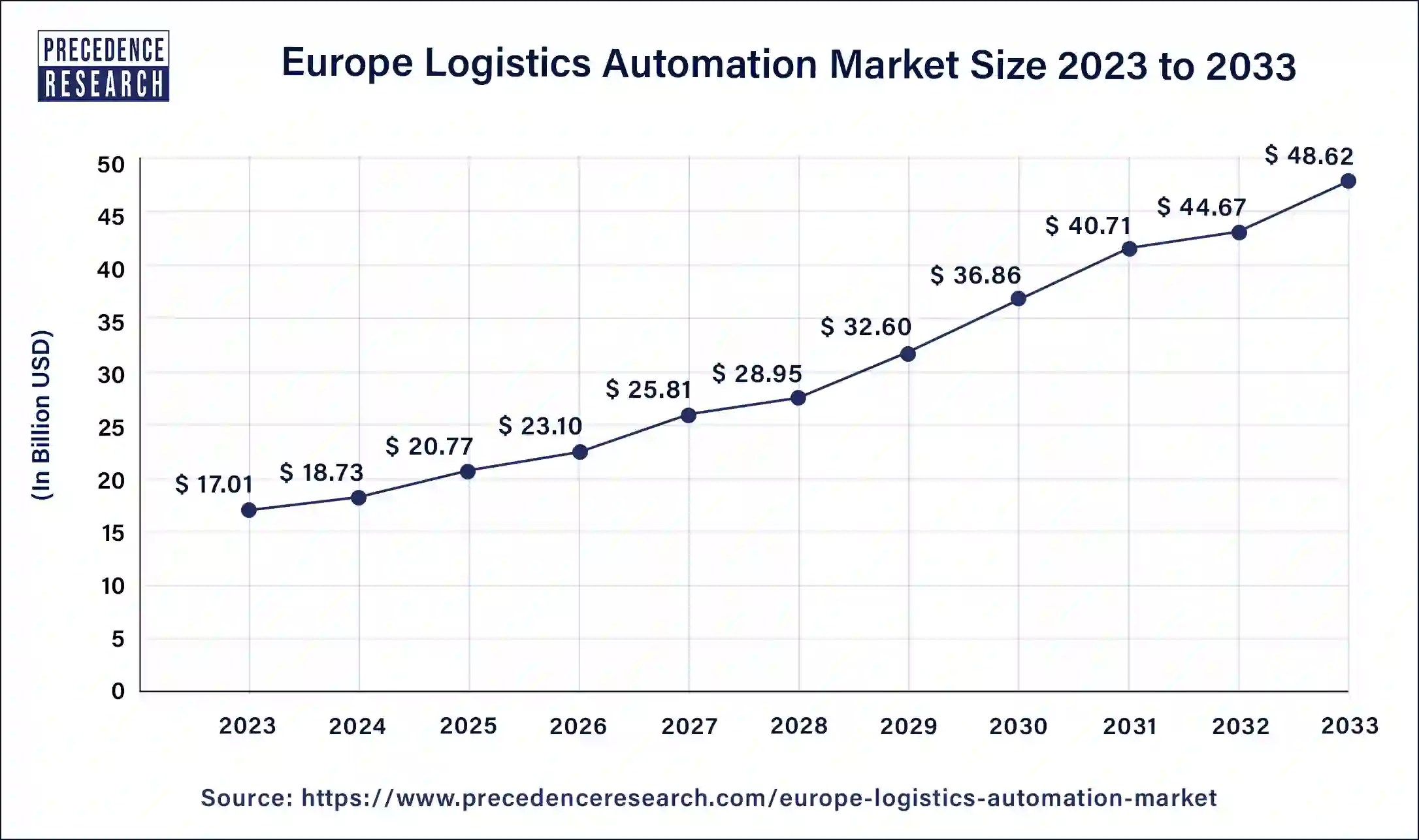

The Europe logistics automation market size reached USD 17.01 billion in 2023 and is predicted to be worth around USD 48.62 billion by 2033, growing at a CAGR of 11.18% from 2024 to 2033.

Key Points

- By type, the production logistics segment dominated the market with the largest revenue share of 50.26% in 2023.

- By type, the sales logistics segment was the second largest with 27.50% revenue share in 2023.

- By component, the hardware has held the biggest revenue share of 55.69% in 2023.

- By component, the software segment is observed to be the fastest growing in the revenue during the forecast period.

- By organization size, the large enterprises segment has contributed the major revenue share of 65.72% in 2023.

- By mode of freight transport, the road segment led market with the highest revenue share of 55.04% in 2023.

- By mode of freight transport, the sea segment is observed to be the fastest growing in the revenue during the forecast period.

- By application, the transportation management segment has held the major revenue share of 69.82% in 2023.

- By end-user, the automotive segment led the market with the major revenue share of 30.56% in 2023.

