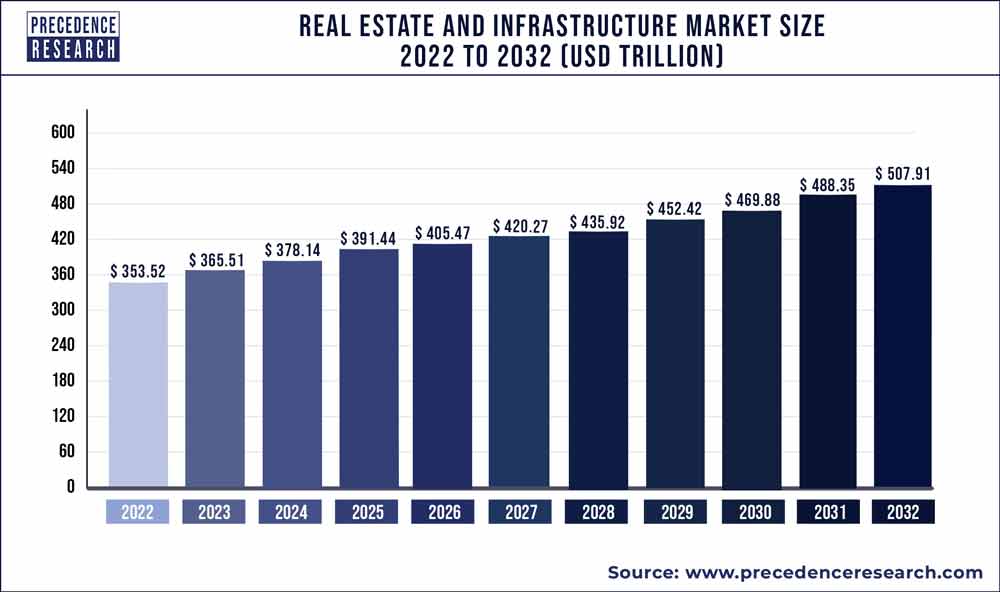

The real estate and infrastructure market size is poised to grow by USD 507.91 trillion by 2032 from USD 365.51 trillion in 2023, exhibiting a CAGR of 3.70% during the forecast period 2023-2032.

Key Takeaways

- By property type, the residential segment dominated the real estate market with a market size of USD 285.28 trillion in 2023 and is likely to reach USD 396.48 trillion with a CAGR of 3.7% in 2032.

- By property type, the commercial real estate market is expected to grow with a market value of USD 26.84 trillion in 2023 and is anticipated to reach USD 34.78 trillion with a CAGR of 2.9% in 2032.

- By business type, the buying segment dominated the real estate market with a market size of USD 198.23 trillion in 2023 and is likely to reach USD 264.12 trillion with a CAGR of 3.2% in 2032.

- By business type, the rental segment is expected to grow with a market value of USD 167.28 trillion in 2023 and is anticipated to reach USD 243.80 trillion with a CAGR of 2.9% in 2032.

- By region, North America dominated the real estate and infrastructure market with the largest market size of USD 107.90 trillion in 2023 and forecasted to reach USD 142.16 trillion with a CAGR of 3.1% in 2032. The Europe segment is expected to increase its market size to USD 94.87 trillion in 2023 and is predicted to reach USD 135.45 trillion with a CAGR of 4.0% in 2032.

Precedence Research has conducted a comprehensive market study that provides valuable insights into the performance of the market during the forecast period. The study identifies significant trends that are shaping the growth of the Real estate and infrastructure market. In this recently published report, essential dynamics such as drivers, restraints, and opportunities are highlighted for both established market players and emerging participants involved in production and supply.

To begin with, the Real estate and infrastructure Market report features an executive summary that offers a concise overview of the marketplace. It outlines the key players and industry categories expected to have an impact on the market in the coming years. The executive summary provides an unbiased summary of the market.

Get a Sample Report: https://www.precedenceresearch.com/sample/3566

Real Estate and Infrastructure Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 365.51 Trillion |

| Market Size by 2032 | USD 507.91 Trillion |

| Growth Rate from 2023 to 2032 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Property Type, By Commercial Property Type, By Specialized Property Type, By Infrastructure Property Type, and By Business Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Industrial Catalysts Market Size To Gain USD 31.49 Bn by 2032

The empirical study on the global Real estate and infrastructure market primarily focuses on the drivers in subsequent sections. It demonstrates how changing demographics are projected to influence the supply and demand dynamics in the Real estate and infrastructure Market. Our market report for the Real estate and infrastructure market also delves into the significant rules and regulations that are likely to impact the future growth of this sector. Moreover, in order to comprehend the underlying demand factors, industry experts have provided insights into its fundamental origins.

