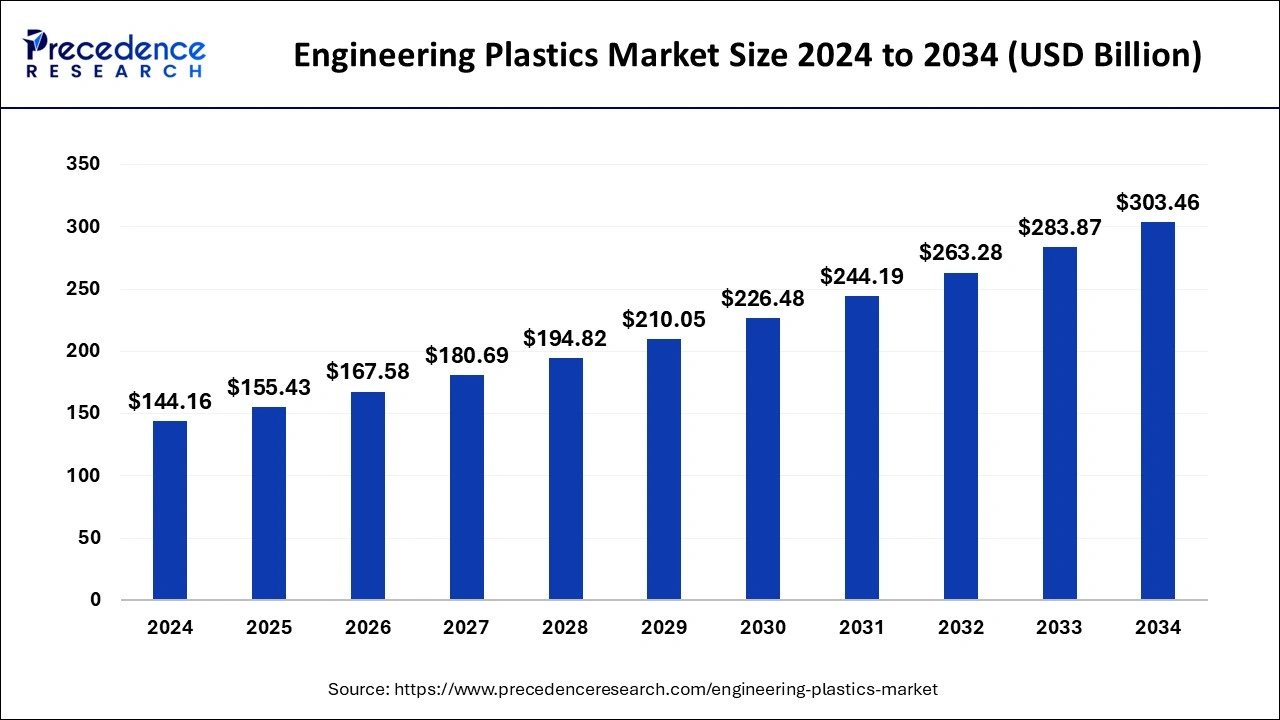

The global engineering plastics market size was estimated at USD 133.70 billion in 2023 and is projected to reach around USD 283.87 billion by 2033, growing at a CAGR of 7.82% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the highest market share of 45% in 2023.

- North America held a notable share of the market in 2023.

- By resin type, the styrene copolymers (ABS and SAN) segment has held the largest market share of 35% in 2023.

- By resin type, the polycarbonate (PC) is expected to grow at a notable CAGR during forecast period.

- By end-use, the automotive & transportation segment accounted for the major market share of 365 in 2023.

- By end-use, the electrical & electronics segment is expected to grow to the highest CAGR during forecast period.

The engineering plastics market is a dynamic sector within the global plastics industry, characterized by the production and application of high-performance polymers tailored for demanding engineering applications. Engineering plastics offer superior mechanical, thermal, chemical, and electrical properties compared to commodity plastics, making them ideal for use in automotive, electronics, construction, aerospace, and other industries. This market segment has experienced steady growth due to increasing demand for lightweight, durable, and sustainable materials in various manufacturing processes.