- By end-user, the retail and e-commerce segment is observed to grow at a significant rate in the revenue during the forecast period.

The Europe logistics automation market is experiencing significant growth, driven by the increasing demand for efficient supply chain solutions. Logistics automation involves the use of technology to manage and streamline logistics processes, reducing human intervention and enhancing operational efficiency. This market encompasses various automated systems, including warehouse management systems (WMS), transportation management systems (TMS), and automated material handling equipment. The adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and robotics is revolutionizing the logistics sector in Europe, enabling faster and more accurate logistics operations.

Get a Sample: https://www.precedenceresearch.com/sample/4365

Growth Factors

Several factors are contributing to the growth of the logistics automation market in Europe. Firstly, the rise of e-commerce has significantly increased the volume of parcels and shipments, necessitating more efficient logistics solutions. Secondly, the need to reduce operational costs and improve efficiency is driving companies to invest in automation technologies. Thirdly, advancements in AI, IoT, and robotics are providing innovative solutions for logistics challenges, enhancing the accuracy and speed of operations. Additionally, the increasing focus on sustainability and reducing carbon footprints is pushing companies to adopt automated systems that optimize resource usage and reduce waste.

Europe Logistics Automation Market Scope

| Report Coverage | Details |

| Europe Logistics Automation Market Size in 2023 | USD 17.01 Billion |

| Europe Logistics Automation Market Size in 2024 | USD 18.73 Billion |

| Europe Logistics Automation Market Size by 2033 | USD 48.62 Billion |

| Europe Logistics Automation Market Growth Rate | CAGR of 11.18% from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Component, Organization Size, Mode of Freight Transport, Application, and End-user |

Europe Logistics Automation Market Dynamics

Region Insights

Within Europe, the logistics automation market shows varying trends and growth rates across different regions. Western Europe, particularly countries like Germany, France, and the United Kingdom, is leading the market due to its well-established logistics infrastructure and high adoption rate of advanced technologies. Germany, being a major logistics hub, is at the forefront of implementing automation in logistics. In contrast, Eastern European countries are gradually catching up, with increasing investments in logistics infrastructure and automation technologies. The Nordic region also demonstrates significant growth potential, driven by high e-commerce penetration and a strong focus on innovation.

Opportunities

The Europe logistics automation market presents numerous opportunities for growth and development. The ongoing digital transformation in the logistics sector offers vast potential for innovative solutions and services. Companies can capitalize on the growing demand for efficient last-mile delivery solutions, especially in urban areas with high population density. Additionally, the integration of blockchain technology in logistics automation can provide enhanced security and transparency in supply chain operations. The push towards sustainability also opens opportunities for developing eco-friendly automated solutions that reduce carbon emissions and optimize energy use.

Challenges

Despite the promising growth, the logistics automation market in Europe faces several challenges. High initial investment costs and the complexity of integrating new systems with existing infrastructure can be significant barriers for many companies. Additionally, there is a need for skilled personnel to manage and maintain automated systems, posing a challenge in terms of workforce training and development. Cybersecurity risks are another major concern, as increased automation and connectivity expose logistics systems to potential cyber threats. Lastly, regulatory and compliance issues across different European countries can complicate the implementation of uniform logistics automation solutions.

Read Also: Commodity Services Market Size to Reach USD 7.58 Billion by 2033

Europe Logistics Automation Market Recent Developments

- In March 2024, Leading European consultant and Oracle business partner Flo Group, which specializes in international supply chain logistics, was purchased by Accenture. Through this acquisition, Accenture’s Oracle capabilities in Europe will be further enhanced, enabling clients to create supply chains that are more resilient, flexible, and end-to-end visible. The transaction’s financial details were kept a secret.

- In January 2024, ABB declared that it has decided to buy Meshmind, one of the largest software service providers, to increase its capacity for AI, Industrial IoT, and machine vision research and development. With this acquisition, ABB will create a new global R&D hub combining software expertise, artificial intelligence (AI), and technical ability to hasten the creation of cutting-edge automation solutions inside its Machine Automation division (B&R).

- In August 2023, A payment module developed by LogiNext assists businesses in choosing providers and handle payments. Through rate charts facilitated by automation and artificial intelligence (AI), the new module makes it easier to select carrier partners by comparing the costs of various carriers and drivers.

Europe Logistics Automation Market Companies

- E&K Automation

- Jungheinrich

- Knapp

- SSI Schaefer

- Swisslog

- System Logistics

- TGW Logistics Group

- SAP

Segments Covered in the Report

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Component

- Hardware

- Software

- Services

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Mode of Freight Transport

- Air

- Road

- Sea

By Application

- Transportation Management

- Warehouse and Storage Management

By End-user

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast Moving Consumer Goods

- Retail and E-commerce

- Automotive

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.uswebwire.com/