Real Estate and Infrastructure Market Players

- Simon Property Group

- CBRE Group

- Cushman and Wakefield PLC

- JLL

- Homie Real Estate

- Houwzer

- American Tower

- RE/Max

- Equity Residential

- Vornado Realty

- BrazilOasis

Data Sources and Methodology

To gather comprehensive insights on the Global Real estate and infrastructure Market, we relied on a range of data sources and followed a well-defined methodology. Our approach involved interactions with industry experts and key stakeholders across the market’s value chain, including management organizations, processing organizations, and analytics service providers.

We followed a rigorous data analysis process to ensure the quality and credibility of our research. The gathered information was carefully evaluated, and relevant quantitative data was subjected to statistical analysis. By employing robust analytical techniques, we were able to derive meaningful insights and present a comprehensive overview of the Global Real estate and infrastructure Market.

The most resonating, simple, genuine, and important causes because of which you must decide to buy the Real estate and infrastructure market report exclusively from precedence research

- The research report has been meticulously crafted to provide comprehensive knowledge on essential marketing strategies and a holistic understanding of crucial marketing plans spanning the forecasted period from 2023 to 2032.

Key Features of the Report:

- Comprehensive Coverage: The report extensively encompasses a detailed explanation of highly effective analytical marketing methods applicable to companies across all industry sectors.

- Decision-Making Enhancement: It outlines a concise overview of the decision-making process while highlighting key techniques to enhance it, ensuring favorable business outcomes in the future.

- Articulated R&D Approach: The report presents a well-defined approach to conducting research and development (R&D) activities, enabling accurate data acquisition on current and future marketing conditions.

Market Segmentation:

By Property Type

- Residential

- Commercial

- Industrial

- Specialized

- Infrastructure

By Commercial Property Type

- Offices

- Hospitals

- Retails

- Others

By Specialized Property Type

- Healthcare

- Education

- Leisure

By Infrastructure Property Type

- Energy

- Telecom

- Utilities

- Transportation

By Business Type

- Buy

- Rental

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Reasons to Consider Purchasing the Report:

- Enhance your market research capabilities by accessing this comprehensive and precise report on the global Real estate and infrastructure market.

- Gain a thorough understanding of the overall market landscape and be prepared to overcome challenges while ensuring robust growth.

- Benefit from in-depth research and analysis of the latest trends shaping the global Real estate and infrastructure market.

- Obtain detailed insights into evolving market trends, current and future technologies, and strategic approaches employed by key players in the global Real estate and infrastructure market.

- Receive valuable recommendations and guidance for both new entrants and established players seeking further market expansion.

- Discover not only the cutting-edge technological advancements in the global Real estate and infrastructure market but also the strategic plans of industry leaders.

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Real Estate and Infrastructure Market

5.1. COVID-19 Landscape: Real Estate and Infrastructure Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Real Estate and Infrastructure Market, By Property Type

8.1. Real Estate and Infrastructure Market, by Property Type, 2023-2032

8.1.1. Residential

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Commercial

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Industrial

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Specialized

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Infrastructure

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Real Estate and Infrastructure Market, By Commercial Property Type

9.1. Real Estate and Infrastructure Market, by Commercial Property Type, 2023-2032

9.1.1. Offices

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Retails

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Real Estate and Infrastructure Market, By Specialized Property Type

10.1. Real Estate and Infrastructure Market, by Specialized Property Type, 2023-2032

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Education

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Leisure

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Real Estate and Infrastructure Market, By Infrastructure Property Type

11.1. Real Estate and Infrastructure Market, by Infrastructure Property Type, 2023-2032

11.1.1. Energy

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Telecom

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Utilities

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Real Estate and Infrastructure Market, By Business Type

12.1. Real Estate and Infrastructure Market, by Business Type, 2023-2032

12.1.1. Buy

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Rental

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Real Estate and Infrastructure Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.6.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.1.7. Rest of North America

13.1.7.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.7.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.7.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.7.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.7.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.8. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.11. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.13. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.15. Market Revenue and Forecast, by Business Type (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.9. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.10.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.11.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.9. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.10.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.11.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.8.5. Market Revenue and Forecast, by Business Type (2020-2032)

Chapter 14. Company Profiles

14.1. Simon Property Group

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. CBRE Group

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Cushman and Wakefield PLC

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. JLL

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Homie Real Estate

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Houwzer

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. American Tower

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. RE/Max

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Equity Residential

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Vornado Realty

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

Precedence Statistics – Empowering Your Data Insights

Contact Us

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com