Get a Sample: https://www.precedenceresearch.com/sample/4256

Growth Factors

Several factors are driving the growth of the engineering plastics market. One key factor is the ongoing trend towards lightweighting in industries such as automotive and aerospace, where the use of engineering plastics helps improve fuel efficiency and reduce emissions. Additionally, the versatility of engineering plastics in terms of design freedom and processability has expanded their applications across diverse industries. Growing awareness of environmental sustainability has also fueled demand for engineering plastics as they can be recycled and offer alternatives to traditional materials like metals.

Region Insights

The adoption and production of engineering plastics vary by region, influenced by factors such as industrialization, infrastructure development, and regulatory policies. Asia Pacific, particularly China and India, has emerged as a major hub for engineering plastics due to rapid industrial growth and increasing investments in manufacturing. North America and Europe remain significant markets, driven by established automotive and electronics industries that demand high-performance materials. Latin America and the Middle East are also experiencing growth as they expand their industrial capabilities.

Engineering Plastics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.82% |

| Global Market Size in 2023 | USD 133.70 Billion |

| Global Market Size in 2024 | USD 144.16 Billion |

| Global Market Size by 2033 | USD 283.87 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Resin Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Engineering Plastics Market Dynamics

Drivers

The engineering plastics market is propelled by several drivers. One primary driver is the continuous development of new and innovative polymer formulations with enhanced properties such as strength, heat resistance, and chemical inertness. These advancements enable engineers to replace traditional materials with plastics in demanding applications. Moreover, the increasing use of engineering plastics in 3D printing and additive manufacturing technologies is opening new avenues for customization and rapid prototyping in various industries.

Opportunities

The engineering plastics market offers substantial opportunities for manufacturers and suppliers. Investment in research and development to create novel polymer blends and compounds with improved performance characteristics presents a significant opportunity. Expanding applications in sectors like healthcare, consumer electronics, and renewable energy further diversify the market and create new avenues for growth. Additionally, strategic partnerships and collaborations across the value chain can facilitate market penetration and innovation.

Challenges

Despite its growth potential, the engineering plastics market faces several challenges. One major challenge is the volatility of raw material prices, particularly for specialty polymers, which can impact production costs and pricing strategies. Technical challenges related to processing and recycling of certain engineering plastics also need to be addressed to optimize manufacturing efficiency and sustainability. Moreover, stringent regulatory requirements concerning chemical safety and environmental impact pose compliance challenges for industry players.

Read Also: Invisible Orthodontics Market Size to Reach USD 75.92 Bn by 2033

Engineering Plastics Market Recent Developments

- In April 2024, Nylon Corporation of America (NYCOA), a custom manufacturer of engineered nylon resins, announced the launch of NY-Clear, an amorphous 6I/6T nylon that is targeted for packaging and precision molded applications.

- In October 2023, Polyplastics launched Sarpek polyether ketone (PEK), an advanced material for metal replacement and applications requiring the highest heat resistance of any injection moldable resin without post-curing. Sarpek PEK is an engineering plastic in the upper end of the crystalline super engineering plastic hierarchy, an advancement upon polyetheretherketone (PEEK) that delivers a high crystallization rate and superior molding efficiency.

- In May 2023, Borealis launched Stelora, a new class of sustainable engineering polymer offering increased strength, durability, and a step change in heat-resistance capability. Stelora, which developed in collaboration with TOPAS Advanced Polymers, the world’s leading producer of cyclic olefin copolymer (COC). It is created using a unique process that combines COCs, which are a relatively new class of clear, high-purity polymer, with polypropylene (PP).

Engineering Plastics Market Companies

- Grand Pacific Petrochemical Corporation

- Mitsubishi Engineering-Plastics Corporation

- Wittenburg Group

- Piper Plastics Corp.

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Evonik Industries AG

- Nylon Corporation of America (NYCOA)

- Eastman Chemical Company

- Ascend Performance Materials

- Ravago

- Teknor Apex

- Trinseo LLC

- Polyplastics Co., Ltd.

- Ngai Hong Kong Company Ltd.

- Ginar Technology Co., Ltd.

Segment Covered in the Report

By Resin Type

- Styrene Copolymers (ABS and SAN)

- Fluoropolymer

- Ethylene Tetrafluoroethylene (ETFE)

- Fluorinated Ethylene-propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Fluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Liquid crystal polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

By End-use

- Automotive & Transportation

- Electrical & Electronics

- Building & Construction

- Consumer Goods & Appliances

- Industrial

- Aerospace

- Medical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/