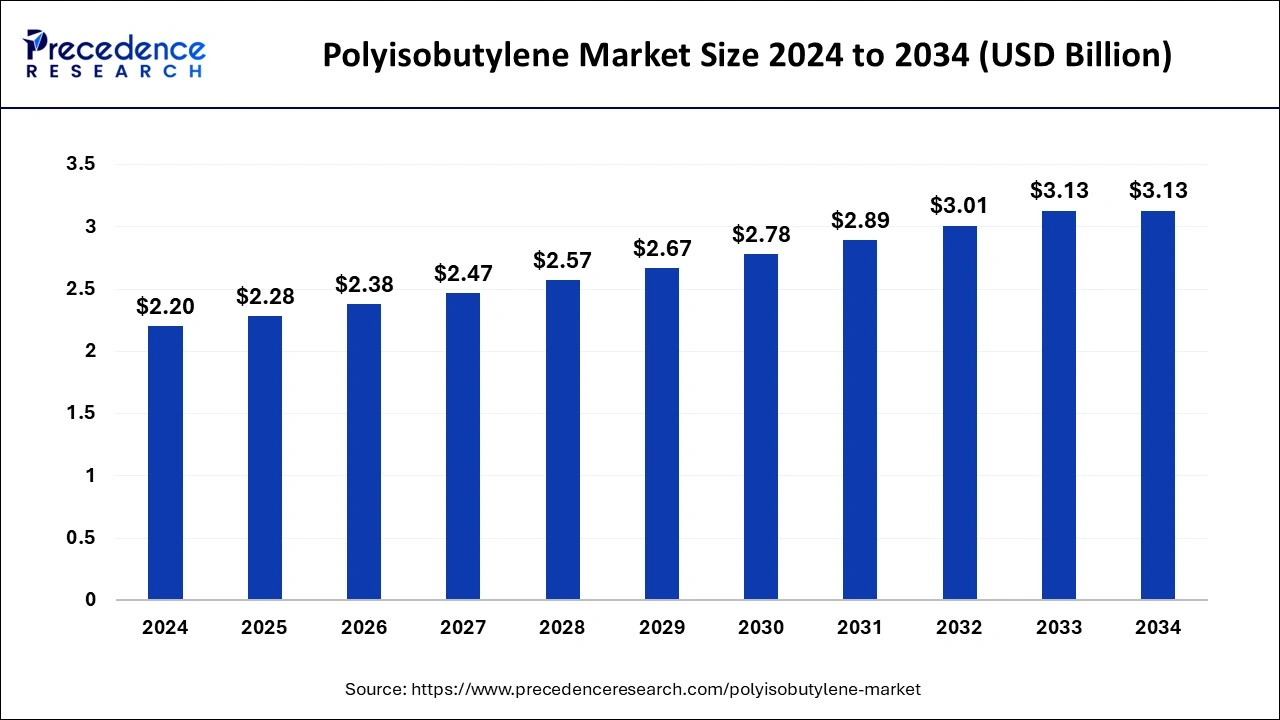

The global polyisobutylene market size was estimated at USD 2.11 billion in 2023 and is projected to reach around USD 3.13 billion by 2033, growing at a CAGR of 4.03% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest market share of 34% in 2023.

- North America is the fastest growing region and is expected to grow significantly in the forecast period.

- By product, the high molecular weight polyisobutylene segment has held the major market of 66% in 2023.

- By product, medium molecular weight polyisobutylene segment is the fastest growing segment and is expected to grow significantly in the forecast period.

- By application, the lubricant additives segment has contributed more than 56% of market share in 2023.

- By application, the automobile industry segment is the fastest growing segment and is expected to grow continuously in the forecast period.

The polyisobutylene (PIB) market is experiencing steady growth driven by its versatile applications across various industries. Polyisobutylene is a synthetic polymer derived from isobutylene, characterized by its unique properties such as high molecular weight, flexibility, and resistance to chemicals and moisture. The market for polyisobutylene spans sectors like automotive, construction, healthcare, and lubricants, where it is used for applications ranging from adhesives and sealants to fuel and lubricant additives. Growing demand for high-performance polymers and increasing investment in research and development activities are expected to further propel the growth of the polyisobutylene market.

Get a Sample: https://www.precedenceresearch.com/sample/4249

Growth Factors

Several factors contribute to the growth of the polyisobutylene market. One of the primary drivers is the expanding automotive industry, particularly the demand for tires and automotive lubricants. Polyisobutylene is a key component in tire inner liners due to its impermeability to air, enhancing tire performance and fuel efficiency. Moreover, the increasing use of PIB in adhesives, sealants, and chewing gum base applications further drives market growth. Additionally, advancements in polymer technology, including the development of low molecular weight PIB for various applications, are opening new avenues for market expansion.

Region Insights

The polyisobutylene market exhibits regional variations influenced by factors such as industrialization, manufacturing activities, and regulatory policies. North America and Europe are prominent markets for polyisobutylene, driven by established automotive and industrial sectors that demand high-quality polymer additives. In Asia Pacific, rapid industrialization and infrastructure development in countries like China and India are fueling market growth, with increasing investments in the automotive and construction industries. The Middle East and Africa region also show potential due to expanding oil and gas activities that require PIB-based products for lubricant and fuel applications.

Polyisobutylene Market Scope

| Report Coverage | Details |

| Polyisobutylene Market Size in 2023 | USD 2.11 Billion |

| Polyisobutylene Market Size in 2024 | USD 2.20 Billion |

| Polyisobutylene Market Size by 2033 | USD 3.13 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Polyisobutylene Market Dynamics

Drivers

Several drivers are accelerating the growth of the polyisobutylene market. The rising demand for tubeless tires, driven by the automotive industry’s focus on fuel efficiency and safety, is a significant driver for PIB consumption. Additionally, the increasing use of polyisobutylene in lubricants and fuel additives to improve performance and longevity of engines contributes to market expansion. Furthermore, the versatility of PIB in applications like adhesives, sealants, and pharmaceutical formulations enhances its market demand across diverse industries.

Opportunities

The polyisobutylene market offers promising opportunities for innovation and market expansion. Research and development initiatives aimed at developing novel PIB grades with tailored properties for specific applications present avenues for growth. Expansion into emerging markets with increasing industrial activities and infrastructure development offers new opportunities for market penetration. Moreover, collaborations between manufacturers and end-users to develop customized solutions and formulations using polyisobutylene can drive market growth and differentiation in competitive landscapes.

Challenges

Despite its growth trajectory, the polyisobutylene market faces certain challenges. Fluctuations in raw material prices, particularly isobutylene, can impact production costs and pricing dynamics within the market. Regulatory frameworks related to polymer additives and chemical substances require compliance and may influence market dynamics. Additionally, competition from alternative materials and substitutes poses a challenge to market penetration and growth in specific applications. Addressing these challenges through sustainable sourcing, technological innovation, and market diversification will be crucial for sustained growth in the polyisobutylene market.

Read Also: Microalgae Fertilizers Market Size to Reach USD 32.25 Bn by 2033

Polyisobutylene Market Recent Developments

- In Aug 2023, BASF announced its plans to increase the production rate of medium molecular weight polyisobutylene. As an outcome, the rise in demand of polyisobutylene is experienced globally.

- In Aug 2022, Quanex announced the launching of new moisture protectant for solar panels that can be useful for manufacturers to apply during the final manufacturing process.

Polyisobutylene Market Companies

- BASF SE

- Daelim Co., Ltd.

- TPC Group

- INEOS

- Kothari Petrochemicals

- Braskem

- ENEOS Corporation

- Zhejiang Shunda New Material Co., Ltd.

- Shandong Hongrui New Material Technology Co., Ltd.

Segments Covered in the Report

By Product

- High Molecular Weight

- Medium Molecular Weight

- Low Molecular Weight

By Application

- Adhesives & Sealants

- Automotive Rubber Components

- Fuel Additives

- Lubricant Additives

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/